Table of Contents

To the 14,000 people who worked at Bear Stearns

CAST OF CHARACTERS

At The Bear Stearns Companies

Alan Schwartz, chief executive

Sam Molinaro, chief financial officer

Bob Upton, treasurer

Tom Marano, head of mortgages

Paul Friedman, chief operating officer of the fixed-income division

Jimmy Cayne, chairman

Alan Ace Greenberg, director and former CEO

Vincent Tese, lead director

Richie Metrick, investment banker

Carl Glickman, director

Tim Greene, cohead of the fixed-income funding desk

Steve Meyer, cochief of the equities division

Pat Lewis, deputy treasurer

Jeff Mayer, cohead of the fixed-income division

David Kim, internal lawyer

Steve Begleiter, head of corporate strategy

At JPMorgan Chase & Co.

Jamie Dimon, chairman and CEO

Steve Black, cochief of the investment bank

Bill Winters, cochief of the investment bank

Matt Zames, head of foreign-exchange and interest-rate product trading

Steve Cutler, general counsel

Doug Braunstein, head of corporate finance

At the Federal Reserve

Tim Geithner, president of Federal Reserve Bank of New York

Ben Bernanke, chairman of the Federal Reserve Board

Kevin Warsh, governor of the Federal Reserve Board

At the U.S. Department of the Treasury

Hank Paulson, secretary

Bob Steel, undersecretary

Advisers to Bear Stearns

Gary Parr, deputy chairman of Lazard Ltd.

Rodge Cohen, chairman of Sullivan & Cromwell LLP

Dennis Block, senior partner, Cadwalader, Wickersham & Taft LLP

At J.C. Flowers & Co., LLC

Chris Flowers, founder

Jacob Goldfield, adviser

John Oros, managing director

Third Parties

Lloyd Blankfein, chairman and chief executive of Goldman Sachs Group, Inc.

Gary Cohn, copresident of Goldman Sachs Group, Inc.

Josef Ackermann, chairman of Deutsche Bank AG

John Mack, chairman and chief executive of Morgan Stanley

Warren Buffett, chief executive of Berkshire Hathaway Inc.

PREFACE

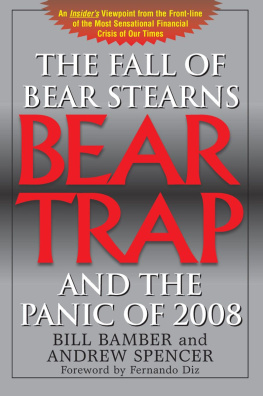

This book was born of a three-part series I wrote for the Wall Street Journal in May 2008 about the demise of The Bear Stearns Companies. Published two and a half months after a devastating run on the investment bank, the articles detailed the battle for survival that had been waged inside Bear during its waning months and days as its employees fought fearful lenders, hesitant trading partners, and, worst of all, clients who had lost their faith.

The series struck a chord with many Journal readers; after its publication, I received hundreds of e-mails and phone calls with commentsthe vast majority admiring. But the most gratifying feedback came from a father of two young children who had worked in Bears equities department. When his kids were old enough, he said, he planned to give them the Journal stories to read. Then, he told me, theyll understand what happened to Daddys career. His words underscored the brutal impact that the Bear Stearns collapseand the credit crisis that spurred ithas had on hundreds of thousands of workers in the U.S. economy.

For Street Fighters, I selected the most dramatic three days of the Bear saga and examined them hour by hour; from the evening of March 13, when Bear executives realized they were nearly out of cash, to the evening of March 16, when Bear directors approved the firms original sale to J.P. Morgan for $2 per share. I wanted to take readers through that agonizing weekend as if theyd been inside 383 Madison Avenue themselves. I hope Ive succeeded.

I am deeply indebted to the roughly one hundred people who availed themselves to me for interviews. The vast majority did so anonymously, with the understanding that their recollections would not be attributed to them by name, job description, or employer. Scenes containing direct quotes or thoughts were reconstructed through interviews with the subjects themselves or, where that wasnt possible, with close associates of those subjects who were familiar with their words and thoughts. I have attempted to corroborate those quotes, thoughts, and situations with all the relevant parties. Cases in which a speaker strongly disagreed with other sources recollections of his or her quotes or thoughtsor in which the speaker refused to comment on the quote one way or anotherhave been footnoted in the text

This book would not have been possible without the help of many friends, colleagues, and advisers. I am grateful to Robert Thomson, the Journals editor in chief; Nik Deogun, deputy managing editor; and Ken Brown, money and investing editor, for granting me book leave. Thanks go also to Mike Siconolfi, Mike Williams, and Alex Martin, the troika of editors who brought the original series to life. I owe particular recognition to Mike Siconolfi, my mentor and friend, for his ongoing advice and support.

For their time, encouragement, and wisdom along the way, I thank Greg Ip, Sarah Ellison, Bruce Orwall, Seth Mnookin, and Michael Lewis. For their tireless handling of my many questions and enthusiasm for the book, I thank my editor, Adrienne Schultz, and my publisher, Adrian Zackheim; without them this would never have come together. Thanks to Bob Barnett, Tom Hentoff, and Bonnie Nathan, who gave invaluable advice, legal and otherwise, and to Scott White and Brian Rance, for their sound technical advice. Finally, my immense gratitude to Yana Collins Lehman, Felice Tebbe, Megan Hickey, and the rest of my inner circle in Park Slope.

Most important, I thank my loving husband, Kyle Pope; my parents, Pat and Joe Kelly; my stepdaughter, Laney Pope; and our boy, Bogart, for their patience and support.

Kate Kelly

February 2009

THURSDAY March 13, 2008

5:30 P.M.

Early on the evening of Thursday, March 13, Sam Molinaro, chief financial officer of The Bear Stearns Companies, called the firms CEO, Alan Schwartz. We have a serious problem, Molinaro said.

Up in his forty-second-floor office, Schwartz had been hearing snippets of bad news all afternoon. Bear traders, trying to do business with rival firms, were getting pointed questions about whether they could make good on their financial obligations, and hedge funds had been yanking money out of their Bear accounts. By the time he got the call from Molinaro, Bears cash supply appeared to be draining fast.

This is looking pretty serious, Schwartz replied. Ill be right down.

Schwartz took the elevator to the sixth floor, where executives were slowly congregating outside Molinaros corner office. Though no one had sent out an e-mail, the word got around that the firms top managers were meeting at 6:00.

Like many meetings led by Molinaro, however, the tone seemed to be one of hurry up and wait. Bears CFO was hopelessly disorganized, and had a knack for making important people hang around outside his office while he wrapped up a phone call or had an impromptu meeting. The delays sometimes lasted for hours. Molinaros chaotic scheduling was so widely remarked on that Paul Friedman, the sardonic chief operating officer in the fixed-income division, liked to sum it up with a joke: What time is our six oclock meeting?