All rights reserved. No portion of this publication may be reproduced or transmitted

in any form or by any means, electronic or mechanical, including photocopy,

recording, or any information storage and retrieval system, without permission in

writing from the publisher, except by a reviewer who may quote brief passages in a

critical article or review to be printed in a magazine or newspaper, or electronically

transmitted on radio, television, or the Internet.

foreword

Fellow collectors,

I am a fourth generation collector who holds and perpetuates a set of coins from 1793 through 1964 that has very few gaps, so I understand what legacy means in every sense of the word. I have been an astute student of coins for more than 50 years and have had the benefit of three prior generations to get me to where I am today in my understanding of this thing we call a hobby.

With that said, I want to try to give you a realistic view of what is going on in the legacy and modern coin arenas. The legacy coins have been slowing down in popularity since about 1995. I could argue that point, but that is about the time that the real modern mania started and it has been accelerating ever since. If you consider the fact that most legacy collections are almost impossible to even complete, much less complete in high grade, and then consider that moderns are attractive, rare and are at this point still completable (even though the window is getting narrow), it's obvious why we all should be paying attention to this area of the market.

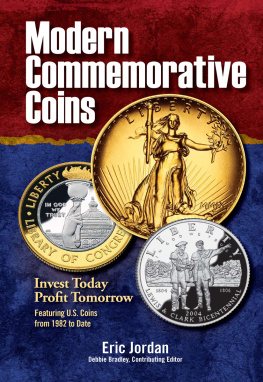

Take a 1907 $20 high relief Saint-Gaudens with a surviving mint state population of about 5,000 coins that has taken a hundred years to mature into the $10,000-$11,000 price range and compare it to mint state platinum eagles with their sub 3,000 mintages. As an owner of several varieties of the high relief Saint-Gaudens, I know that from an appreciation standpoint, the saint is pretty flat. As someone who just purchased several sets of the mint state platinum Eagles, they have just lifted off and you haven't seen anything yet. I will challenge you to look at any modern silver, gold, or platinum coin going and you will see what I mean by the reality of things to come.

The Baby Boomers, or those people born prior to about 1955, have been the holders of most of America's wealth for a lot of years. I have seen them give rise to booms and busts in almost everything from the 1960s muscle cars to the current boom in nursing homes. These people have motivated inventions, driven markets of every description, and in general financed this country.

With that said, I have to bring into perspective that these people (like myself) are getting old and starting to die off. As this attrition deepens, there will be a shift in amounts of money and interest in what coins will be sought after and hoarded. What you will see in the future is that the new breed of collector will come into the market, not with the perspective of old coins, but with the coins that he/she can relate to. This ultimately will be the moderns of today.

I am not preaching the doom of legacy coins, I am just stating that life has a certain evolution that is inevitable. Collectors who fail to recognize these foreseeable changes will most assuredly find themselves facing unnecessary losses.

We are on the tail end of the legacies and the front end of the moderns, so if you have a little money, a few years in front you and do a little homework, the upside potential in well-selected moderns is very impressive. This text is a good start on what you need to know to take advantage of the opportunities that modern U.S. coinage is offering us all today.

Sincerely,

Hank Swain

(Hank Swain is a fourth generation collector of U.S. coins.)

from the author

Wendy Jo and Eric Jordan

I started collecting coins in middle school during the early 1980s and had the privilege of working for Palmetto Galleries in Columbia, S.C., as a coin grader starting in late high school. My undergraduate studies were completed at North Carolina State's School of Engineering at Raleigh and it was at this point that I realized what I really enjoyed is the study of markets, their history and economics. These realizations led me to finish my graduate work at the University of South Carolina at Columbia's School of Business.

My formative collecting years were dominated by my interest in proof-like Morgan dollars, full bell line Franklin halves and to a certain extent classic commemoratives. Starting in the late 1990s, I realized that I was not going to be able to complete the proof-like Morgan set, which was my first love. Even if I did, the set's value indexed to inflation had leveled out or worse. This was a serious problem given that a significant percentage of my savings was in my coin collection.

Curiosity about all things related to U.S. numismatics and precious metals brought to my attention the radical drop in high-end modern coin mintages and the obvious low risk opportunity they presented. I had not started on my intense study of rare coin market history and modeling yet, but it was obvious that these new design-based coins had good genetics and were cheap. You will never get hurt if you buy the good stuff cheap, my old mentor used to tell me.

It was about this time that I began comparing notes with a highly competent and forward thinking fourth generation collector named Hank Swain. It is through hours of discussion with him and other experienced collectors and dealers, such as Dan Knauth, that the primary concepts seen in this text began to take form. Michael White, Judy Dixon and other U.S. Mint Office of Public Affairs personnel have been helpful with data acquisition.

I kept several things in mind during the seemingly endless hours it took to complete this research. They are:

He who is taught only by himself had a fool as his master.

Ben Johnson

What we think isn't as important as why we think it.

Unknown

No one can play at this level without the help of others.

Coach Bryant

So I would like to take this opportunity to thank my wife Wendy Jo for putting up with the endless hours of study needed to complete this text, my parents Buck and Sandy Jordan, my grandparents Bob and Nora Rice and my brother Brian's family for their love and support. Most of all I would like to thank Jesus for his unfailing love and mercy.

Sincerely,

Eric Jordan

P.S. This text is written to those who want to have a better shot at recognizing and buying Secretariats for the stable long before they have won the Triple Crown and then holding them to produce ultra long cycle taxable events that are likely to benefit succeeding generations.