Ben S. Bernanke - 21st Century Monetary Policy

Here you can read online Ben S. Bernanke - 21st Century Monetary Policy full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. genre: Politics. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:21st Century Monetary Policy

- Author:

- Genre:

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

21st Century Monetary Policy: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "21st Century Monetary Policy" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

21st Century Monetary Policy — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "21st Century Monetary Policy" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

21 ST

CENTURY

MONETARY

POLICY

The Federal Reserve from

the Great Inflation to COVID-19

BEN S. BERNANKE

W.W. NORTON & COMPANY

Independent Publishers Since 1923

ON JANUARY 29, 2020, JAY POWELL strode briskly to the podium to begin the first press conference of his third year as chair of the Federal Reserve. He flipped open a white binder, looked up briefly to welcome the assembled reporters, and then looked down to read his prepared statement. His demeanor was low-key, almost somber. But his message was upbeat: The U.S. economy had entered the eleventh year of a record-long expansion, unemployment remained at a half-century low, and people in lower-paying jobs were seeing wage gains after years of stagnation. The trade tensions that had roiled financial markets for the past two years had diminished and global growth seemed to be stabilizing.

In passing, he noted uncertainties affecting the economic outlook, including those posed by the new coronavirus.

Five weeks later, on March 3, Powell walked to the same podium and in the same calm tone read a much darker statement to reporters. He offered his sympathy to people the virus had harmed around the world, noted that it had disrupted the economies of many countries, and predicted that measures to contain the virus will surely weigh on economic activity both here and abroad for some time. The Fed, he said, was cutting interest rates to help the economy keep strong in the face of new risks. He hinted at more to come. The state of the world had changed dramaticallyand the Feds policy had changed with it.

Between the January 29 and March 3 press conferences, the virus had evolved from a localized problem to an incipient global crisis. Reported cases of the disease that would become known as COVID-19 had risen from fewer than 10,000, almost all in China, to more than 90,000 worldwide. Italy had quarantined towns in its Lombardy region and Iran had reported a surge of infections. In the United States, the first virus death was reported on February 29a man in his 50s, near Seattle. U.S. cases, and deaths, grew exponentially from there, threatening to overwhelm health-care systems in New York City and other hot spots.

Meanwhile, virus fears triggered the worst week in U.S. financial markets since the 20072009 financial crisis, signaling trouble ahead for the economy. The Dow Jones Industrial Average, which had hit a record high earlier in the month, plunged more than 12 percent during the week ending February 28. In March the turmoil spread to bond markets. Sellers of even ultrasafe U.S. Treasury securities had difficulty finding buyers, who showed little interest in holding anything other than cash. The markets for private credit, where corporations, home buyers, and state and local governments borrow, threatened to freeze entirely as lenders and investors grappled with coronavirus-induced uncertainty.

The markets panic attack did, in fact, presage economic trauma. With businesses and schools closing, either voluntarily or under lockdowns imposed by local governments, economic activity contracted at an unprecedented rate. In February 2020, following a long recovery from the Great Recession, only 3.5 percent of the labor force was unemployed. Two months later, in April, the official unemployment rate stood at 14.8 percent, a shocking increase that likely understated the damage to the labor market. More than 20 million jobs were lost in April, by far the largest drop recorded since the data series began in 1939. The Business Cycle Dating Committee of the National Bureau of Economic Research, the arbiter of the timing of recessions and expansions, would later date the start of the pandemic recession to February.

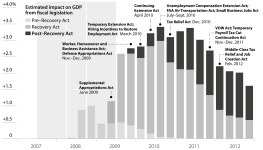

Having served as Fed chair during the 20072009 global financial crisis, I had some idea of the stress that Powell and his colleagues at the Fed were experiencing. But, unlike the crisis we faced a dozen years earlierwhich played out over nearly two yearsthis one seemed to happen all at once. On the principle that its better to get ahead of a crisis when you can, the Powell Fed quickly took a remarkable range of actions to calm the financial turmoil and protect the economy. It took its short-term interest rate target close to zero and promised to hold it there for as long as needed. To help restore normal functioning in money markets and Treasury debt markets, it lent to cash-strapped financial firms and bought hundreds of billions of dollars worth of Treasury and mortgage-backed securities on the open market. It reinstituted financial crisisera programs to support business and consumer credit markets. Working with foreign central banks, it ensured global markets an adequate supply of dollars, the worlds reserve currency. And it would ultimately promise to continue its large-scale purchases of securitiesa policy known as quantitative easinguntil economic conditions improved substantially.

All of those measures were drawn from a playbook developed during the 20072009 crisis. But the Powell Fed did not stop there. It worked with Congress and the Treasury Department to establish new programs to backstop corporate and municipal bond markets and to finance bank loans to medium-sized businesses and nonprofit organizations. And in August 2020 it announced important changes to its monetary policymaking frameworkthe outcome of a process begun before the pandemic struckaimed at making policy more powerful when interest rates are already low. In the ensuing months, it fleshed out its monetary approach by making more explicit its promises to keep interest rates low for as long as needed.

Of course, the Federal Reserve could do nothing to affect the course of the virus, the ultimate source of the crisis. Nor could it tax and spend to support the people and businesses most affected by the disease, as the administration and Congress could. But it could use both monetary policy and its lending powers to provide stability to the financial system, smooth the flow of credit to the economy, support consumer and business spending, and promote job creation. In doing so, it would play a substantial role in bridging the economy to the recovery that would follow the pandemic.

As I often remarked when I led the Fed, monetary policy is not a panacea. But money mattersa great deal. And, as the responses of the Powell Fed to the pandemic illustrate, monetary policy in the 21st centuryand central banking more generallyhas been defined by remarkable innovation and change. The Feds varied and sweeping actions during the pandemic, and the speed at which they were decided upon and announced, once would have seemed inconceivablenot only to the Fed of the 1950s and 1960s, chaired by the first modern Fed leader, William McChesney Martin Jr., but even to the Fed of the 1990s, led by one of historys most influential central bankers, Alan Greenspan. As Powell himself would acknowledge, We crossed a lot of red lines that had not been crossed before.

The aim of this book is to help readers understand how the Federal Reserve, the steward of U.S. monetary policy, got to where it is today, what it has learned from the diverse challenges it has faced, and how it may evolve in the future. Although my account focuses on the Fed, the central bank I know best, I also draw on the experiences of other major central banks, which have faced many of the same challenges and have made important innovations of their own. I hope this book will be useful to my fellow economists and their students, but I have tried to make it accessible to anyone with an interest in economic policy, finance, or central banking. As the role played by the Powell Fed in the pandemic crisis makes clear, an appreciation of the goals of the Federal Reserve, and of the tools and strategies it uses to meet those goals, is essential for understanding the contemporary global economy.

Next pageFont size:

Interval:

Bookmark:

Similar books «21st Century Monetary Policy»

Look at similar books to 21st Century Monetary Policy. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book 21st Century Monetary Policy and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.