The EY Tax Guide Editorial Board 2015

Special thanks to:

Mark Weinberger, Global Chairman and CEO; Stephen R. Howe, Americas Area Managing Partner; Gary L. Belske, Americas Deputy Managing Partner, Kathryn J. Barton, Americas Vice ChairTax Services; Eric Solomon and Michael Mundaca, Co-Directors of National Tax; Marnix vin Rij, Global Director of Private Client Services; Steven L. Shultz, Americas Director of Private Client Services.

Special awards and acknowledgments:

The EY Tax Guide is a proud recipient of a Communications Concept, Inc. 2013 Apex Grand Award for Electronic Media; a 2012 Apex Grand Award for Content Excellence for Content and Design (Brochures, Manuals & Reports category); and, an Independent Publisher 2012 Axiom award for Best Business Reference Book.

Thanks to Amy Koeppl, Ellen Lee, Ingrid McGuire, Peter McKinley, and Lizzie McWilliams.

The Ernst & Young global network of member firms has more than 35,000 tax practitioners worldwide, with more than 12,300 practitioners in the United States. This book draws upon the experience of many of those professionals for its content.

Copyright 20092015, Ernst & Young LLP

Copyright 19892008 by Ernst & Young LLP and

Peter W. Bernstein Corporation

Copyright 19841988 by Arthur Young & Company and

Peter W. Bernstein Corporation

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying or recording, or by any information storage or retrieval system, without written permission from Ernst & Young LLP. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, whether electronic, mechanical or otherwise, and including without limitation photocopying, recording, scanning, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions.

Published by John Wiley & Sons, Inc.

Notice: In the preparation of this book, every effort has been made to offer the most current, correct, and clearly expressed information available prior to publication: the Internal Revenue Code as of September 2014, the 2013 version of Internal Revenue Service Publication 17, Your Federal Income Tax (rev. Jan. 2013), updated by the author for 2014, and portions of other pertinent Internal Revenue Service publications. Readers may obtain the 2014 version of Publication 17 at www.irs.gov. Note also that inadvertent errors can occur, and tax rules and regulations often change.

Limit of Liability/Disclaimer of Warranty: The information in the text is intended to afford general guidelines on matters of interest to taxpayers. The application and impact of tax laws can vary widely, from case to case, based upon the specific or unique facts involved. Readers are encouraged to consult with professional advisors for advice concerning specific matters before making any decision, and the author and publisher disclaim any responsibility for positions taken by taxpayers in their individual cases or for any misunderstanding on the part of readers. While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. Neither the publisher nor author shall be liable for any loss of profit or any other damages, including but not limited to direct, indirect, special, incidental, consequential, or other damages.

For general information on Ernst & Young LLP's other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

ISBN

978-1-118-86698-6 (paper); 978-1-118-86683-2 (epdf);

978-1-118-86696-2 (epub)

ISSN

1059-809X

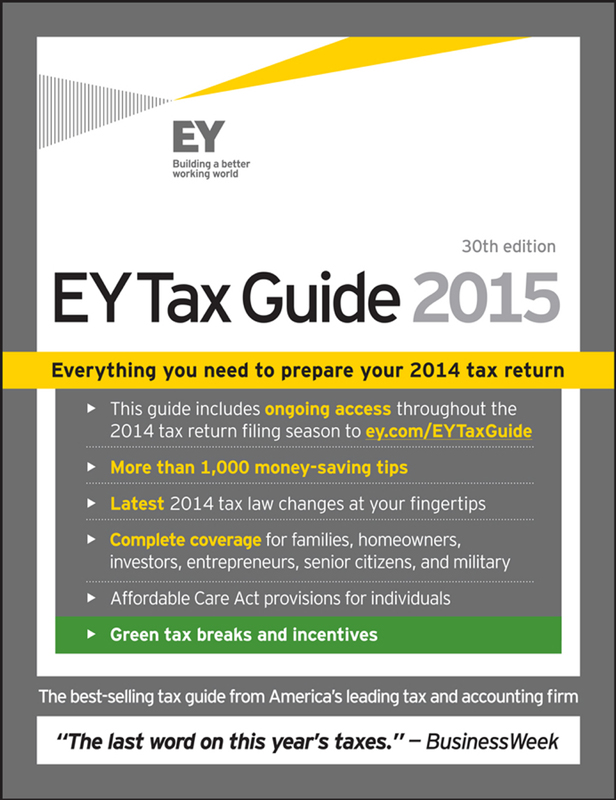

The EY Tax Guide 2015

Years of critical acclaim for America's no. 1 tax guide...

This is the best tax guide of the bunch... the most up-to-date guide.

USA Today

Hard to beat... [EY professionals] elucidate each point, giving examples, definitions and strategies that you won't learn about from the IRS.

Money

This book... has more up-to-date information on tax changes than its competitorsor even the IRS.

Chicago Sun-Times

Best of the commercially available guides.

New York Daily News

Destined to become the old standard,' all written in plain English .... If you can afford just one tax book, this could be the one.

Seattle Post-Intelligencer

The text-with-commentary approach makes the book both authoritative and easy-to-use.

People

The simplest tax guide to understand.

CBS This Morning

The explanations, examples, and planning advice are top-drawer.

Orlando Sentinel

Exceptionally detailed.

The Sunday Denver Post

An excellent book, full of clear explanations, planning hints, tax savers and sample forms.

Atlanta Journal Constitution

Our brand-name choice for filers with lots of questions for filing and planning situations.

Fort Worth Star-Telegram

... a veritable fountain of information.

Milwaukee Sentinel

... the best of the bunch for return preparation.

Des Moines Register

2015 tax calendar

| Date in 2015 | Action required |

| January |

| 15 |  Final estimated tax payment for 2014 due if you did not pay your income tax Final estimated tax payment for 2014 due if you did not pay your income tax

(or enough of your income tax) for that year through withholding. Use Form 1040-ES. |

| February |

| 2 |  If you did not pay your last installment of estimated tax by January 15, file your income tax return for 2014 If you did not pay your last installment of estimated tax by January 15, file your income tax return for 2014

on this date, thereby avoiding any penalty for late payment of the last installment. Use Form 1040 or 1040A. |

|

Next page

Final estimated tax payment for 2014 due if you did not pay your income tax

Final estimated tax payment for 2014 due if you did not pay your income tax