PENGUIN BOOKS

FIREFIGHTING

Ben S. Bernanke, currently a distinguished senior fellow at the Brookings Institution and president of the American Economic Association, was chairman of the Federal Reserve from 2006 to 2014. He is the author of The Courage to Act: A Memoir of a Crisis and Its Aftermath.

Timothy F. Geithner is president of Warburg Pincus and was from 2009 to 2013 the seventy-fifth secretary of the Treasury for President Barack Obamas first term. Formerly president of the Federal Reserve Bank of New York, he is the author of Stress Test: Reflections on Financial Crises.

Henry M. Paulson, Jr., is founder and chairman of the Paulson Institute and served from 2006 to 2009 as the seventy-fourth secretary of the Treasury under President George W. Bush. Formerly chairman and CEO of Goldman Sachs, he is the author of On the Brink: Inside the Race to Stop the Collapse of the Global Financial System and Dealing with China: An Insider Unmasks the New Economic Superpower.

PENGUIN BOOKS

An imprint of Penguin Random House LLC

penguinrandomhouse.com

Copyright 2019 by Ben S. Bernanke, Timothy F. Geithner, and Henry M. Paulson, Jr.

Penguin supports copyright. Copyright fuels creativity, encourages diverse voices, promotes free speech, and creates a vibrant culture. Thank you for buying an authorized edition of this book and for complying with copyright laws by not reproducing, scanning, or distributing any part of it in any form without permission. You are supporting writers and allowing Penguin to continue to publish books for every reader.

LIBRARY OF CONGRESS CATALOGING -IN-PUBLICATION DATA

Names: Bernanke, Ben, author. | Geithner, Timothy F., author. | Paulson, Henry M., 1946- author.

Title: Firefighting : the financial crisis and its lessons / Ben S. Bernanke, Timothy F. Geithner, and Henry M. Paulson, Jr.

Other titles: Financial crisis and its lessons

Description: New York : Penguin Books, 2019. | Includes index.

Identifiers: LCCN 2018058930 (print) | LCCN 2019000225 (ebook) | ISBN 9780525506270 (E-book) | ISBN 9780143134480 (paperback)

Subjects: LCSH: Monetary policy--United States. | Banks and banking--Government policy--United States, | Global Financial Crisis, 2008-2009. | BISAC: BUSINESS & ECONOMICS / Government & Business. | POLITICAL SCIENCE / Public Policy / Economic Policy. | BIOGRAPHY & AUTOBIOGRAPHY / Political.

Classification: LCC HG540 (ebook) | LCC HG540 .B47 2019 (print) | DDC 330.9/0511--dc23

LC record available at https:/lccn.loc.gov/2018058930

Cover design: Christopher Brian King

Cover image: Eduard Muzhevskyi / Getty Images

Version_3

We dedicate this book to the many public servantsof both parties and in both the legislative and executive brancheswho worked closely with us in the fight against the global financial crisis. Special thanks are due to Presidents George W. Bush and Barack Obama for their leadership and to the staffs of the Federal Reserve, Treasury, the FDIC, and other agencies for their creativity and hard work in the service of our country.

Contents

INTRODUCTION

Epic financial infernos dont happen often. Usually, turmoil in financial markets burns itself out. Markets adjust, firms fail, and life goes on. Sometimes, financial fires get so serious that policymakers need to help put them out. They make loans when firms need liquidity, or find a safe way to wind down a troubled firm, and life goes on. Its exceedingly rare that a fire rages out of control, threatening to consume the financial system and the rest of the economy, creating extreme disruption and deprivation. It happened in the United States during the Great Depression, and then it didnt happen again for seventy-five years.

But it happened again in 2008. The United States governmenttwo successive presidents, Congress, the Federal Reserve, the Treasury Department, and thousands of public servants at a variety of agencieshad to confront the worst financial crisis in generations. And the three of us were in positions of responsibilityBen S. Bernanke as chairman of the Federal Reserve; Henry M. Paulson, Jr., as secretary of the Treasury under President George W. Bush; Timothy F. Geithner as president of the Federal Reserve Bank of New York during the Bush years and then Treasury secretary under President Barack Obama. We helped shape the American and international response to a conflagration that choked off global credit, ravaged global finance, and plunged the American economy into the most damaging recession since the breadlines and shantytowns of the 1930s.

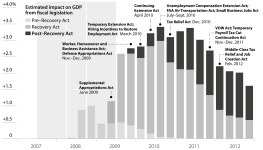

Along with our colleagues at the Fed, Treasury, and other agencies, we fought the fire with an extraordinary barrage of emergency interventions, escalating from conventional and then unconventional loans to government rescues of major firms and government backstops for vital credit markets. When the fire kept raging, we persuaded Congress to give us even more powerful tools to fight it, including the authority to inject hundreds of billions of dollars of capital directly into private financial institutions. Working alongside an outstanding group of dedicated public officials in the United States and around the world, we eventually helped stabilize the financial system before frozen credit channels and collapsing asset values could drag the broader economy into a second Depression. Even so, the economy suffered a major downturn, and unprecedented monetary and fiscal stimulus would be needed to help jump-start the recovery.

This was a classic financial panic, reminiscent of runs and crises that have afflicted finance for hundreds of years. We know from that long experience that the damage inflicted by financial panics is never limited to the financial sector, even though the strategies for stopping them require support for the financial sector. Americans who arent bankers or investors still rely on a functioning credit system to buy cars and homes, borrow for college, and grow their businesses. Financial crises that damage the credit system can create brutal recessions that hurt ordinary families as well as financial elites. Today, much of the American public remembers the governments interventions as a bailout for Wall Street, but our goal was always to protect Main Street from the fallout of a financial collapse. The only way to contain the economic damage of a financial fire is to put it out, even though its almost impossible to do that without helping some of the people who caused it.

Ten years later, we thought it would be useful to look back at how the crisis unfolded, and to consider the lessons that might help reduce the damage from future crises. All three of us have already written memoirs about our experiences, but we wanted to speak about what we did together and what we learned together, about the theory and practice of financial firefighting. We have very different backgrounds and very different personalities. We did not know one another well before the crisis. But we found ways to collaborate effectively as we worked to put out the fire, and we agree that some basic principles could apply to fighting any fire in the financial sector. Financial crises recur in part because memories fade. Were writing about this again to help convey some of the key lessons from our experience, in the hope that it will keep memories fresh and help firefighters of the future protect economies from the ravages of financial crises.