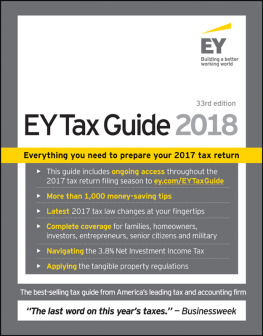

Ernst - Ernst & Young Tax Guide 2013

Here you can read online Ernst - Ernst & Young Tax Guide 2013 full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2012, publisher: Wiley, genre: Home and family. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Ernst & Young Tax Guide 2013

- Author:

- Publisher:Wiley

- Genre:

- Year:2012

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

Ernst & Young Tax Guide 2013: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Ernst & Young Tax Guide 2013" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

File your taxes with the help of a proven leader

If you wish to personally prepare your 2012 federal tax return, but seek the guidance of a trusted name in this field, look no further than the Ernst & Young Tax Guide 2013. Drawing from the tax experience and knowledge base of Ernst & Young professionals, this reliable resource not only covers how to file your federal income tax return but also provides valuable insights on how to avoid common errors and maximize your federal tax deductions.

Designed in a straightforward and accessible style, the Ernst & Young Tax Guide 2013 contains essential information that will help you save time and money as you prepare your 2012 federal tax return. Throughout the book, youll find hundreds of examples illustrating how tax laws work, as well as sample tax forms and schedules to show you how to fill out your return line by line.

- Includes 50 of the most commonly overlooked deductions to take into account when preparing your return

- Provides specific solutions in its special contents index for taxpayers in particular circumstances, including families, homeowners, investors, entrepreneurs, senior citizens, and military personnel

- Contains an individual tax organizer, 2013 tax calendar, and a summary of expiring provisions

- Provides checklists of key 2012 tax breaks and deductions you may be eligible to use

Comprehensive yet direct, the Ernst & Young Tax Guide 2013 has everything youll need to personally prepare your 2012 federal tax return.

Ernst: author's other books

Who wrote Ernst & Young Tax Guide 2013? Find out the surname, the name of the author of the book and a list of all author's works by series.