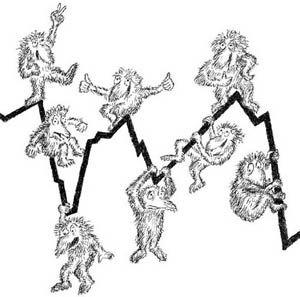

Animal Spirits

Animal Spirits

HOW HUMAN PSYCHOLOGY DRIVES

THE ECONOMY, AND WHY IT MATTERS

FOR GLOBAL CAPITALISM

With a new preface by the authors

GEORGE A. AKERLOF

AND

ROBERT J. SHILLER

Princeton University Press PRINCETON AND OXFORD

George Akerlof is the Daniel E. Koshland Sr. Distinguished Professor of Economics at the University of California at Berkeley; co-director of the Program on Social Interactions, Identity and Well-Being of the Canadian Institute for Advanced Research; and a member of the board of directors of the National Bureau of Economic Research. Robert Shiller is the Arthur M. Okun Professor of Economics at the Cowles Foundation for Research in Economics and Professor of Finance at the International Center for Finance, Yale University; research associate at the National Bureau of Economic Research; and co-founder and principal of two U.S. firms that are in the business of issuing securities: MacroMarkets LLC and Macro Financial LLC. The views expressed herein are solely those of the authors and do not necessarily reflect the views of these institutions.

Copyright 2009 Princeton University Press

Requests for permission to reproduce material from this work should

be sent to Permissions, Princeton University Press

Published by Princeton University Press, 41 William Street, Princeton,

New Jersey 08540

In the United Kingdom: Princeton University Press, 6 Oxford Street,

Woodstock, Oxfordshire OX20 1TW

press.princeton.edu

All Rights Reserved

Ninth printing, and first paperback printing, with a new preface

by the authors, 2010

Paperback ISBN: 978-0-691-14592-1

The Library of Congress has cataloged the cloth edition of this book as follows

Akerlof, George A., 1940

Animal spirits : how human psychology drives the economy, and why it matters for global capitalism / George A. Akerlof and Robert J. Shiller.

p. cm.

ISBN 978-0-691-14233-3 (hardcover : alk. paper)

1. EconomicsPsychological aspects. 2. FinancePsychological aspects. 3. Capitalism. 4. Globalization. I. Shiller, Robert J. II. Title.

HB74.P8A494 2009

330.122019dc22

2008052649

British Library Cataloging-in-Publication Data is available

This book has been composed in Adobe Galliard and Formata

by Princeton Editorial Associates, Inc., Scottsdale, Arizona

Printed on acid-free paper.

Printed in the United States of America

10 9

Contents

SEVEN Why Do Central Bankers Have Power over the

Economy (Insofar as They Do)?

POSTSCRIPT TO CHAPTER SEVEN The Current Financial Crisis:

What Is to Be Done?

NINE Why Is There a Trade-off between Inflation and

Unemployment in the Long Run?

ELEVEN Why Are Financial Prices and Corporate

Investments So Volatile?

Preface to the Paperback Edition

The worldwide recession that was raging just as the hardcover edition of this book was published in February 2009 seems to many observers, as of this writing in October 2009, to be coming to an abrupt end. There are definite signs of improvement. These observers could be right. Maybe this is just another recession that will eventually be forgotten among the annals of business-cycle history. But the theory that we lay out in this book gives us cause to worry that we may be in a sick economy over much of the world for years to come. Even the stirring success stories of the past decade or so in the developing world, notably China and India, may see their economic growth reduced to a disappointing level.

We think this because we have an unusual view of the economy, a view that animal spirits, as we define them in the Introduction, drive almost everything. Animal spirits are more than just confidence as measured by confidence indicators. We argue that declining animal spirits are the principal reason for the recent severe economic crisis. And, despite the recent positive economic indicators, we see no clear indication that these spirits are yet revived.

The news media are singularly lacking in any explanation for the recent resurgence of the world economy beyond the improvement in leading indicators, such as stock market prices and retail sales numbers. The reasons the leading indicators have improved remain mysterious. The stimulus packages put in place by most countries do not seem to have been big enough to be held responsible. By many popular accounts, the nascent recovery merely reflects a new willingness to spend all over the world, as if that is a primordial force of the economy that defies any further analysis.

There seems, to a reader of these accounts, to be an unseen force propelling the economy, driving it into its periodic booms and busts. But this perception is nothing new. In his 1873 book Lombard Street, Walter Bagehot said that it seems that in an economic recovery business leaps forward as if by magic:

Most people who begin to think of the subject are puzzled.... Why should there be any great tides of industry, with large diffused profit by way of flow, and large diffused want of profit by way of ebb? The main answer is hardly given distinctly in our common books of political economy. These books do not tell you what is the fund out of which large general profits are paid in good times, nor do they explain why that fund is not available for the same purpose in bad times.

Indeed, people are still puzzled today, in late 2009, by the sudden improvement in our world economy. Textbooks of economics, while vastly improved since Bagehots day, still do not give much enlightenment about the ultimate drivers of the economy. They do not do so because the understanding of the drivers must lie somewhat outside the traditional boundaries of economic research, in the realm of psychology (as even Bagehot suggested), which is an intellectual tradition alien to most economists. Macroeconomists have found it difficult to formalize the concept of animal spirits on their own terms, and so they have largely neglected it.

The recovery we have been seeing of late certainly defies the analysis of many economists who build structural econometric models and see the sudden recovery as the result of error terms or residuals or innovations in their equations. It defies the analysis of those economists of the real business cycle persuasion, who are in the habit of thinking that all economic fluctuations are ultimately driven by exogenous changes in technology and productivity, but cannot point to a description of the cause of such a change right now. And of course, it defies those who build purely statistical time-series models that quantify past patterns in the data and calculate an optimal extrapolation of recent wiggles in the same data.

Not only are we puzzled by the sudden turn toward recovery, we also do not clearly see the longer-term threat to the economy. The longerterm problem today remains that, after a terrible financial crash, the coherence of our animal spirits and our economic institutions is shattered. Humpty Dumpty is broken and cannot be put back together again. We need a new egg. We have to reinvent our capitalist economy, reestablish a genuine creative business spirit in peoples minds, and support their attitudes via institutions that really work and satisfy their definition of justice. Instead, today we have, in their eyes, institutions too big to fail, which are on life support from the government and our central banks, operating as money-printing machines, and a general feeling that business is corrupt and that the government support these institutions receive has been arranged by evil lobbyists. We are facing the same problem today that we faced in the later years of the Great Depression (described in )business today is inhibited by uncertainty about the future, about the tolerance of an angry public, about a disaffected labor force, and about what further government actions may be coming.

Next page