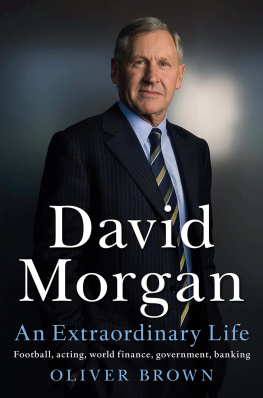

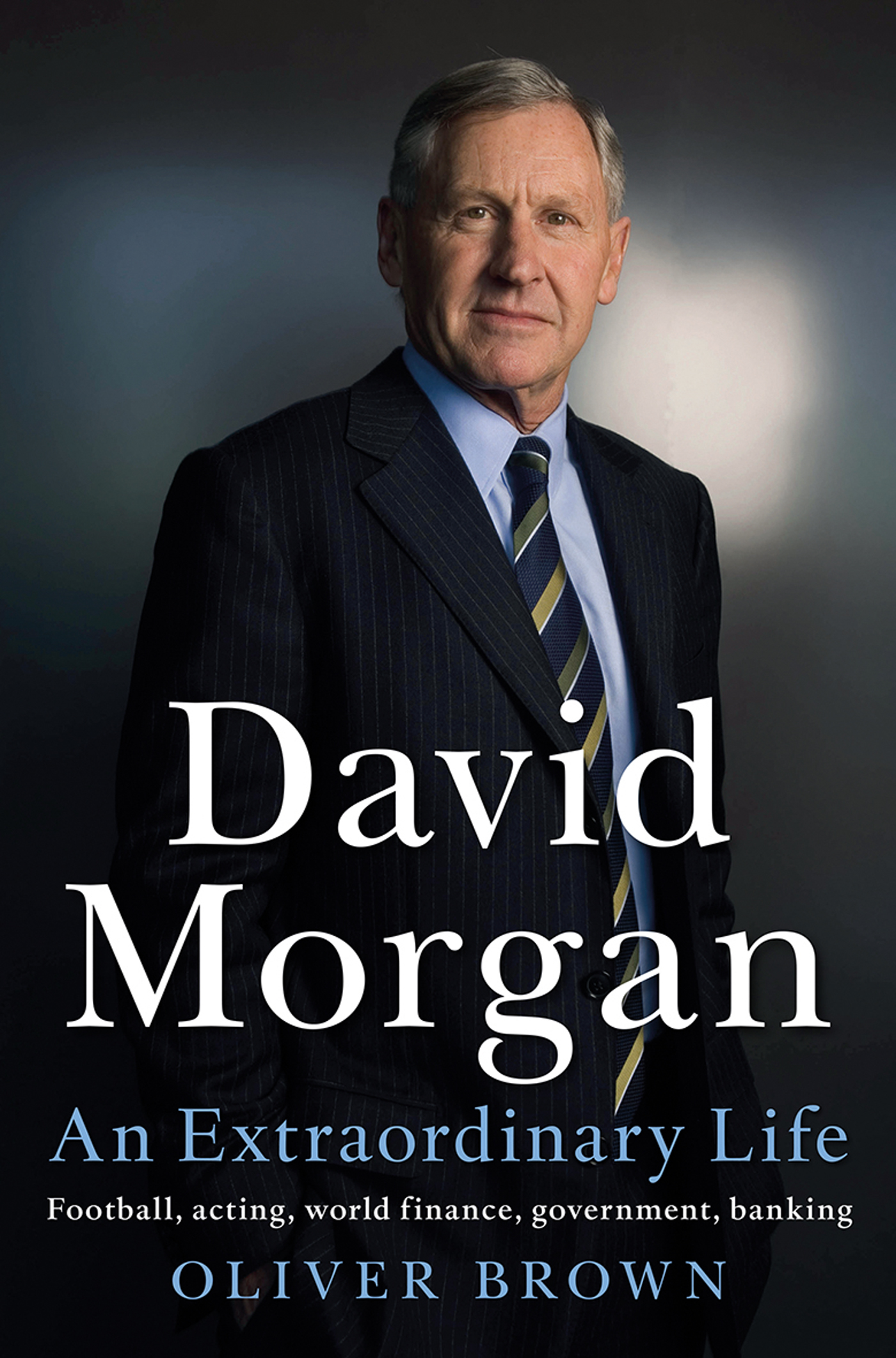

If David Morgan agrees to be CEO, and puts some of his own money in, Im in.

Warren Buffett, chairman of Berkshire Hathaway

David was the principal engine of the 1985 tax reform.

The cabinet decided to embark on the biggest fiscal consolidation in the history of the OECD. From 1983 until 1989, he was the officer most charged with the burden of these responsibilities. Somebody had not just to coordinate it, but to guide it, and David did. He had a prodigious capacity for work. Conscientious, perfectionist.

He would have made an effective secretary to the Treasury, just as he made an effective CEO of Westpac.

Paul Keating, former treasurer and prime minister of Australia

I believe that everyone should be treated equal in the company, including the janitor, the receptionist and the people who clean the kitchen. David thinks about things the same way. Hes a very engaging guy.

Jamie Dimon, chairman and CEO of J.P. Morgan

Davids leadership is truly transformative. Its infectious.

Ken Henry, chairman of National Australia Bank and former secretary to the Treasury

David systematically strengthened the risk framework of the bank. That manifested itself quite powerfully in the years from 2008 to 2010, when we were clearly better, absolutely and relatively, than both other major banks within Australia and other banks globally.

Gail Kelly, former CEO of Westpac

David was regarded as one of the strongest banking CEOs of the last couple of generations in Australia. There was a level of professional management that he brought to it and discipline which was more akin to the global markets than the domestic market.

David is very focused on the nature of leadership, the values of the leader. The natural intellect and social curiosity around matters of leadership make him something of an expert. It makes him valuable to other CEOs.

He was really successful and on top of the pile. Not just as a bank CEO he was legit. I dont know that Ive come across any CEOs who are quite that methodical, disciplined, diligent, prepared.

James Gorman, chairman and CEO of Morgan Stanley

The most remarkable thing about David was his incredible desire to improve and learn, and an ability to take feedback and actually change. Not many people can do that. It was pretty amazing.

During his nine years as CEO of Westpac, it really became a highly regarded institution which it wasnt when I left.

Bob Joss, former CEO of Westpac and professor and dean emeritus, finance, of the Stanford Business School

I thought he had the most successful outcome in his tenure of the banks.

John McFarlane, chairman of Barclays and former CEO of ANZ

I think David is the most successful of the people who left the public sector and went into the private sector.

Ian Macfarlane, former governor of the Reserve Bank of Australia

David was never one of these self-made people who ended up despising his origins. He actually has some sense of them.

Don Watson, author

From a strategy point of view, David was probably the first to really grasp the potential of wealth management in banking.

He has an enviable track record of hiring extremely high-quality people.

One key legacy of David is the sustainability focus. At the time it was pretty out there. Westpac ended up being recognised as the worlds most sustainable bank, and that really set a benchmark for others to pursue.

Brian Hartzer, CEO of Westpac

He was very successful as a chief executive. David had to give Westpac a new future. I thought he managed all that superbly.

John Uhrig, former chairman of Westpac

He was the stand-out banker of his generation. David correctly saw a lot of the big shifts of the era, notably banks moving away from personal finance and into wealth management. Critically, he was also really clinical on banks having to be safe, resilient and able to withstand shocks. Although he left before the global financial crisis hit in 2008, the bank was in such a strong position because of him.

Andrew Cornell, ANZ executive and former chief financial writer and associate editor atThe Australian Financial Review

When Westpac entered the global financial crisis it was in a much stronger position than its peers by virtue of what David had done.

Brian Johnson, bank equity analyst

David has the highest work rate of anyone I have ever known, to this day.

Phil Chronican, non-executive director of NAB and former senior executive of Westpac and ANZ

CONTENTS

By any gauge, the life of David Morgan is an intoxicating Australian story. The boy brought up in a broken home, in the shadow of his fathers financial ruin and racked by anxiety about whether the butcher could be paid on time, morphed into the man who would steer Westpac from the edge of oblivion to its position as a global top-20 bank. It was, in every sense, a road less travelled. As a child actor, he savoured a life beyond his peers most exotic imaginings, singing alongside Olivia Newton-John and completing his high-school studies aboard a schooner in the South Pacific. As a young economist at the International Monetary Fund, he was parachuted into some of the worlds most benighted spots, accused of being a CIA agent by the kleptocratic ruler of Sierra Leone and forced to beat his retreat under the watch of armed guards. As a senior Treasury bureaucrat, and one of Paul Keatings inner sanctum, he held sufficient influence to wipe $1.5 billion off the projected federal Budget deficit with barely more than the stroke of a pen.

All of this he could claim before even crossing the threshold of Westpac. It was little wonder that the banks more reactionary executives, accustomed to lavish expense accounts and a jobs-for-life culture, scorned him at first as an academic socialist, an interloper who threatened to disrupt the status quo. A budding thespian he might have been, but as a banker, Morgan was anything but a product of central casting. A profile in The Mail on Sunday in 2010, conducted soon after his relocation from Sydney to London with private equity firm J.C. Flowers, depicted him as a big-hitter who defies stereotypes. Brian Johnson, the Australian banking analyst who has credited Morgan with steeling Westpac against the ravages of the global financial crisis, was even more succinct when I met him. David, he smiled, is a bloody interesting guy.

Initially, Morgan was torn about the notion of a book. Eighteen years at Westpac, including nine as CEO, had convinced him that the lessons of leadership were far too complex and multi-faceted to be condensed under such boilerplate eighties slogans as true grit or only sharks can swim. Equally, his daughter, Jessica, knew enough about his passion for economics to caution against the dangers of producing a dry academic textbook. But over dinner one evening, at the family farm in the Southern Highlands, we agreed that the greatest value lay in documenting his extraordinary path in full.

For a start, there was the unusual dimension of public service versus private sector, and his record of success on both sides of the fence. There was also the richest historical backcloth. During graduate study at the London School of Economics, Morgan was not so much learning his craft as living it, as the global oil and energy crisis of the early seventies tipped the UK into painful austerity. In Washington DC, his office at the IMF was just three blocks removed from the White House, affording him a front-row seat for every twist of Watergate. Even in Treasury, he bore witness to a fundamental shift, as the calcified hierarchies of seventies Canberra gave way to a far more audacious spirit, with the Labor government of Bob Hawke and Paul Keating seeking to liberalise Australias economy in ways that would once have been unthinkable.