Contents

Guide

For Jacob Mai and Louis Van

May you live the American Dream...

Contents

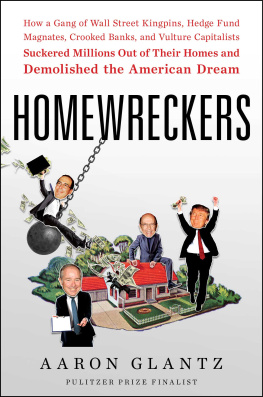

I AM ONE OF THE lucky ones. I profited off the housing bust. I leveraged the Great Recession to live the American Dream.

In May 2009, with the housing market in free fall, I bought a foreclosure. I scrounged money saved living in a nonprofit housing complex near the University of California at Berkeley, where Id gone to school, and, with help from my parents, my wifes parents, and my grandmother, cobbled together a down payment on a two-bedroom house.

The house isnt much. Its boxy, a thousand square feet, up a hill on the southern edge of San Francisco, but from my favorite chair in the living room, I can see the Pacific Ocean. Like millions of other Americans, my home is now my primary source of wealth. Its my hope for retirement and my backup plan for financing my childrens college education. Eight years after I bought it, my mortgage payments are lower than what many of my friends and colleagues pay to rent their apartments. In the morality play of recession and recovery, my experience shows the good guys can win, and the profiteers sometimes lose.

Before I bought it, the home had fallen into foreclosure, subject to a scheme hatched by three Filipino American women who flipped San Francisco real estate between one another, artificially driving up the purchase price. The first woman bought the house for $547,000 in 2003, quickly defaulted on the new mortgage, and then unloaded the house for the generous sum of $663,000. The seller repaid what was owed to the bank, but since the resale price had been much more than what she paid, the result was a huge profit. Given that banks pay the full amount of the purchase price to the seller, those earnings came out of the loans issued to the second buyer.

That was in 2004. The trio did the same thing again for $825,000 in 2007, just before the crash of 200809. Each time, property records show, the women put down almost no money. Credit flowed free and easy, and nobody from any of the banks appeared to ask any questions. Through this system, the women were able to clear more than $100,000 in profit each time they sold.

Besides this hustle, the women divided up the home, splitting the kitchen in two with cheap Sheetrock to create an extra bedroom. They rented the house out to undergrads from nearby San Francisco State University, who doubled up in rooms (and painted the living room a fluorescent-lime green). But the $2,500 the speculators collected each month in rent did not come close to covering their monthly mortgage payments, whichthanks to the ballooning purchase prices and ever-larger amounts of debtcame to nearly $4,000, excluding property tax and insurance. Again they defaulted on their mortgage. Previously, that might simply have been the cue to pull the same six-figure trick as before, but here the three women ran out of luck. When property values collapsed in the bust, the speculators were left without access to easy credit, and their small real estate empire crumbled. In April 2008, when they lost the house to foreclosure, the mortgage on the house was $44,000 greater than it was when theyd taken it out the year before. Nevertheless, in less than five years they had managed to pocket hundreds of thousands of dollars from banks that did not care if the loans they were making were in any way responsible.

People were doing things they never should have been doing, our agent, Menelva Boyd, said when we told her about the scheme. Menelva, a sixty-eight-year-old African American divorce from Tyler, Texas, was also a neighbor of ours in the nonprofit housing complex. Shed spent weeks driving us to open homes in her silver Nissan Ultima before locating this foreclosurewhich was discounted on account of its confusing tenant situation.

My wife, Ngoc, and I hadnt been looking for a home on top of this hill. I wanted to live closer to the shops and streetcar line that ran down Ocean Avenuefrom City College of San Francisco, to the tony neighborhood of West Portal, and then into a tunnel that sped commuters downtown each morning.

And yet, when I saw the house, I felt like we had won the lottery. A third-generation San Franciscan who has never felt at home anywhere else, I had previously given up the possibility of raising my own children in the city of my birth. Successive waves of gentrification had driven real estate prices far beyond the modest means of working journalists, and the housing bubble had made things worse. Now, thanks to the bust, a home had miraculously fallen into my price range. If I could pull this off, we would have the peace of mind that came with our own piece of land. We would know that if we worked hard and made our mortgage payments, we could never be evicted. Secure in the locked-in payments of a fixed-rate mortgage, wed be able to breathe easy with the knowledge that there would be no landlord to skimp on repairs, jack up the rent, or try to force us out in favor of wealthier tenants.

Still, there were complications. I worried that if we did buy the house, we wouldnt be able to move in. The garage was full of junk hoarded by one of the women, a thin, forty-four-year-old with hip, rectangular eyeglasses, whotogether with another one of the three speculatorshad sold the home at a hefty profit in 2007, when all appeared fine in the housing market. Now she was claiming to be a tenant, creating a sticky legal situation that drove away other prospective buyers. But we needed to move. Ngoc was pregnant with our first child, and though we had rearranged our apartment to fit a crib in our bedroom, we knew we would soon need more space than our affordable-housing unit could provide.

Our families urged us to be aggressive. Ngoc had come to the United States as a refugee in 1975, the result of the courageous actions of her father, a lieutenant in the South Vietnamese navy. On April 30, the day Saigon fell to the Communist North Vietnamese, he loaded his family onto a boat and steered it to an American base in the Philippines. After the US government flew them to a resettlement camp in Arkansas, her family made a series of brief movesfirst to the cold of western Michigan, where they were sponsored by a Christian family; then to not-much-warmer upstate New York, where they reunited with other members of the Nguyen clanbefore settling in Southern California.

Ngocs parents toiled for decades as factory workers in the aerospace industry. Her father, a swing-shift machinist, logged hundreds of hours of overtime, while her mother labored six days a week making brake parts on an assembly line. But like millions of other immigrants, their path to the American Dream also had a lot to do with savvy real estate investments. In 1979, just four years after they arrived in the States, the two pooled together their life savingsmuch of which they had carried out by hand in the form of gold bars as they fled Vietnamand bought a small single-story bungalow near LAs Griffith Park for $24,000 in cash. By 1987, the home had already increased in value. So, they went to Bank of America and took out a $30,000 home equity loan to finance the purchase of a Minimart and a small apartment building in the San Fernando Valley. Two more apartment buildings followed. While the women who speculated on our house were in it for the quick flip, Ngocs family invested for the long haul. They never stopped working their blue-collar jobs, and dedicated their nights and weekends to maintaining the buildings themselves. They made money month after month charging rent on the apartments. Eventually they sold them, using the profits to buy a Laundromat and then a small medical building on Ball Street in Anaheima stones throw from Disneyland. As property values increased, their wealth grew, their future secure.

Buy property, was one of her fathers favorite sayings. After the crash, it seemed to begin every conversation. You want to find something in a neighborhood thats up and comingnot one thats hot right now. Youll end up paying too much. Failing to buy during the downturn, when the nations housing market was having a 50-percent-off sale, was simply not an option.

Next page