Is the gold you just bought real or is it fake? Did you pay a fair price for it? Is it a good investment? The coin you recently purchased, is it real? Did you get a good deal? What is the best investment strategy with respect to precious metals? Should you buy silver coins or gold coins? Should you buy silver bars or gold bars? Should you invest in precious metal ETFs or Mutual Funds and how do these investments compare to owning physical gold or silver? What rate of return can you expect from any precious metal investment in any form and from rare coins? Who do you safely buy from?

I could list questions like these for pages, but I think you get the point. There is so much interest in rare coins and gold and other precious metals in the myriad forms they take. And with this vast array of choices comes uncertainty and the possibility of making a poor decision and being taken advantage of.

Will this book rescue you? I hope so. I am throwing you a lifeline and inviting you to get on board as we journey down this path together. We will explore all the forms gold, silver and platinum take from coins to bars to rounds to numerous paper forms: ETFs, Mutual funds, ETNs, Futures, Options, Savings Accounts and so much more. We will travel back and look at the return these investment types have generated over the years. I will show you the safest way to buy gold and silver and coins, how to test your products for authenticity, and how to find gold, silver and coins without running around to yard sales, flea markets and estate sales! We will examine rare coins and explain how they relate to the topics mentioned. This book will end with an introduction to coin collecting: learn how to get started and why it is so important to know about coins and how they relate to precious metal investing. We will even look at ancient coins. This journey will begin with baby steps as we cover very basic information then get much more involved with these topics as the book unfolds. The road to success starts with knowledge. Why did this 1794 Silver Dollar sell for $10.5 million and break all coin records? (Answer at books end!)

Copyright, Legal Notice and Disclaimer

This publication is protected under the US Copyright Act of 1976 and all other applicable international, federal, state and local laws, and all rights are reserved, including resale rights: you are not allowed to give or sell this book and the materials contained in it, to anyone else.

Please note that much of this publication is based on personal experience and anecdotal evidence. Although the author and publisher have made every reasonable attempt to achieve complete accuracy of the content in this book, they assume no responsibility for errors or omissions. Also, you should use this information as you see fit, and at your own risk. Your particular situation may not be exactly suited to the examples illustrated here; in fact, its likely that they wont be the same, and you should adjust your use of the information and recommendations accordingly.

Any trademarks, service marks, product names or named features are assumed to be the property of their respective owners, and are used only for reference. There is no implied endorsement if I use one of these terms. All images in this book are readily available in various places on the Internet and believed to be in public domain. Images used are believed to be used within the authors and publishers rights according to the U.S. Copyright Fair Use Act (title 17, U.S. Code.)

Finally, use your head. Nothing in this book is intended to replace common sense, legal, or other professional advice, and is meant to inform and entertain the reader.

Copyright 2014 . All rights reserved worldwide.

Introduction

Who could have imagined that a routine trip to McDonalds back in the late 50s would start a life long journey into the world of coins and the many forms of gold and silver. My dad took me to this new hamburger joint that he loved, and as always, he handed me the change. As we were leaving and heading for the car, I looked at the coins in my hand and was surprised to find one with an Indian Head on it. I glanced at my dad and showed him the coin. He exclaimed: Thats an Indian Head Penny, you can find them in change, why not keep it and look for more.

Those few words and that neat looking Indian Head got my mind spinning. Could it be so easy to find these different looking pennies? In those days it was! My quest eventually evolved into collecting other coins and precious metal investing.

Coin collecting and searching is quite exciting and very financially rewarding. Our younger generation has little patience for such a pastime, and I fear that it may die out at some point. Who can say for sure?

I am glad we are going on this journey together, and maybe you or someone you know will take up the hobby after this read. I hope you pass on this information and reward yourself in the process. And if precious metal investing is your cup of tea, you are in the right place.

Table of Contents

Gold may be the most recognized object on the face of the earth. Even those who do not know what it is have a fascination with its color and shine, even children. Its beauty and appeal seem everlasting.

I can think of no better place to start this journey than by looking at the gold industry: Where does gold come from? What countries are involved? How much is available and how is it consumed? What is the gold industry worth in dollars and cents? How did we become interested in gold as an investment? Have Americans always been allowed to own gold?

What most people fail to realize is that of all the gold ever mined, almost all of it, is still with us; it hasnt gone anywhere. This is a difficult concept to grasp. If gold has been mined for centuries, even thousands of years, why hasnt it been used up?

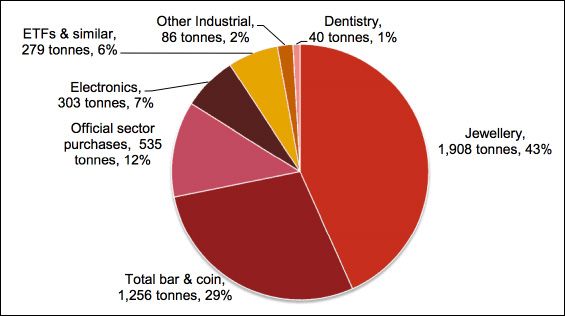

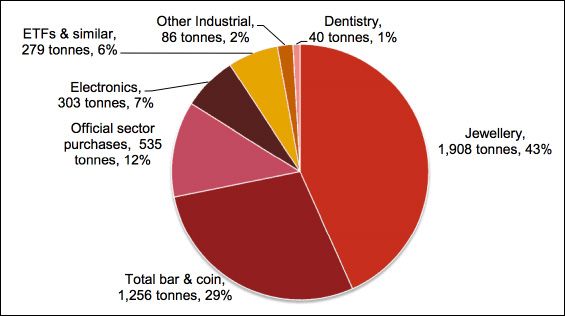

You see, gold is only consumed in very small amounts (about 10%), 90% of gold mined each year goes into jewelry and investing, so it is always available in one form or another. Most of the gold ever mined, a staggering figure estimated at 6.5 - 9 trillion dollars worth, is still here. Lets look at the consumption breakdown: (Please note that most charts show metric tons or tonnes. A tonne is a metric system unit of mass equal to 1,000 kilograms (2,204.6 pounds) or 1 megagram (1 Mg))

Its easy to understand why most gold is still with us only 10% goes into technology and much of it can be recycled when no longer needed. Gold mines account for most of the worlds gold. Stories of the oceans being rich with the yellow metal are true, but the cost of extraction is currently much greater than the price.

This list of countries by gold production is from a report on the U.S. Geological Survey website.

For many years, until 2006, South Africa was the worlds dominant gold producer. Recently, other countries with large surface area have surpassed South Africa, including China, Russia, the United States, Peru and Australia.

Next page