Across the Great Divide

Th e Hoover Institution on War, Revolution and Peace, founded at Stanford University in 1919 by Herbert Hoover, who went on to become the thirty-first president of the United States, is an interdisciplinary research center for advanced study on domestic and international affairs. Th e views expressed in its publications are entirely those of the authors and do not necessarily reflect the views of the staff, officers, or Board of Overseers of the Hoover Institution.

HOOVER INSTITUTION

Stanford University

Stanford, California, 94305-6010

www.hoover.org

Th e Brookings Institution is a private nonprofit organization devoted to research, education, and publication on important issues of domestic and foreign policy. Its principal purpose is to bring the highest quality independent research and analysis to bear on current and emerging policy problems. Th e Institution was founded on December 8, 1927, to merge the activities of the Institute for Government Research, founded in 1916, the Institute of Economics, founded in 1922, and the Robert Brookings Graduate School of Economics and Government, founded in 1924.

THE BROOKINGS INSTITUTION

1775 Massachusetts Avenue, N.W.

Washington, D.C. 20036

www.brookings.edu

Hoover Institution Press Publication No. 652

Hoover Institution at Leland Stanford Junior University,

Stanford, California, 94305-6010

Copyright 2014 by the Board of Trustees of the Leland Stanford Junior University

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without written permission of the publisher and copyright holders.

For permission to reuse material from Across the Great Divide, ISBN 978-0-8179-1784-5, please access www.copyright.com or contact the Copyright Clearance Center, Inc. (CCC), 222 Rosewood Drive, Danvers, MA 01923, 978-750-8400. CCC is a not-for-profit organization that provides licenses and registration for a variety of uses.

Cataloging-in-Publication Data is available from the Library of Congress.

ISBN 978-0-8179-1784-5 (cloth : alk. paper)

ISBN 978-0-8179-1786-9 (epub)

ISBN 978-0-8179-1787-6 (mobi)

ISBN 978-0-8179-1788-3 (PDF)

Contents

Martin Neil Baily and John B. Taylor

Sheila C. Bair and Ricardo R. Delfin

Lawrence H. Summers

John B. Taylor

Kevin M. Warsh

Alan S. Blinder

Michael D. Bordo

Peter R. Fisher

Allan H. Meltzer

Martin Neil Baily and Douglas J. Elliott

John H. Cochrane

Darrell Duffie

Steve Strongin

Randall D. Guynn

Kenneth E. Scott

David A. Skeel Jr.

Michael S. Helfer

Paul Saltzman

George P. Shultz

Simon Hilpert

Introduction

Martin Neil Baily and John B. Taylor

T he financial crisis of 2008 and the resulting recession devastated the American economy and caused US policymakers to rethink their approaches to major financial crises. Six years have passed since the collapse of Lehman Brothers, but questions persist about the best ways to avoid future financial crises and respond to those that occur anyway.

On October 1, 2013, the Brookings Institution and the Hoover Institution jointly hosted a conference addressing these issues. Twenty-four economic and legal scholars discussed the crisis, its effect on the US economy, and the way ahead. The conference took place simultaneously in Washington, D.C., and Stanford, California, with simulcasting between the locations for maximum interaction among panelists and audience members. A diverse group of panelists made for a day of lively discussion and interesting debate. As participants worked to identify the way forward, they highlighted the need for policies that can adequately help us avoid or deal with future crises. While there was a diversity of views presented, there were some important areas of agreement and the experts agreed on the need for further discussions to expand the range of consensus.

This volume is titled Across the Great Divide: New Perspectives on the Financial Crisis. The title is symbolic, first of all, of the range of different groups and opinions brought together, including, for example, those who have been harshly critical of the Federal Reserve Board and those who give high marks to the Feds rescue efforts and unusual policy measures. In addition, while both Brookings and Hoover are proud of the range of scholars within each institution who embrace different politics and economic philosophies, Brookings is often seen as center left while Hoover is center right. So it was an important step to undertake this joint conference as a way of expanding the dialogue around monetary and regulatory policy. The goal is to maximize agreement in these important policy areas, both of which need continuity in order to give certainty to market participants and citizens that the rules of the game will not change with each swing in the White House or Congress.

This volume focuses on the 2008 financial crisis, the US response, and the lessons learned for future regulatory policy. It contains papers written by the conference panelists and serves to broaden the discussion about potential reforms. After this introductory chapter, Part I of the book explains the causes and effects of the financial crisis. Part II focuses on the role played by the Federal Reserve before, during, and after the 2008 panic. Part III addresses the concept of too big to fail (TBTF), and Part IV considers bankruptcy, bailout, and resolution. The volume closes with remarks on the key issues facing financial reforms and thoughts on the key findings of the conference and the way ahead for economic policy.

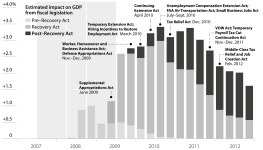

Causes and Effects of the Financial Crisis

The volume begins with an assessment by Sheila Bair and Ricardo Delfin of the Pew Charitable Trusts on the ways in which corrective regulatory policy often gives rise to new problems and risks in the financial system. They note that new policies which take lessons learned from previous crises into account often develop into blind spots that fuel future crises. They begin by examining five key drivers of the 2008 crisis: highly accommodative monetary policy, the housing bubble, the rise of securitization, the self-regulating markets myth, and the idea of too big to fail. Bair and Delfin argue that the accommodative monetary policy seen in recent years has biased the financial system toward risk-taking and against risk-aversion. They remind the reader of the positive feedback loop created in the housing market in the years leading up to the 2008 crisis and suggest that financial asset prices and recent Fed actions raise serious questions about the stability of the market as a whole and the possibility of future bubbles. The authors point to the role securitization played in the housing bubble and note that the securitization model was a response to the 1980s savings and loan crisis. They go on to describe the regulatory policy changes that were borne of the failed self-correcting approach to markets, enforcement, and oversight. But they point out that the new command-and-control strategy is also concerning because it risks becoming overly dependent on micromanagement and regulatory discretion. Implicit government support for large financial institutions and government-sponsored enterprises, Bair and Delfin say, hampered discipline within the market and promoted a dangerous level of risk-taking. The paper concludes with suggested practices that temper lesson-learning with responsibility. The authors encourage regulatory policymakers to trust no one, including themselves; to remember what government and markets do well and what they do poorly; and to focus on strong, simple rules. By all means, they say, solve the underlying problem. But we must remain alert to unexpected consequences of our solutions and prepare ourselves to quickly and appropriately address new risks to the financial system.