Contents

Guide

ALSO BY JAMES GRANT

Bernard M. Baruch: The Adventures of a Wall Street Legend

Money of the Mind

Minding Mr. Market

The Trouble with Prosperity

John Adams: Party of One

Mr. Market Miscalculates

Mr. Speaker! The Life and Times of Thomas B. Reed

The Forgotten Depression

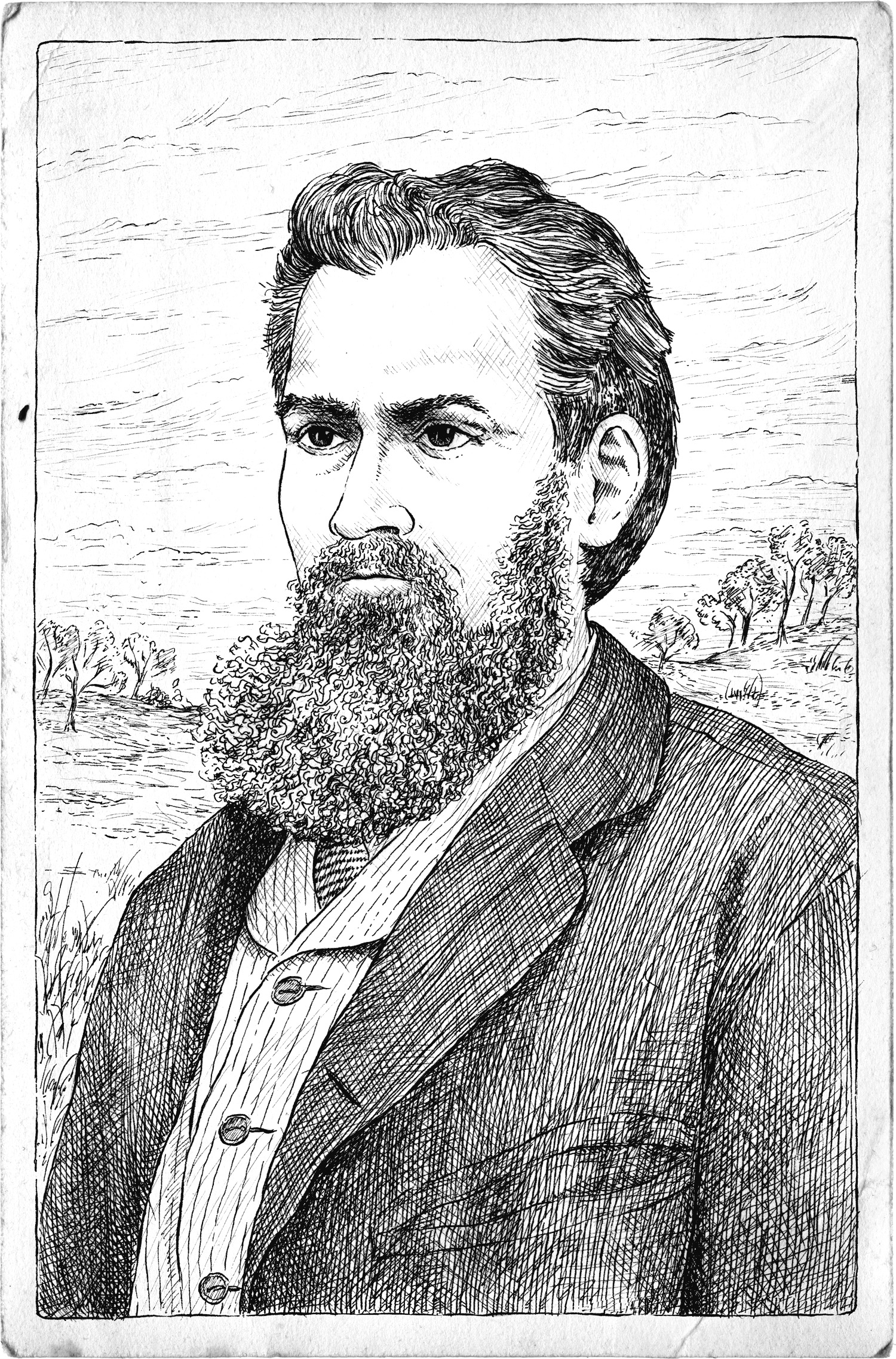

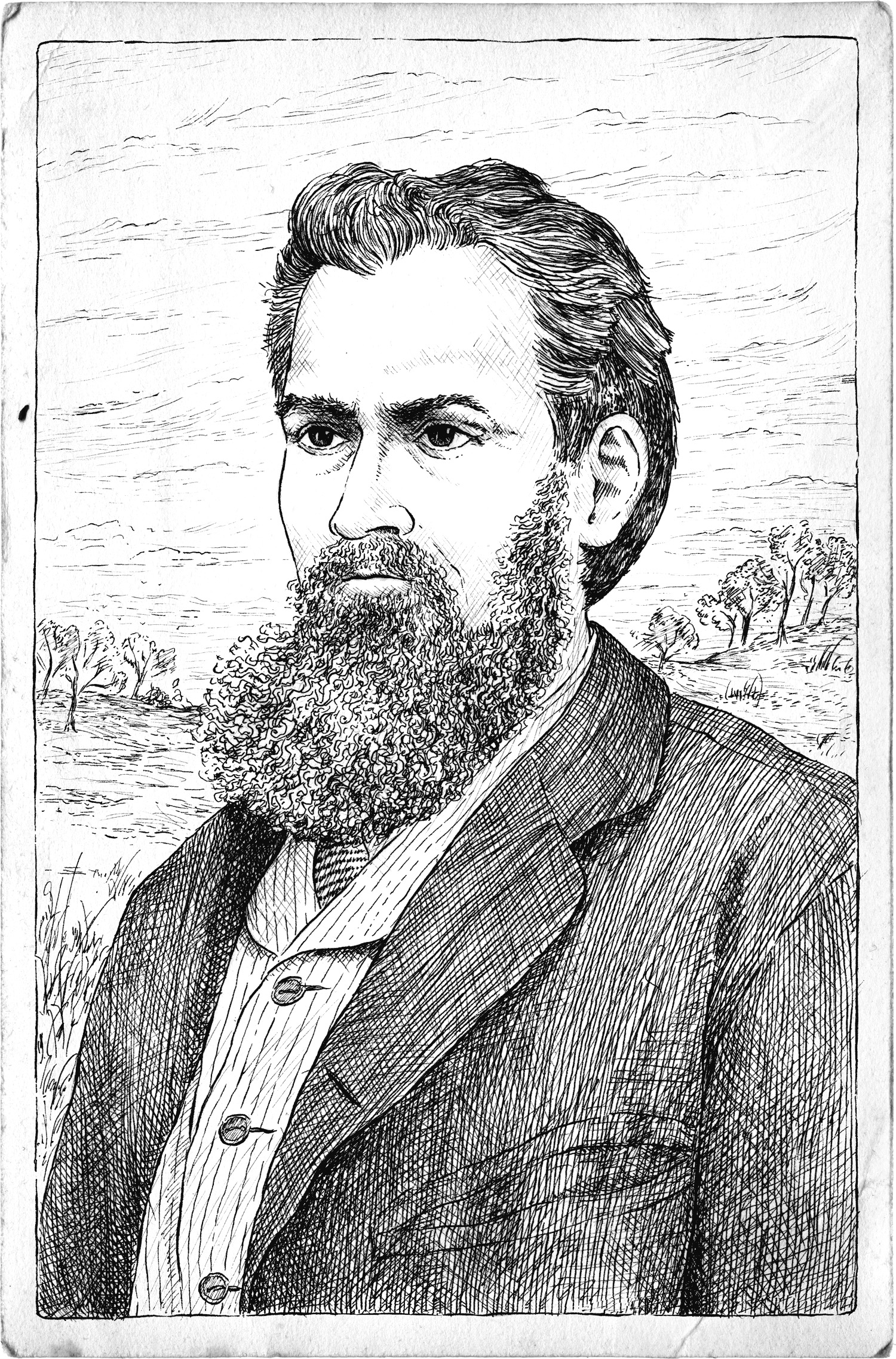

No portrait of Walter Bagehot is known to exist except for the famous profile that a photographer snapped in Bagehots middle years. The image you see here is the product of the remote collaboration between the former New York City Police Department forensic artist, Stephen Mancusi, and the illustrator and book designer, Katherine Messenger. Together, the two have imagined the face in full that no one has seen since Bagehots death in 1877.

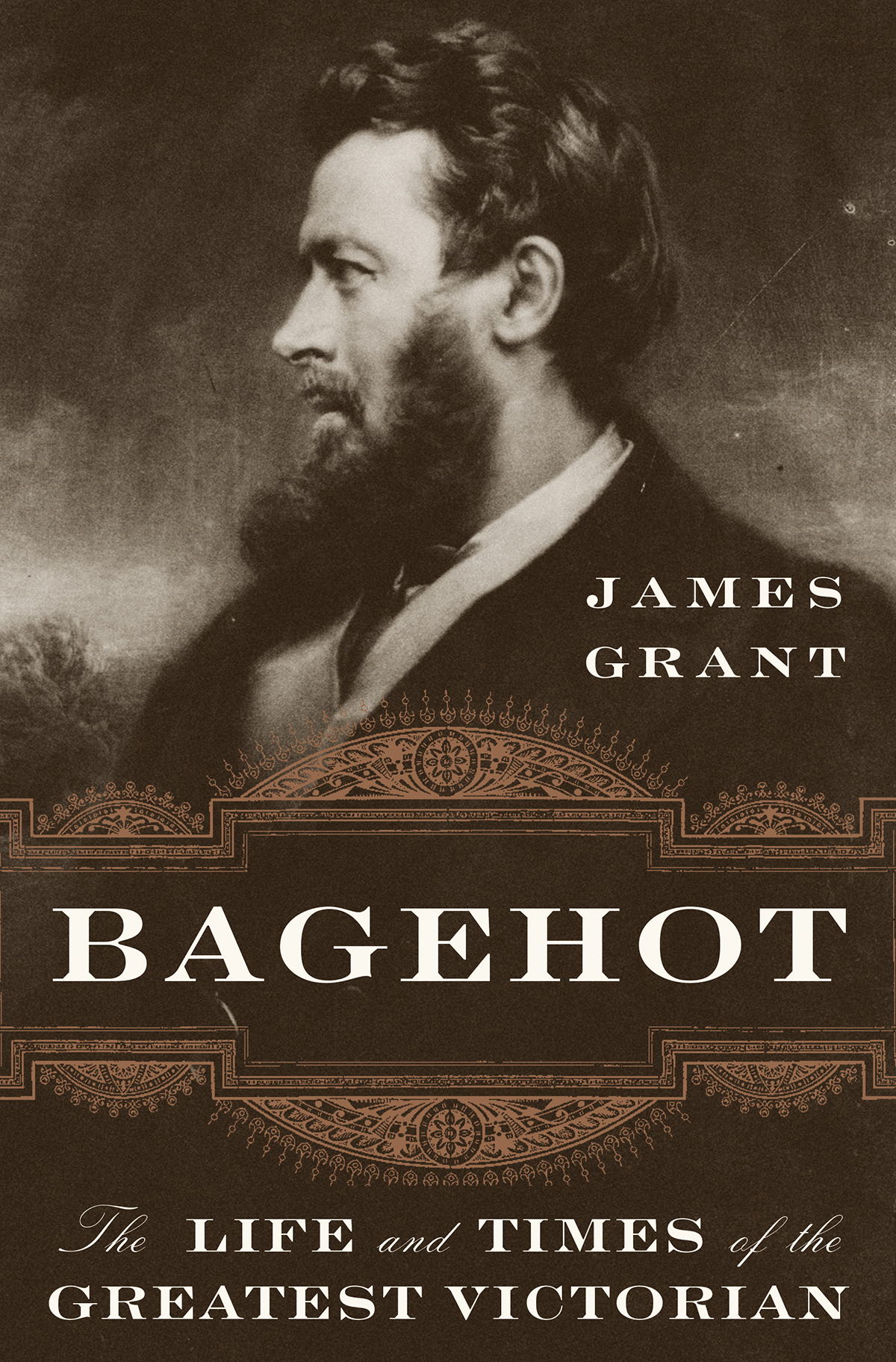

BAGEHOT

T HE L IFE AND T IMES OF THE G REATEST V ICTORIAN

James Grant

Copyright 2019 by James Grant

All rights reserved

First Edition

Photographs National Portrait Gallery, London, unless noted otherwise. Cartoon of The Old Lady of Threadneedle Street and photograph of Richard Holt Hutton are in the public domain. Material relating to Stuckeys Bank, including directors minutes, financials, and the data used to create the Victorian Money Machine chart, from the Royal Bank of Scotland Archives. Endpapers: London from the Monument , William Wyllie c. 1870 (private collection).

Excerpts from Till Times Last Sand David Kynaston, 2017, Till Times Last Sand: A History of the Bank of England 1694-2013 , Bloomsbury Publishing Plc.

For information about permission to reproduce selections from this book, write to Permissions, W. W. Norton & Company, Inc., 500 Fifth Avenue, New York, NY 10110

For information about special discounts for bulk purchases, please contact W. W. Norton Special Sales at specialsales@wwnorton.com or 800-233-4830

Book design by Ellen Cipriano

Production manager: Beth Steidle

The Library of Congress has cataloged the printed edition as follows:

Names: Grant, James, 1946- author.

Title: Bagehot : the life and times of the greatest Victorian / James Grant.

Description: First edition. | New York : W.W. Norton & Company, [2019] |

Includes bibliographical references and index.

Identifiers: LCCN 2019004287 | ISBN 9780393609196 (hardcover)

Subjects: LCSH: Bagehot, Walter, 1826-1877. | BankersGreat

BritainBiography. | EssayistsGreat BritainBiography. |

JournalistsGreat BritainBiography. | Economist (London, England :

1843)History. | Great BritainPolitics and government1837-1901. |

Great BritainEconomic conditions19th century.

Classification: LCC HB103.B2 G73 2019 | DDC 330.092 [B]dc23

LC record available at https://lccn.loc.gov/2019004287

W. W. Norton & Company, Inc., 500 Fifth Avenue, New York, N.Y. 10110

www.wwnorton.com

W. W. Norton & Company Ltd., 15 Carlisle Street, London W1D 3BS

for Edward Chancellor,

who insisted

We are looking for a man who was in and of his age, and who could have been of no other: a man with sympathy to share, and genius to judge, its sentiments and movements: a man not too illustrious or too consummate to be companionable, but one, nevertheless, whose ideas took root and are still bearing; whose influence, passing from one fit mind to another, could transmit, and can still impart, the most precious element in Victorian civilization, its robust and masculine sanity. Such a man there was: and I award the place to Walter Bagehot.

G. M. Young, The Greatest Victorian,

Spectator , June 18, 1937

CONTENTS

The immense fluctuations in our commerce, caused by protection, were aggravated by immense fluctuations in our credit, and the combined result was unspeakably disastrous.

Walter Bagehot on the commercial and monetary conditions prevailing in England around the time of his birth

I N 1832, J EREMIAH H ARMAN, a long-serving director of the Bank of England, testified before a parliamentary committee on how the Bank rose to meet the occasion of the Panic of 1825. It was a desperate time, and the Bank lent money in unprecedented ways. We lent it by every possible means, and in modes that we never had adopted before, Harman explained;

we took in stock as security, we purchased exchequer bills, we made advances on exchequer bills, we not only discounted outright, but we made advances on deposit of bills of exchange to an immense amount; in short by every possible means consistent with the safety of the Bank; and we were not upon some occasions over nice; seeing the dreadful state in which the public were, we rendered every assistance in our power.

Bagehot (pronounced Badge-it), who wrote the still-canonical prescription for stopping a run on the banks, Lombard Street , never recommended a policy so extreme. Faced with a crisis, he famously asserted, a central bank should lend freely at a high rate of interest against good banking collateral. He said much more than that, but those wordscustomarily abbreviated to omit the part about the high interest rateare invoked to this day. No sooner do the banks bring down a crisis on themselves, or stock prices take a tumble, than the call goes out for the Federal Reserve to infuse the market with emergency credit. In his memoir of the Great Recession, The Courage to Act , Ben S. Bernanke, chairman of the Federal Reserve from 2006 to 2014, cited Bagehot more frequently than any living economist.

Bagehot was a banker, a man of letters, and a financial journalist; most famously, he edited the Economist . But he was no economist himselfthat is, he made no original contribution to the body of economic theory.

It is a comment on the nature of economics as much as it is on the genius of Bagehot that his dicta on central banking continue to hold sway almost a century and a half after he propounded them. In the physical sciences, progress is cumulative; we stand on the shoulders of giants. In economics, the most ostensibly rigorous of the social sciences, progressand error, tooare cyclical; we keep stepping on the same rakes.

There is a misconception that Bagehot originated the idea of a lender of last resort. Its obvious he could not have done so; Jeremiah Harman and his fellow directors were doing more than Bagehot would later recommend two months before the author of Lombard Street was even born. He did, however, popularize and legitimize the proposition, controversial at the time but now taken as revealed truth, that a central bank owed a public duty to private persons dealing with large sums of money. Unfortunately, he seriously underestimated the extent to which this supposed obligation would induce people to take risks they would not otherwise accept in the absence of expected government help.

Perhaps Bagehot himself would agree. He believedat least, at age thirty-nine, when a monetarily astute friend took the trouble to make a careful inventory of his viewsthat money was gold and silver and that alone. All forms of currency, including the notes of the Bank of England, were credit instruments, no different than personal checks, from which it followed that the government had no business intervening in the business of banking. Bagehot came to modify his ideas about financial regulationbut, unacknowledged by the many who approvingly quote him on the imperative of central bank crisis management, he never changed his publicly expressed view about the gold standard or the abomination of fiat currency.