Praise for

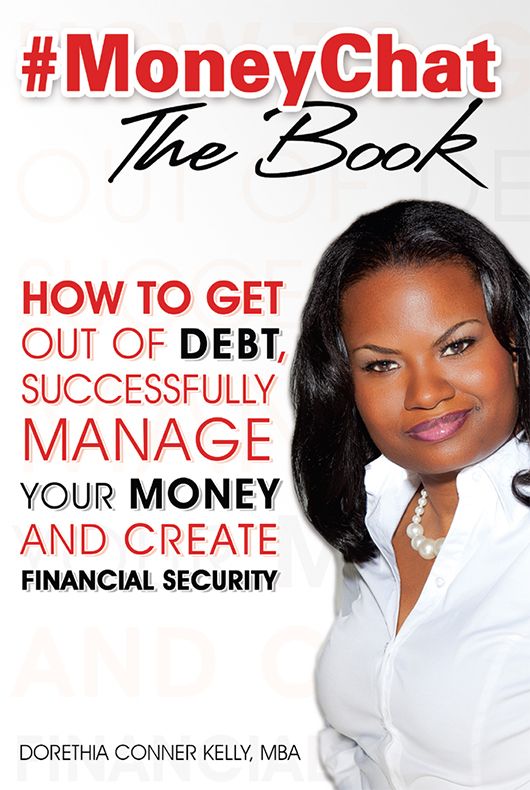

#MoneyChat THE BOOK

For years Dorethia Conner Kelly has been a valuable financial expert in the community helping numerous clients achieve financial success and overflow. Finallyshe has made her expertise and knowledge available in print. Kudos for #MoneyChat THE BOOK. Now consumers have a user-friendly, practical and much needed guide with simple steps to get out of debt and become financially independent.

Glinda Bridgforth, author of

Girl, Get Your Money Straight!, Girl, Get Your Credit Straight!

and co-author of

Girl, Make Your Money Grow!

If you are tired of people simply telling you to manage your money better, but not telling you how, this book is for you. Dorethia has provided realistic methods for getting out of debt and preparing for the financial life you want now!

Ryan C. Mack, author of

Living in the Village, Build Your Financial Future

and Strengthen Your Community

Searching for a great long-term investment? Look no further than Dorethia Conner Kellys new book #MoneyChat. Spend a few hours curled up with this financial guide and you will reap dividends for years to come as you learn how to get out of debt, set yourself up on solid financial ground, and prudently invest your money for your future.

Manisha Thakor, co-author of

On My Own Two-Feet and Get Financially Naked

How People are Changing Their

#MoneyChat!

Although I earned a great income, I was never really able to save money. After working with Dorethia, I was able to see where my money was going and create a realistic financial plan that I could follow.

S. Johnson, Administrative Assistant, Washington, D.C.

Working with Dorethia was very eye opening. As she helped us match our behaviors and spending habits with the numbers, we realized unexpected expenses were stopping us from reaching our goals. We developed a fund for for those irregular expenses are now better able to forecast throughout the year and add to savings.

The Cordaways, New Haven, Connectcut

Dorethia helped me understand the mindset of paying myself first and how it was transferrable across several goals. I began to set aside a percentage of my paycheck not only for emergency savings, but also when I needed to prepare for a large purchase. This allowed me to save and pay cash for a previously owned vehicle as opposed to financing a new vehicle.

L. Corbin, Healthcare Professional, Detroit, Michigan

#MoneyChat The Book

Copyright 2015 by Dorethia Conner Kelly, MBA

All rights reserved. In accordance with the U.S. Copyright Act of 1976, the scanning, uploading, and electronic sharing of any part of this book without the permission of the publisher constitutes unlawful piracy and theft of the authors intellectual property. If you would like to use material from the book (other than for review purposes), prior written permission must be obtained by contacting the publisher. Thank you for your support of authors rights.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

Cover design: Ashley Fulgenti Designs

Cover photograph of author: Shawn Lee Photography

Interior design: Jera Publishing

Editor: Sonja Mack

Published in the United States

by Felicity Media Group, LLC.

Detroit, Michigan

ISBN 978-0-9863383-0-4

Library of Congress Control Number 2015900547

Dedication

For my children and grandchildren, my prayer is that you always have financial success.

To my mother, I love you, that is all.

To my husband Will, its primetime, who knew? Love you.

Acknowledgments

Thank you to everyone who helped me along the way, held my hand, offered advice, provided their referrals, and resources time and time again. This is the short list, there are so many more, too many to list. Please know that I appreciate you all.

Thank you LaKeisha Mallett, Manyell Akinfe-Reed and Lori Mello for contributing your wealth of knowledge to #MoneyChat.

Thank you: Kim Brooks, Glinda Bridgforth, Ryan Mack, Manisha Thakor, Alisa T. Weinstein, Gail Perry-Mason, Gia Parker-Maxwell, B. Valaise Smith, Romeo Clayton, Tamekia Ashford, Karen Cordaway, Shareeke Edmead-Nesi

Thank you Karen Cordaway, Elizabeth Durden, Robin Wooten and Lamont Corbin for sharing your #MoneyChat stories. You guys ROCK!

Contents

Introduction:

#MoneyChat: Changing what you SAY and DO with your money!

INTRODUCTION

#MoneyChat: Changing What You SAY and DO With Your Money!

W ATCH YOUR MOUTH! HOW MANY of us heard that as kids? Both of my hands are raised, my mouth was always getting me in trouble. You need to tell yourself the same thing when you hear yourself saying negative comments about your money! I have always believed that our words have power, if you are constantly saying the negative, you wont be able to achieve the positive.

I can remember, as a young woman in my early 20s, never really hearing anyone say anything positive when it came to money. Someone was always moaning about not having it, needing to borrow it or loaning it out but never getting it back. They couldnt pay bills, bill collectors were always callingthey just stayed stressed out about debt and never having enough money.

Thats part of my own story. Ive heard many others, including some about those who have more than enough money. So much that they were able to have whatever they wanted. They never heard the word NO, so there were no boundaries. People like this may not have ever learned how to live without an abundance of money until they were on their own, which was probably a major shock. Saying no to yourself and to others is important to changing your money habits. We each have our own unique situations, whether its never having enough or not understanding financial boundaries, that influence what we SAY about money as well as what we DO with it.

Thats exactly what the #MoneyChat movement is aboutchanging what you say about money so your actions will follow! In my financial coaching practice, there are three recurring things people want to do:

Get out of the debt hole

Learn how to manage their money

Grow their money by investing and saving for retirement.

Many just dont know how to make that happen, so I wanted to write a book that spoke to those concerns. I also added chapters about IRS debt and gambling, because these are important money issues that are crippling millions of families, but theyre not discussed as much mainstream.

At the foundation of changing your financial future, is building an emergency fund. In this chapter I share my experience and how you can start an emergency fund, bit by biteven when money is tight.

Throughout each chapter in this book, Ive included an action for you to take. It makes no sense to simply read what to do and not have some accountability. In my financial and business coaching practice I always give homework, so each chapter gives you homework as well. Please share your success stories with me at and connect with us below.