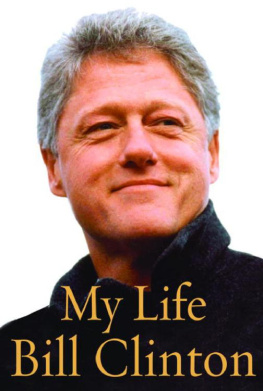

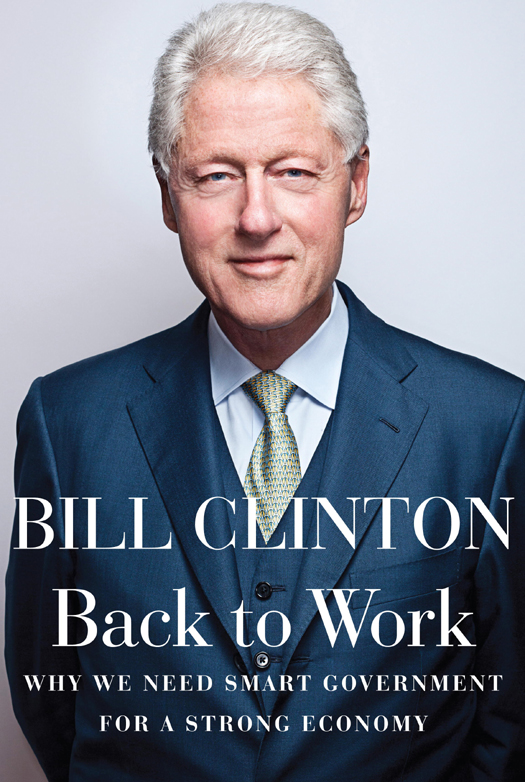

THIS IS A BORZOI BOOK

PUBLISHED BY ALFRED A. KNOPF

Copyright 2011 by William Jefferson Clinton

All rights reserved. Published in the United States by

Alfred A. Knopf, a division of Random House, Inc., New York,

and in Canada by Random House of Canada Limited, Toronto.

www.aaknopf.com

Knopf, Borzoi Books, and the colophon are registered

trademarks of Random House, Inc.

Due to limitations of space, permissions to reprint previously

published material can be found following the acknowledgments.

Library of Congress Control Number: 2011940942

eISBN: 978-0-307-95976-8

Jacket photograph by Andrew Hetherington, 2011/Redux

Jacket design by Carol Devine Carson

v3.1_r1

To the millions of good people who are looking for the

chance to be part of Americas recovery, and their own.

CONTENTS

INTRODUCTION

I WROTE THIS BOOK BECAUSE I love my country and Im concerned about our future. As I often said when I first ran for president in 1992, America at its core is an ideathe idea that no matter who you are or where youre from, if you work hard and play by the rules, youll have the freedom and opportunity to pursue your own dreams and leave your kids a country where they can chase theirs.

That belief has a tenuous hold on the more than fifteen million people who are unemployed or who are working part-time when they need full-time jobs to support themselves and their families. And it must seem downright unreal to the growing number of men and women whove been out of work for more than six months and cant even get interviews for job openings, as if theyre somehow to blame for becoming casualties of the worst recession since the Depression.

Work is about more than making a living, as vital as that is. Its fundamental to human dignity, to our sense of self-worth as useful, independent, free people. I earned my first money mowing lawns when I was twelve. At thirteen, I worked in a small grocery store and set up a used-comic-book stand on the side. By the time I finished college, Id made a little money doing seven other things. By the end of law school, seven more. Over the last four decades, nine more, not counting my foundation and other philanthropic work. Most of my early jobs didnt last long. I didnt like them all. But I learned something in every jobabout the work, dealing with people, and giving employers and customers their moneys worth.

I came of age believing that no matter what happened, I would always be able to support myself. It became a crucial part of my identity and drove me to spend a good portion of my adult life trying to give other people the chance to do the same thing. Its heartbreaking to see so many people trapped in a web of enforced idleness, deep debt, and gnawing self-doubt. We have to change that. And we can.

In these few pages, Ill try to explain what has happened to our country over the last thirty years, why our political system hasnt done a better job of meeting our challenges, and why government still matters and what it should do. Ill do my best to clarify what our choices are to revive the economy and deal with our long-term debt, and Ill argue that the looming debt is a big problem that cant be solved unless the economy starts growing again. And I dont mean the kind of jobless, statistical growth of the first decade of the twenty-first century, with stagnant wages, rising poverty, crippling household debt, and 90 percent of the income growth going to the top 10 percent. I want American Dream growthlots of new businesses, well-paying jobs, and American leadership in new industries, like clean energy and biotechnology.

Unless we restore robust economic growth, well be stuck in this economy for years, and nothing we do will solve the longer-term debt problem, regardless of how we try to do it.

In short, weve got to get America back in the future business.

P ART I

Where We Are

CHAPTER 1

Our Thirty-Year

Antigovernment Obsession

I DECIDED TO WRITE THIS BOOK after the 2010 midterm election not because my party took a beating, but because of what the election was about. The bad economy, the high cost of keeping the recession from falling into full-scale depression, the fact that the recovery had not yet begun to improve many livesall these ensured that anger and anxiety would be at high tide on Election Day, and thats always bad news for the party in power.

What troubled me is that with so many people hurting and so many challenges to be faced, the election season offered few opportunities for a real discussion of what went wrong, what the president and Congress had actually done or failed to do in the previous two years, what the two parties proposed to do in 2011 and 2012, and what the likely consequences would be in the short and long runs. Nor was there much of substance said on the larger issues on which these questions would have an impact: How do we propose to restore and maintain the American Dream at home? How do we ensure Americas economic, political, and security leadership in the more competitive, complex, fragmented, and fast-changing world of the twenty-first century?

Instead, the election seemed to occur in a parallel universe of inflated rhetoric and ferocious but often inaccurate attacks that shed more heat than light. The Republicans seemed to be saying that the financial crash and the recession that followed, as well as the failure of the United States to fully recover from it less than eighteen months after the economy bottomed out, were caused by too much government taxing, spending, and regulating, and that all would be well once we cut the cancer of government out of our lives and pocketbooks. They portrayed Democratic congressional incumbents and the president as big-government liberals who had brought America to the edge of destruction and, if given two more years, would push us over into the abyss.

The attack proved to be very effective in the election, but I thought it was all wrong. First, the meltdown happened because banks were overleveraged, with too many risky investments, especially in subprime mortgages and the securities and derivatives that were spun out of them, and too little cash to cover the risks. For example, Bear Stearns was leveraged at thirty-five to one when it failed; traditionally, commercial bank lending is leveraged at ten or twelve to one, investment banking a bit more. In other words, there was not enough government oversight or restraint on excessive leverage.

Second, the meltdown did not become a full-scale depression because the government acted to save the financial system from collapse. The Federal Reserve made massive investments of about $1.2 trillion to stop the financial collapse, including buying securities and guaranteeing loans. The often-derided Troubled Asset Relief Program (TARP) was originally authorized to spend up to $700 billion and spent a bit over $400 billion. Most of the TARP money has been paid back, with only $104 billion still outstanding. In a July 8, 2011, Washington Post article, Allan Sloan and Doris Burke estimated that the final cost of the TARP program would be just $19 billion and cited an analysis in Fortune magazine concluding that the Federal Reserves income on its investments would produce a net profit for the taxpayers on the bailout of between $40 billion and $100 billion.