CONTENTS

INTRODUCTION

In which investigative journalists release massive amounts of data about owners of secret tax haven accounts, and the Canadian finance minister hastens to Bermuda

1889

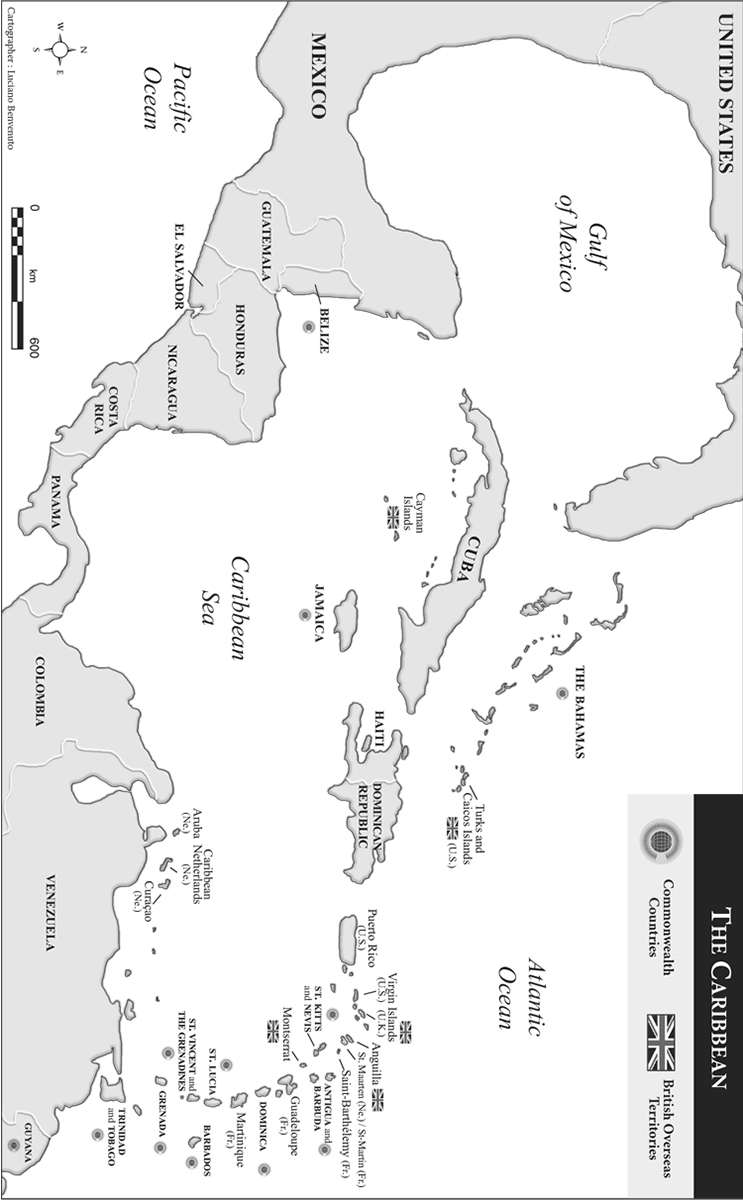

WELL-OILED BANKING HINGE BETWEEN THE UNITED STATES AND THE CARIBBEAN

In which the Bank of Nova Scotia, the Royal Bank of Canada, and the Canadian Bank of Commerce step in to answer the needs of American companies in the Caribbean at a time when American banks are prevented from acting abroad

1956

INDUSTRIAL FREE ZONE

In which an ex-governor of the Bank of Canada mysteriously intervenes in Jamaica as the colony reshapes its financial institutions and tax laws, and multinationals such as Alcan consign the country to economic oblivion so that becoming a free zone looks like the only way out

1960

DEN OF AMERICAN ORGANIZED CRIME

In which the Bank of Nova Scotia provides the Bahamas with a trusted adviser, and the Royal Bank finds a Bahamian finance minister to join its board

1966

HIDEOUT FOR SPECULATIVE HIGH FINANCE

In which a lawyer from Calgary lays the foundations of hedge-fund law

1980

HOME GROUND FOR CANADIAN OFFSHORE FIRMS

In which the Canadian government creates a tax-amnesty corridor leading straight from Barbados to Canada

1986

TRUE SOUTH STRONG AND FREE

In which Liberals and Conservatives try to create an eleventh province offering sun, sand, and bank accounts

1992

PETRO-STATE POLITICS

In which the government of Alberta embraces the oil and gas industry, leaving citizens and the environment to fend for themselves

1994

FINANCIAL HEART OF THE WORLD MINING INDUSTRY

In which the majority of the worlds extractive corporations flock to Toronto to enjoy investment tax incentives

1998

TAX HAVEN

In which the federal government decides to imitate tax havens by reducing corporate taxes

2006

BERMUDAS BACK OFFICE

In which the Nova Scotia government helps offshore firms hire professional accountants

2009

OFFSHORE LOBBY AT THE WORLD BANK AND THE INTERNATIONAL MONETARY FUND

In which the Canadian government forms an alliance with a group of Caribbean offshore territories

2010

DRUG-TRAFFICKING HUB

In which the Canadian government signs a free-trade agreement to the benefit of money launderers in Latin America

CONCLUSION NOW

A SYSTEM OF VOLUNTARY BLINDNESS

In which the fight against tax havens is found to be rooted in the public conscience

TABLES AND ILLUSTRATIONS

ILLUSTRATIONS

TABLES

INTRODUCTION

HEADLONG FLIGHT

In which investigative journalists release massive amounts of data about owners of secret tax haven accounts, and the Canadian finance minister hastens to Bermuda

O n April 4, 2013, members of the International Consortium of Investigative Journalists ( ICIJ ) in countries throughout the world announced that they had gained access to the financial records of over 100,000 investors with bank accounts in tax havens. Among the ICIJ members were CBC and Radio-Canada journalists, who covered the story at the national level. In short, although information on this topic is still relatively sparse, bank secrecy is no longer as impenetrable as it once was.

By the time investigative journalists unleashed their thunderbolt, the home states of major clients of offshore banks had already begun to take action. After years of leniency, in March 2010 the

The Canadian government could not remain indifferent to this issue. By 2012, Canadians had invested more than $155 billion in seven offshore tax havens.

The chief effect of all these decisions, however, was to transform a political debate into a legal issue. Focusing on tax cheats is a way of taking attention away from the fact that, for decades, Canada has been legalizing the use of tax havens under a wide range of circumstances and has also looked to them for inspiration in developing its own policies.

The federal governments real response to CBC and ICIJ revelations was expressed on April 12, 2013, when Finance Minister Jim Flaherty hastened to Bermuda to reassure the business community there. Flaherty was welcomed with open arms by Business Bermuda, an association dedicated to the promotion of investment in the archipelago. Bermuda, one of the most overtly criticized tax havens in the world, is also one of the states that has signed a Tax Information Exchange Agreement ( TIEA ) with Canada. As we will see, hundreds of companies in the wider insurance field have incorporated in Bermuda in order to bypass the tax policies and regulations of countries such as Canada. The minister trivialized the relocation of a colossally profitable economic sector, which, at a moment when the world was becoming acutely conscious of the severity of the relocation problem, was nothing short of provocative.

What became clear in the spring of 2013 was that the Canadian federal governments policy is to fight tax fraud by legalizing it. The government simultaneously condemns the fraudulent use of tax havens and encourages their legal use by corporations and the very rich; in some cases, it even provides these users with benefits. As sociologist Pierre Bourdieu argues, the left hand of the state doesnt know what the right hand is doing. The principles that lead the government to fight tax fraud are obviously contradicted by measures that incite corporations and wealthy individuals legally to benefit from highly permissive legislative and jurisdictional regimes. And in order to satisfy the financial and industrial class whose interests are represented in Ottawa, Canada is now working unobtrusively to legalize what was formerly viewed as fraud.

TAX HAVENS AND HIGHLY PERMISSIVE JURISDICTIONS

A tax haven is commonly defined as a jurisdiction whose tax rate is or approaches zero and whose legal system (not that its unworthy rules really deserve to be known as laws) creates a level of bank secrecy that conceals the identity of account holders as well as the nature of their transactions. No substantial activity takes place in a tax haven: its jurisdiction is used strictly for accounting and legal purposes to avoid laws and regulations in force elsewhere in the world. In this sense, it is a haven a safe place for corporations and high-net-worth individuals trying, by legal or illegal means, to avoid paying taxes.

But highly permissive jurisdictions include more than just tax havens. They also include other types of states: states that provide not only tax advantages, but also a wide range of privileges, and especially privileges of a regulatory and legal nature. Working to benefit banks, corporations, and wealthy individuals, these ultra-permissive states neutralize the laws, public policies, and regulations that hold sway in traditional states. We will refer to all these states as accommodating jurisdictions , a generic term we suggested in a previous work to include not only tax havens but also legal and regulatory havens, free zones, and free ports. Each of these jurisdictions, of which there are dozens, in its own way enables privileged actors to bypass not only laws of taxation in their country of origin, but also laws applying to many other fields such as high finance, insurance, accounting, intellectual property rights, manufacturing, or maritime transportation.

What this means is that tax havens cannot be reduced to a cartoon representation of coconut trees and dazzling beaches on a distant island where anything goes. Today, the traditional image is being replaced by an image of countries whose laws and tax administration are effective in that they have the power to attract. The idea of the tax haven, like any other concept, evolves over time, This definition tells us that tax havens arent necessarily where we think they are. Today, unsuspected jurisdictions can sometimes be detected only by signs such as capital flows especially when these flows bear no relation to the state of the real economy or a high number of incorporations.