| With its eminent scholars and world-renowned library and archives, the Hoover Institution seeks to improve the human condition by advancing ideas that promote economic opportunity and prosperity, while securing and safeguarding peace for America and all mankind. The views expressed in its publications are entirely those of the authors and do not necessarily reflect the views of the staff, officers, or Board of Overseers of the Hoover Institution. |

www.hoover.org

Hoover Institution Press Publication No. 679

Hoover Institution at Leland Stanford Junior University,

Stanford, California 94305-6003

Copyright 2017 by the Board of Trustees of the Leland Stanford Junior University

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without written permission of the publisher and copyright holders.

For permission to reuse material from Rules for International Monetary Stability ISBN 978-0-8179-2054-8, please access www.copyright.com or contact the Copyright Clearance Center, Inc. (CCC), 222 Rosewood Drive, Danvers, MA 01923, 978-750-8400. CCC is a not-for-profit organization that provides licenses and registration for a variety of uses.

Efforts have been made to locate original sources, determine the current rights holders, and, if needed, obtain reproduction permissions. On verification of any such claims to rights in the articles reproduced in this book, any required corrections or clarifications will be made in subsequent printings/editions.

Hoover Institution Press assumes no responsibility for the persistence or accuracy of URLs for external or third-party Internet websites referred to in this publication, and does not guarantee that any content on such websites is, or will remain, accurate or appropriate.

Cataloging-in-Publication Data is available from the Library of Congress.

ISBN-13: 978-0-8179-2054-8 (cloth)

ISBN-13: 978-0-8179-2056-2 (EPUB)

ISBN-13: 978-0-8179-2057-9 (Mobipocket)

ISBN-13: 978-0-8179-2058-6 (PDF)

Contents

Michael D. Bordo and John B. Taylor

Sebastian Edwards

: David H. Papell

: Christopher Crowe, Harald Uhlig, Allan H. Meltzer, Michael Hutchinson, William English, Vasco Curdia, Richard Clarida, Evan F. Koenig

David Beckworth and Christopher Crowe

: Christopher Erceg

: Richard Clarida, David H. Papell, Harald Uhlig, Sebastian Edwards, Michael Melvin, Robert E. Hall

Varadarajan V. Chari, Alessandro Dovis, and Patrick J. Kehoe

: Harald Uhlig

: George P. Shultz, Ken Singleton, Sebastian Edwards, Michael Hutchison

Pierre-Olivier Gourinchas

: John H. Cochrane

: Lee E. Ohanian, John H. Cochrane, Robert E. Hall, Sebastian Edwards, Varadarajan V. Chari

Michael D. Bordo and Catherine Schenk

: Allan H. Meltzer

: Andrew T. Levin, Christopher Erceg, Harald Uhlig, Christopher Meissner, Robert Kaplan, Bill English

: John B. Taylor, An International Monetary System Built on Policy Rules and Strategies

: Richard Clarida, National Monetary Policies often Correlate, May Sometimes Coordinate, but Rarely Cooperate (And Thats Probably a Good Thing!)

: George P. Shultz, Reforming the International Monetary System in Practice

: Steve Chapman, David H. Papell, John H. Cochrane, Andrew T. Levin, Christopher Crowe

: James Bullard, International Monetary Stability: A Multiple Equilibria Problem?

: Robert Kaplan, International Monetary Stability and Policy

: Dennis Lockhart, Post-2008 Central Bank Operating Frameworks: Differences, Commonalities, and Implications for Reform

: John C. Williams, The Decline in the Natural Rate of Interest: An International Perspective

: Sebastian Edwards, Christopher Erceg, Robert E. Hall, Andrew T. Levin, Allan H. Meltzer, Richard Clarida, Steve Liesman, John B. Taylor, George P. Shultz, John H. Cochrane, Varadarajan V. Chari, Terry Jones, David Malpass, Harald Uhlig

Preface

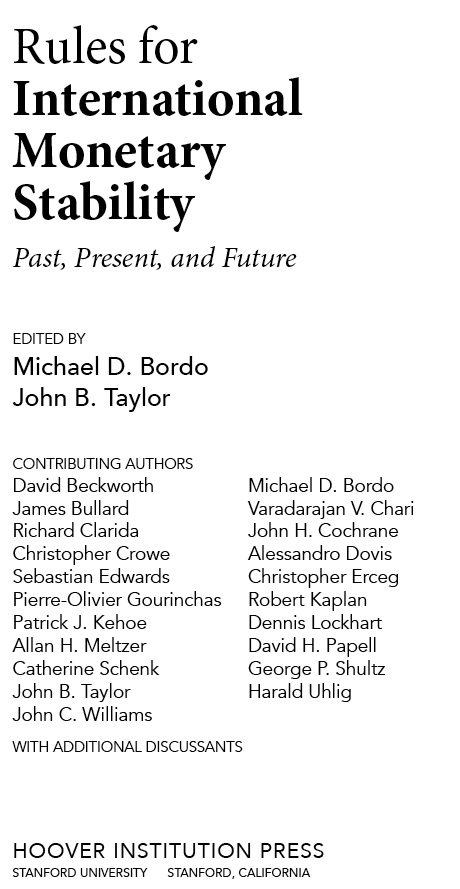

The Hoover Institution held a conference entitled International Monetary Stability: Past, Present, and Future on May 5, 2016. This conference was the third in a series of conferences on key issues of monetary policy put on by the Economic Policy Working Group at the Hoover Institution under the direction of John B. Taylor. These conferences were organized by Hoover Senior Fellows John Taylor, Michael Bordo, John Cochrane, and Lee Ohanian.

This years forum drew an impressive list of participants, including four Federal Reserve bank presidents and numerous representatives from the Federal Reserve, academia, the financial sector, and business media. Five presentations of monetary research projects and two panel discussions focused on the deepening links of international monetary policy regimes, exchange rate volatility, and international capital flows as well as next steps for central banks as they assess the results of unconventional monetary interventions.

For invaluable help in organizing this conference, we thank Daniel Robertson and Marie-Christine Slakey, and, for a great deal of additional help in putting the conference volume together, we also thank Kyle Palermo and Barbara Arellano.

Michael D. Bordo

John B. Taylor

Introduction

Since the end of the Great Recession in 2009 the central banks of the advanced countries have taken unprecedented actions to reflate and stimulate their economies. There have been significant differences in the timing and pace of these actions. These independent monetary policy actions have had significant spillover effects on the economies and monetary policy strategies of other advanced countries. In addition, the monetary policy actions and interventions of the advanced countries have had a significant impact on the emerging market economies, leading to the charge of currency wars.

The perceived negative consequences of spillovers from the actions of national central banks has led to calls for international monetary policy coordination, including one by the general manager of the Bank for International Settlements, Jamie Caruana, another from the former chair of the Federal Reserve, Paul Volcker, and a number in papers at the European Central Banks policy conference in Sintra, Portugal, in June 2016. The arguments for coordination based on game theory are the same today as they were back in the 1980s, when they led to the Plaza and Louvre accords of 1987 and 1988, respectively. Both accords, which required that participant countries follow policies to improve global welfare at the expense of domestic fundamentals, led to disastrous consequences, especially the Japanese boom and bust of 1991 (Taylor 2016).