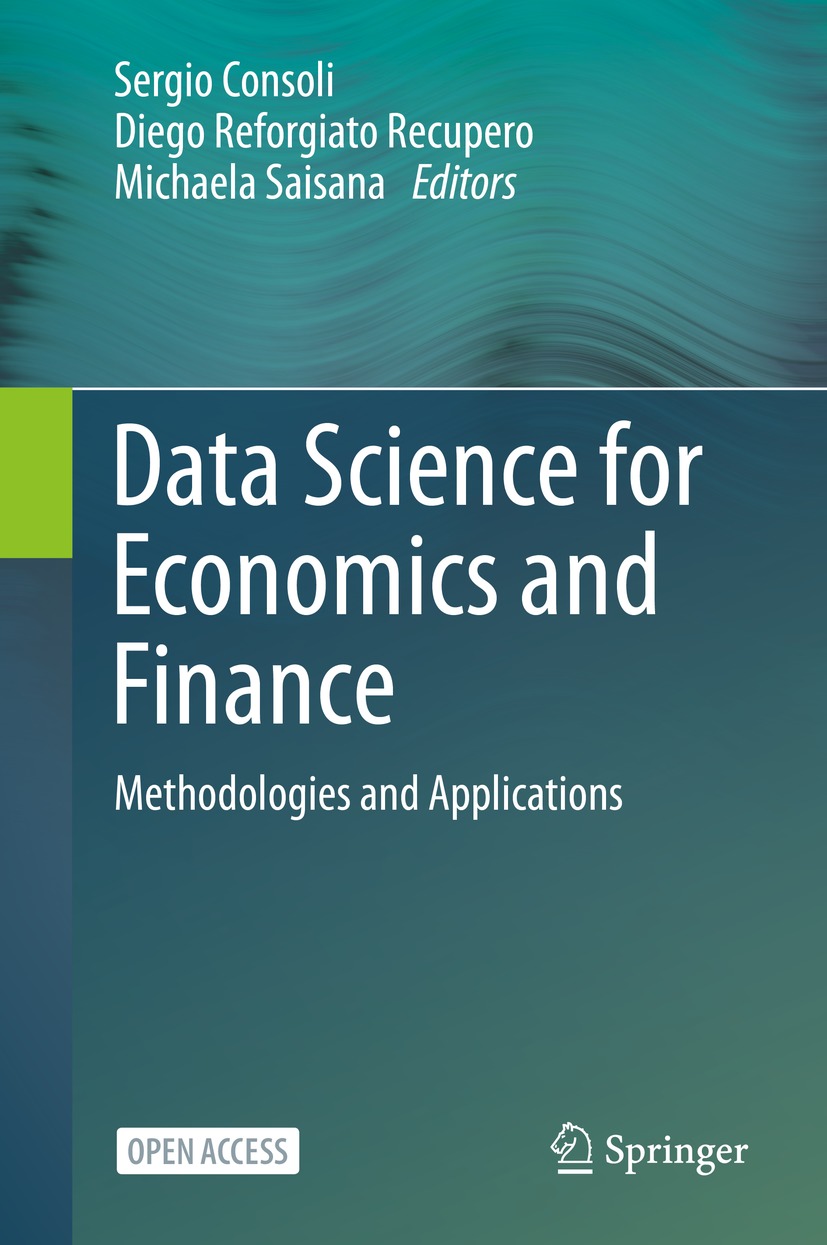

Sergio Consoli (editor) - Data Science for Economics and Finance: Methodologies and Applications

Here you can read online Sergio Consoli (editor) - Data Science for Economics and Finance: Methodologies and Applications full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2021, publisher: Springer, genre: Politics. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Data Science for Economics and Finance: Methodologies and Applications

- Author:

- Publisher:Springer

- Genre:

- Year:2021

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

Data Science for Economics and Finance: Methodologies and Applications: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Data Science for Economics and Finance: Methodologies and Applications" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

This open access book covers the use of data science, including advanced machine learning, big data analytics, Semantic Web technologies, natural language processing, social media analysis, time series analysis, among others, for applications in economics and finance. In addition, it shows some successful applications of advanced data science solutions used to extract new knowledge from data in order to improve economic forecasting models.

The book starts with an introduction on the use of data science technologies in economics and finance and is followed by thirteen chapters showing success stories of the application of specific data science methodologies, touching on particular topics related to novel big data sources and technologies for economic analysis (e.g. social media and news); big data models leveraging on supervised/unsupervised (deep) machine learning; natural language processing to build economic and financial indicators; and forecasting and nowcasting of economic variables through time series analysis.

This book is relevant to all stakeholders involved in digital and data-intensive research in economics and finance, helping them to understand the main opportunities and challenges, become familiar with the latest methodological findings, and learn how to use and evaluate the performances of novel tools and frameworks. It primarily targets data scientists and business analysts exploiting data science technologies, and it will also be a useful resource to research students in disciplines and courses related to these topics. Overall, readers will learn modern and effective data science solutions to create tangible innovations for economic and financial applications.

Sergio Consoli (editor): author's other books

Who wrote Data Science for Economics and Finance: Methodologies and Applications? Find out the surname, the name of the author of the book and a list of all author's works by series.