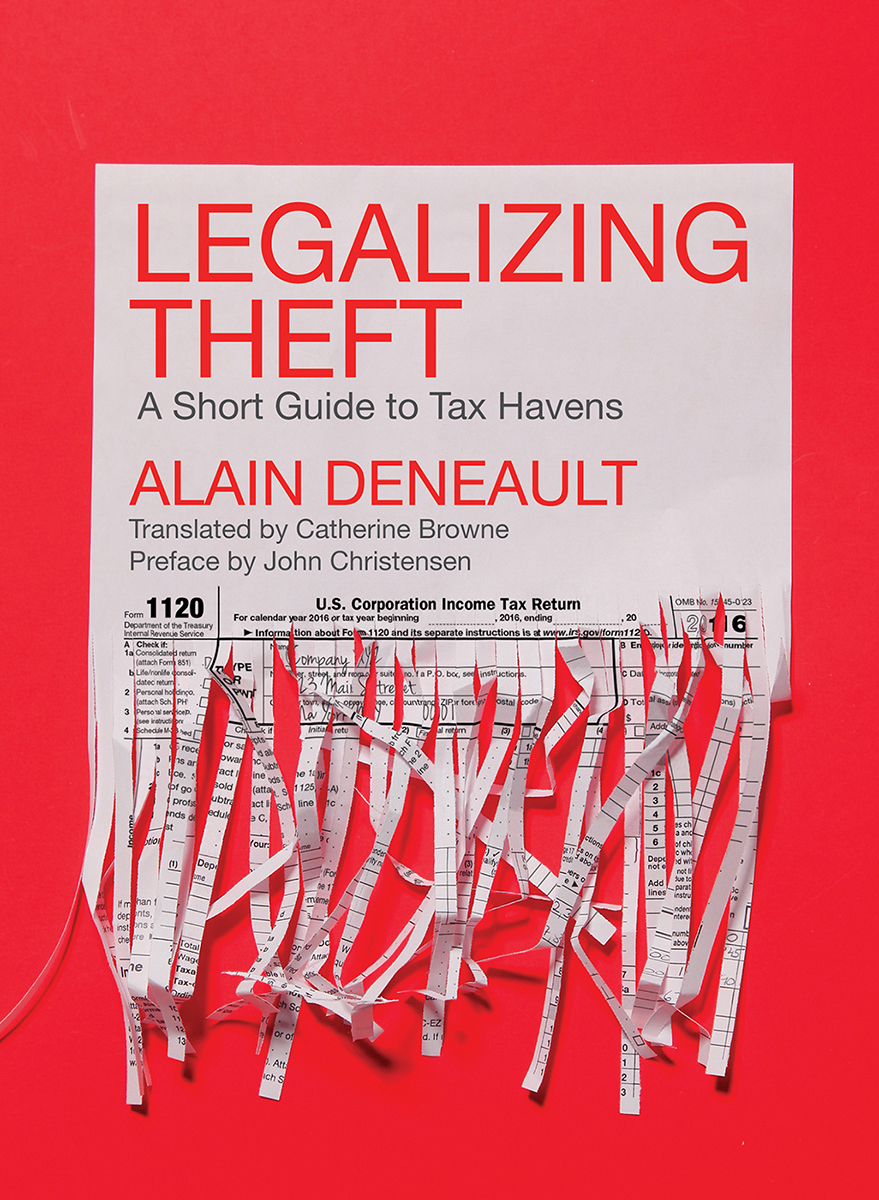

LEGALIZING THEFT

LEGALIZING THEFT

A Short Guide to Tax Havens

Alain Deneault

Translated by

Catherine Browne

Foreword by

John Christensen

Fernwood Publishing

Halifax & Winnipeg

Copyright 2016 Les ditions cosocit

Copyright 2018 Alain Deneault

Translation 2018 Catherine Browne

All rights reserved. No part of this book may be reproduced or transmitted in any form by any means without permission in writing from the publisher, except by a reviewer, who may quote brief passages in a review.

Cover design: John van der Woude

eBook: tikaebooks.com

Printed and bound in Canada

Published by Fernwood Publishing

32 Oceanvista Lane, Black Point, Nova Scotia, B0J 1B0

and 748 Broadway Avenue, Winnipeg, Manitoba, R3G 0X3

www.fernwoodpublishing.ca

Fernwood Publishing Company Limited gratefully acknowledges the financial support of the Government of Canada, the Canada Council for the Arts, the Manitoba Department of Culture, Heritage and Tourism under the Manitoba Publishers Marketing Assistance Program and the Province of Manitoba, through the Book Publishing Tax Credit, for our publishing program. We are pleased to work in partnership with the Province of Nova Scotia to develop and promote our creative industries for the benefit of all Nova Scotians.

This work was originally published in French as Une escroquerie lgalise. Prcis sur les paradis fiscaux by ditions cosocit, Montreal, Quebec, in 2016. We acknowledge the financial support of the Canada Council for our translation activities.

Library and Archives Canada Cataloguing in Publication

Deneault, Alain, 1970

[Escroquerie lgalise. English]

Legalizing theft: a short guide to tax havens / Alain Deneault; translated by Catherine Browne.

Translation of: Une escroquerie lgalise.

Includes bibliographical references. Issued in print and electronic formats.

ISBN 978-1-77363-053-3 (softcover)ISBN 978-1-77363-054-0 (EPUB)ISBN 978-1-77363-055-7 (Kindle)

1. Tax havensCanada. 2. Tax sheltersCanada. 3. TaxationLaw and legislationCanada. I. Title. II. Title: Escroquerie lgalise. English.

HJ2337.C3D46213 2018 336.206 C2017-907882-8 C2017-907883-6

Such is the despotism of each man, that,

always ready to plunge societys laws into their former chaos, he will continuously endeavour not only to take away from the common mass his own portion of liberty, but to encroach on that of others.

Cesare Beccaria,

An Essay on Crimes and Punishments, 1764

Contents

Foreword

The fax arrived on the first working day of the new year. With immediate effect I started to transfer ownership of every company well over thirty of them, mostly registered in the British Virgin Islands from a Jersey-based trust to a new trust administered from Bermuda. The client who originally settled the trust in Jersey was headed for bankruptcy in the Californian courts. His real estate business had failed owing hundreds of millions to construction companies and banks, and his wife was suing for a multi-million-dollar divorce settlement. He also owed tens of millions of back taxes to various states in the US. What none of his creditors not even his soon-to-be ex-wife knew, was that none of the wealth he appeared to own, not even his cars and art collection, actually belonged to him. Legally it all belonged to an offshore trust secretly settled in Jersey, on the other side of the Atlantic Ocean, and the trustee (me) who legally controlled those assets on his behalf, was instructed by a flee clause written into the trust deed to make the trust disappear at the first whiff of an investigation by tax authorities or any other investigating agency.

By mid-day the flee clause was implemented. Ownership of assets worth over seventy million dollars, including office buildings in California and Florida, private dwellings in the US and the Caribbean, plus a valuable art collection and a stud farm in Berkshire, England, had been switched to a new trust established at a law firm in Bermuda. A different trustee took over control of the new trust as office hours opened that morning in Hamilton. Finally, we carefully erased all evidence of the existence of the previous trust, right down to correspondence and fee invoices dating back eight years, from our computer systems and hard copy files. Had a tax inspector, or FBI investigator, or even an attorney representing his embittered wife, turned up at our offices we could in all truthfulness have said that we had no record of the trusts existence.

Everything we did that wet and miserable morning in Saint Helier was legal under Jersey law. My employer was a trust administration company belonging to one of the worlds Big Four accounting firms. We had teams of lawyers and tax accountants to advise on every aspect of what is known euphemistically as wealth protection. The trust was established in compliance with Jersey trust law, which is used extensively to escape from tax authorities, criminal investigators, and former spouses. As trustee I was familiar with the affairs of the client, who was both settlor of the trust and, in practice, its beneficiary. I also knew about his high-rolling lifestyle, his failed marriage and multiple mistresses, his elaborate strategies for evading taxes, and the secret delight he took in shafting his many creditors, who would never trace the tens of millions he had squirrelled offshore over the course of the eight previous years.

This episode happened a long time ago, in the late 1980s. I was working undercover at the time, investigating how law firms and accounting practices collude with tax haven officials to enable their clients to circumvent the laws of their home countries. Having previously trained in London in forensic investigation, I was experienced in how to examine client files and piece together the evidence of how elaborate offshore networks of trusts, foundations, and companies are used for criminal purposes. What I had not fully appreciated when I started my investigations in Jersey was the extent to which law firms, accounting practices, banks, and the senior officials and politicians of the tax haven jurisdictions are complicit in these activities.

Over the course of twenty-two months I investigated around 120 client files. Most revealed complex tax evasion or avoidance schemes. Some clients were involved in embezzlement or hiding assets from creditors. At least two were involved in insider trading. Others were engaged in market rigging, or were hiding political or commercial conflicts of interest. Every client file I examined revealed some type of felony or misdemeanour, but since all these crimes occurred elsewhere, outside Jersey, the chances of them ever being investigated were slim to non-existent. Most investigating agencies know that trying to track information about who benefits from offshore trusts is a costly and time-consuming process that will be frustrated at every step by lawyers and the courts of secrecy jurisdictions. Trusts remain highly secretive legal instruments, and at time of writing in January 2018, tax havens continue to resist all attempts to require registration of trusts on official public registries.

I stayed in Jersey for a further decade, working as Economic Adviser to the islands government, witnessing at first-hand how extensively secretive tax havens like Jersey have integrated themselves into the globalized economy. The vast majority of cross-border trade and investment is transacted on paper via tax havens to enable profits shifting. Similarly, a huge proportion of private wealth has been shifted offshore to dodge taxes. In 1995 I was invited to a global wealth-management seminar in London where lawyers and bankers outlined their plans to shift the assets of their high and ultra-high net worth clients, approximately nine million billionaires and multi-millionaires or one tenth of one percent of the global population, offshore. By 2015 it was estimated that up to US$36 trillion of personal wealth was sitting offshore, entirely untaxed, and almost entirely unrecorded in official wealth statistics.