ALSO BY NICHOLAS WAPSHOTT

Ronald Reagan and Margaret Thatcher:

A Political Marriage (2007)

Older: The Biography of George Michael with Timothy Wapshott (1998)

Carol Reed: A Biography (1994)

Rex Harrison (1991)

The Man Between: A Biography of Carol Reed (1990, in United Kingdom)

Thatcher with George Brock (1983)

Peter OToole: A Biography (1981; in

United Kingdom, 1983)

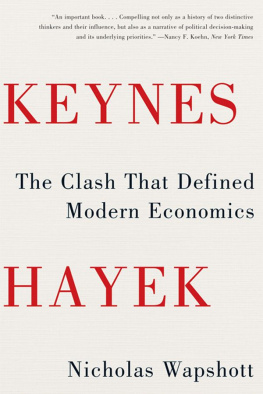

KEYNES

HAYEK

Nicholas Wapshott

W. W. NORTON & COMPANY

NEW YORK LONDON

T O A NTHONY H OWARD

CONTENTS

PREFACE

It was, perhaps, the most unusual episode in the long-running duel between the two giants of twentieth-century economic thought. During World War II, John Maynard Keynes and Friedrich Hayek spent all night together, alone, on the roof of the chapel of Kings College, Cambridge. Their task was to gaze at the skies and watch for German bombers aiming to pour incendiary bombs on the small picturesque cities of England.

In the spring and summer of 1942, in retaliation against British bombing of the medieval cities Lbeck, which sheltered a U-boat lair, and Rostock, home to the Heinkel bomber works, German planes bombed a string of English cities that held no strategic value. Exeter, Bath, and York endured flamestorms that put their ancient buildings at risk. The British headline writers came up with the phrase The Baedeker Blitz because it seemed the Luftwaffe planners were selecting British targets by consulting the German guidebook that rated cities according to their cultural worth. Though Cambridge held few important war industries, it warranted its place on the Nazi menu of devastation for its collegiate university founded in the Middle Ages.

Night after night the faculty and students of Kings, armed with shovels, took turns to man the roof of the ornate Gothic chapel, whose foundation stone was laid by Henry VI in 1441. The fire watchmen of St. Pauls Cathedral in London had discovered that there was no recourse against an exploding bomb, but if an incendiary could be tipped over the edge of the parapet before it set fire to the roof, damage could be kept to a minimum. And so Keynes, just short of sixty years old, and Hayek, age forty-one, sat and waited for the impending German onslaught, their shovels propped against the limestone balustrade. They were joined by a common fear that they would not emerge brave or nimble enough to save their venerable stone charge.

It was particularly fitting that the two economists should defy the Nazi peril, for both, in different ways, had foreseen the coming of the national socialist tyranny and presaged the rise of Hitler. Keynes was a young economic don at Kings when, at the outbreak of World War I, he was recruited by the Treasury, the British finance ministry, to raise money from Wall Street to finance the Allies efforts. Once the war was brought to an end in 1918, Keynes was kept on to advise how best to squeeze reparations from the defeated Germans.

What Keynes found at the peace talks in Paris shocked him. While the victorious Allied leaders, sparked by vengeance, relished the misery they hoped to inflict on the German nation by severe financial penalties, Keynes saw the issue in a quite different light. He believed that to deliberately beggar a modern trading nation like Germany was to impose crippling poverty on its citizens, which would provide the conditions for extreme politics, insurrection, even revolution. Rather than bringing a just end to World War I, Keynes thought the Treaty of Versailles was planting the seeds of World War II. Back home, he penned The Economic Consequences of the Peace , a devastating indictment of the folly of the Allied leaders. The book was a best seller worldwide and propelled Keynes into the international limelight as an economist with the common touch.

Keyness caustic eloquence was not lost on Hayek, a young soldier in the Austrian army on the Italian front who returned to find his home city of Vienna devastated and its peoples confidence broken. Hayek and his family suffered from the precipitous inflation that soon beset the Austrian economy. He saw his parents savings melt away, an experience that was to permanently harden him against those who advocated inflation as a cure for a broken economy. He was determined to prove that there were no simple solutions to intractable economic problems, and came to believe that those who advocated large-scale public spending programs to cure unemployment were inviting not just uncontrollable inflation but political tyranny.

Although both Keynes and Hayek agreed on the shortcomings of the Versailles peace treaty, they went on to spend most of the 1930s arguing over the future of economics. Before long, their disagreement included the role of government itself and the threat to individual liberties of intervening in the market. The debate was heated and ill-mannered and took on the spirit of a religious feud. When the 1929 stock market crash triggered the Great Depression, the two men provided competing claims on how best to restore health to the shattered world economy. Though the pair eventually agreed to disagree, their ardent disciples continued the fierce battle long after the two men died.

In September 2008, another Wall Street crash took place and another world financial crisis erupted. President George W. Bush, an ostensible adherent of Hayeks views on the sanctity of the free market, was faced with a stark choice: to watch while the market came to rest with a depression that might rival the one of nearly eighty years before, or to speedily adopt Keynesian remedies to spend trillions of borrowed government dollars to save the sinking economy from more harm. So alarming was the prospect of letting the free market do its worst that, with barely a second thought, Bush abandoned Hayek and embraced Keynes. The election of a new president, Barack Obama, oversaw further vast injections of borrowed money into the economy. But before the stimulus funds were fully spent, there was a violent popular reaction against incurring such unprecedented levels of public debt. The Tea Party movement rose to demand that the administration change its course. Hank, the American people dont like bailouts, Tea Party champion Sarah Palin scolded Treasury Secretary Henry Paulson in October 2008. Glenn Beck, the political commentator, revived the reputation of Hayek by drawing the attention of Americans to his neglected Road to Serfdom , and the long-forgotten Austrian rose to the top of the book sales charts. Keynes was now out and Hayek in.

Arguments over the competing claims to virtue of the free market and government intervention now rage as fiercely as they did in the 1930s. So who was right, Keynes or Hayek? This book is an attempt to answer the question that has divided economists and politicians for eighty years and to show that the stark differences between two exceptional men continue to mark the great divide between the ideas of liberals and conservatives to this day.

ONE

The Glamorous Hero

How Keynes Became Hayeks Idol, 191927

The greatest debate in the history of economics began with a simple request for a book. In the early weeks of 1927, Friedrich Hayek, a young Viennese economist, wrote to John Maynard Keynes at Kings College, Cambridge, in England, asking for an economic textbook written fifty years before, Francis Ysidro Edgeworths exotically titled Mathematical Psychics . Keynes replied with a single line on a plain postcard: I am sorry to say that my stock of Mathematical Psychics is exhausted.

Next page