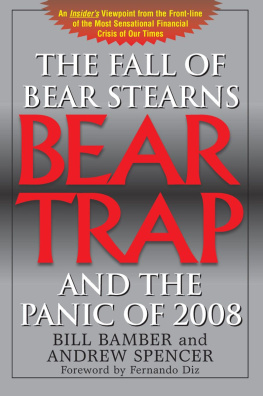

BEAR

TRAP

Bear Inside 9-27 10/16/08 2:05 PM Page i

BEAR

TRAP

The Fall of Bear Stearns and the Panic of 2008

BILL BAMBER and ANDREW SPENCER

Foreword by Fernando Diz

Brick Tower Press New York Bear Inside 9-27 10/16/08 2:05 PM Page ii

Brick Tower Press

1230 Park Avenue

New York, NY 10128

Tel: 212-427-7139 Fax: 212-860-8852 bricktower @ aol.com www.BrickTowerPress.com

The Brick Tower Press colophon is a registered trademark of J. T. Colby & Company, Inc.

All rights reserved under the International and Pan-American Copyright Conventions. Printed in the United States by J. T. Colby & Company, Inc., New York. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, or otherwise, without the prior written permission of the copyright holder.

Library of Congress Cataloging-in-Publication Data

By Bill Bamber and Andrew Spencer. Bear Trap

ISBN-10: 1-883283-63-9 ISBN-13: 978188283636 LCC#2008929923

First Edition September 2008 Includes index.

Copyright 2008 by Bill Bamber and Andrew Spencer

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic,

or otherwise, without the prior written permission of the copyright holder.

Cover design and typesetting by The Great American Art Company

10 9 8 7 6 5 4 3 2 1 Bear Inside 9-27 10/16/08 2:05 PM Page iii

Contents

Acknowledgments, v

Foreword byFernando Diz, vii

Prologue, xi

1. Of Bulls and Bears, 11

2. Hedge Your Bets, 25

3. Shoot to Kill, 43

4. Truth Is What You Make It, 61

5. Circular Reasoning, 75

6. No News Is Good News, 87

7. Bleeding Out, 101

8. A Sucker Born Every Minute, 115

9. Brother Can You Spare a Dime?, 129 10. To the Victors Go the Spoils, 139 11. Business as Usual, 151

12. The Devil Is in the Details, 165 13. What Do You Say When Its Over?, 175 14. Survival of the Fittest, 191

15. So What?, 211

Epilogue, 221 Bear Inside 9-27 10/16/08 2:05 PM Page v

Acknowledgments

W

riting a book is, by its very nature, a collaborative effort. And when a book has two authors, the fact that it is a collaborative effort is doubly true. We are both indebted to John Colby of Brick Tower Press for putting this project together and making it a reality, and to Alan Morell of the Creative Management Group Agency for bringing the different players together. Were also indebted to Betsy Colby for all of her help, photographic and otherwise. Aydin Caginalp reviewed the final manuscript with his lawyers glasses. Were very grateful to Jeanne Kramer at NBN for all of her encouragement, support and related efforts. Mike Stromberg did the typesetting. Thanks also to Fernando Diz for writing the foreword, and to Ellen Beck for introducing us to Fernando. Whew! But wait, theres more.

From Bill:

I would like to acknowledge first and foremost my former colleagues at Bear Stearns, an amazing group of people with whom I have experienced so much. This is your story. Special thanks to all my friends for their encouragement and support of me and this book. To Holly Bamber, Jason Prole, Dagmar Smek, Heather Stewart and Claire DiLorenzo, and the Rubino Brothers for their feedback on drafts. And Leigh, for your love and amazing spirit. No matter how wild the terrain you are always game for the adventure.

From Andrew:

I, too, would like to thank the former Bear Stearns employees for unwittingly allowing me into their world; I wish you all the best of luck in your future endeavors. Special gratitude to Bill Bamber for entrusting me with this opportunity and for his endless vaults of knowledge and patience,

v

both of which helped me to understand the secret language of investment banking, no matter how many times he had to explain it. David Edwards of Heron Capital Management and George and Arnold of the Family Spencer all provided advice, feedback and direction. Lucretia Voigt of Mitchells Book Corner in Nantucket, Massachusetts, offered invaluable feedback on drafts. Many thanks to Mom and Dad, of course, for everything. Arnold Willcox once tried to teach me about the stock market; with any luck, his spirit shines through here; maybe a little of his wisdom does, too. And Jill, I never could have gotten through thisand none of it would have been worth doingif it werent for you.

Bear Inside 9-27 10/16/08 2:05 PM Page vii

Foreword

T

he experts think it could have been the end of the U.S. financial system. So much so that the U.S. Treasury and the Federal Reserve felt compelled to intervene and prevent the real possibility of a financial debacle the effects of which, to this day, nobody can estimate with any certainty. The fall of Bear Stearns will be studied for years to come and, to be sure, we shall learn that things could have been done differently. But the path leading to Bears fall is not unlike the path followed in other spectacular falls. Bill Bamber and Andrew Spencer put you in the front seat and let you watch the events as they unfold from the perspective of those whose livelihoods were at stake.

But what started the downward spiral that led to the eventual demise of Bear Stearns? A good old-fashioned rumor that Bear Stearns was having liquidity problems. Reader beware: The power of rumors should never be underestimated. Gustave Le Bon, a studious researcher of the popular mind, knew how powerful rumors could be back in the nineteenth century. He had clearly identified the ingredients necessary to imbue the mind of a crowd with certain suggestions or beliefs. For a rumor to have the devastating effect it had on Bear Stearns, several conditions needed to be in place. First, the public needed to be preconditioned by certain events or circumstances. There is no doubt that the public had been preparing for a catastrophe to happen somewhere in the financial system; the highly publicized troubles of two of Bear Stearns hedge funds, large writedowns at many financial firms and the subprime mortgage market dislocations were just a few of those preconditioning events or circumstances. However, the preconditioning only paves the way for a rumor to start.

The next ingredient of an effective rumor is affirmation. As Le Bon states: Affirmation pure and simple, kept free of all reasoning and all proof, is one of the surest means for making an idea enter the mind of the

vii Bear Inside 9-27 10/16/08 2:05 PM Page viii BEAR TRAP

crowd. The more concise an affirmation is, i.e. Bear is insolvent or Goldman will not do business with Bear, the more weight it carries. Affirmation, however, has no real influence unless it is constantly repeated, and this leads us to the third ingredient for an effective rumor: Repetition. Quoting Le Bon: The thing affirmed comes by repetition to fix itself in the mind in such a way that it is accepted in the end as a demonstrated truth. What better than a media machine operating in overdrive to provide such repetition? After all, rumors make good media stories, especially if the rumor validates what the public has already been conditioned for.

Anybody that watches the financial press on a daily basis understands how effective it is in giving a rumor the repetition it needs to become what is perceived to be the truth. But repetition is no longer confined to the realms of television, radio, or the printed press. Today, you only need to go to Google Finance, type a ticker symbol and look at the news for the ticker to see the same story presented countless times from different sources. When a rumor has been effectively repeated and there is unanimity in its repetition, it is transformed into current opinion, and contagion follows. The opinions and beliefs of crowds are propagated by contagion, but never by reasoning. One only needs to visit the blogosphere or the countless numbers of social Internet sites to realize how fast a rumor can spread. At this point, the rumor is no longer a rumor and it can no longer be stopped. People complaining that a rumor does not die do not realize that it has reached the contagion stage and that it will not die because it is now the truth. Bamber and Spencers account of the events leading Bear to a financial crisis reads remarkably like a case study of Le Bons predictions. It is fascinating to see how even Bear insiders like Bill Bamber can become hypnotized by the power of rumors and how the media seems to play a pivotal role in accelerating the downward spiral by repeating it relentlessly.

Brick Tower Press New York Bear Inside 9-27 10/16/08 2:05 PM Page ii

Brick Tower Press New York Bear Inside 9-27 10/16/08 2:05 PM Page ii