Penguin supports copyright. Copyright fuels creativity, encourages diverse voices, promotes free speech, and creates a vibrant culture. Thank you for buying an authorized edition of this book and for complying with copyright laws by not reproducing, scanning, or distributing any part of it in any form without permission. You are supporting writers and allowing Penguin to continue to publish books for every reader.

Acknowledgements

In writing a book one accumulates many debts. Here I acknowledge just a few of them.

I have to start with thanking Andrew Wylie, my agent, whose boundless energy and enthusiasm made this book happen. I want to thank John Makinson, chairman and chief executive of Penguin, who decided to publish it. I also acknowledge the invaluable contributions of Scott Moyers and Stuart Proffitt, my editors at Penguin, whose care and attention to detail have made the book immeasurably better and clearer than it would otherwise have been. Stuart in particular was inexorable. I recognize the immense importance of his contribution and greatly appreciate the time he took and the attention he bestowed on this book. I also want to note their patience with the delays in completing a book whose writing had to fit in with my normal duties. In addition, I extend my thanks to Richard Duguid and Donald Futers on the Penguin production team, and to Richard Mason for his very helpful editorial input.

I would also like to thank Lionel Barber, the editor of the Financial Times , for accommodating the needs of the book. I have taken off a substantial amount of time in order to write it, more than I had hoped, in fact. I appreciate enormously the way the FT has accommodated this and promise not to do it again in the near future. I also want to thank colleagues at the FT from whom I have learned so much. Particular thanks for contributions to ideas in this book go to Chris Giles, Ferdinando Giugliano, my former colleague Krishna Guha, Robin Harding, Martin Sandbu and Gillian Tett.

I owe thanks to an immense number of thinkers and policymakers from whose writings I have been privileged to learn over many years. I recognize most of these debts via citations in the text, endnotes and references. I would like to record particular thanks to three individuals. The first is Max Corden, who taught me at Oxford and whose remarkable combination of clarity, rigour and good sense has marked me for life. I have aspired, not always successfully, to match these qualities in my professional activities. It was a great honour and still greater pleasure to deliver a lecture, named after him, in his home town of Melbourne in October 2012 . The second person is Adair Turner, former chairman of the Financial Services Authority. Adair was kind enough to read the third part of the book and the concluding chapter. I have greatly appreciated his wisdom and support, and learned immensely from his writing on the crisis and its aftermath. The final person is Mervyn King, former governor of the Bank of England and a friend for more than two decades. Despite inevitable professional disagreements, I have always greatly admired his intelligence and integrity. I am grateful to Mervyn for reading the book in draft and giving me supportive and helpful comments. He encouraged me to be even more radical than I had intended to be.

Others to whom I owe gratitude for conversations on the topics of this book include Anat Admati of Stanford University, C. Fred Bergsten of the Peterson Institute for International Economics, Ben Bernanke, former Chairman of the Federal Reserve, Olivier Blanchard of the International Monetary Fund, Claudio Borio of the Bank for International Settlements, Paul de Grauwe of the London School of Economics, my former colleague Chrystia Freeland, Member of the Canadian Parliament, Andy Haldane of the Bank of England, Robert Johnson of the Institute for New Economic Thinking, Paul Krugman of Princeton University, Philippe Legrain, former adviser to the president of the European Commission, Michael Pettis of Peking University, Adam Posen of the Peterson Institute for International Economics, Raghuram Rajan, governor of the Reserve Bank of India, Carmen Reinhart of Harvard University, Kenneth Rogoff of Harvard University, Jeffrey Sachs of Columbia University, Hans-Werner Sinn of CES ifo, George Soros, Joseph Stiglitz of Columbia University, Andrew Smithers of Smithers & Co., Lawrence Summers of Harvard University, Alan Taylor of the University of California, Paul Tucker, formerly of the Bank of England, David Vines of Oxford University, William White, formerly of the Bank for International Settlements, and Malcolm Wiener. I wish also to offer thanks to John Vickers, Claire Spottiswoode, Martin Taylor and William (Bill) Winters, with whom I had the pleasure to serve on the UK governments Independent Commission on Banking in 201011, as well as to the members of its admirable secretariat. I apologize to all who might feel slighted by omission from this list. It is far from exhaustive. Needless to say, none of the people I have listed bears any responsibility for what appears in this book.

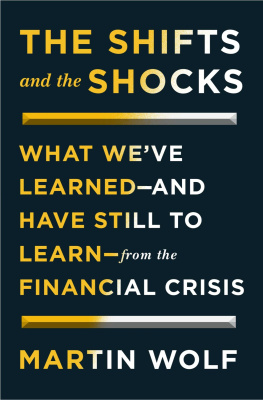

I also want to give my special thanks to Douglas Irwin of Dartmouth University and Kevin ORourke of Oxford University for permission to use the title The Shifts and the Shocks , which I have drawn from their interesting paper, Coping with Shocks and Shifts. This phrase captured my theme perfectly.

Finally, and far above all, I must offer my deepest thanks to Alison, my wife of more years than she would like to admit. She has given me everything that could make a mans life happy, including the three children to whom this book is dedicated. Beyond that, I thank her for her encouragement and support in writing this book, which was far from an easy process. Without her, I am sure it would not have been finished. I must thank her, not least, for reading all of the draft and giving me comments that were both sensible and to the point, as she has always done. Above all, she forced me to explain what I mean to a highly intelligent reader who does not live in the world of international macroeconomics and global finance. The value of such a reader is and has always been beyond measure.

List of Figures

Libor OIS Swap

General Government Borrowing Requirement

Real GDP Since the Crisis

Employment

US Cumulative Private Sector Debt over GDP

Spreads over German Bund Yields

Spreads over Bund Yields

Current Account Balances in the Eurozone 2007 (US$bn)

Current Account Balances in the Eurozone 2007 (per cent of GDP )

Unit Labour Costs in Industry Relative to Germany

Current Account Balances

Average General Government Fiscal Balance 2000