I am not a defender of socialism or big government!

P AUL K RUGMAN

I N J ULY 2015, I debated the Nobel Prizewinning economist Paul Krugman in front of more than 2,000 people at FreedomFest in Las Vegas. This was billed as the economic showdown of the year: the lead economics columnist for the New York Times versus the former senior economics writer for the Wall Street Journal. The overall theme was socialism versus capitalism. Do we need more government in the economy to achieve more growth and economic fairness?

The debate was moderated by Mark Skousen, the founder of FreedomFest. It was cordial, and the back-and-forth was illuminating, especially for understanding the clash of worldview between left and right. But it was primarily a debate about results, not ideology. My old boss Representative Dick Armey used to say, I dont need faith in free markets. I have evidence. Liberalism, alas, is based on wishful thinking and good intentions (but not even always that). I dont think its any exaggeration to say that Paul Krugman is the most influential left-liberal economist in America today. Democrats and academicians absorb his analyses and recommendations as gospel, so this exchange offers a window into their mindset.

We dueled on almost all the major economic and financial issues in todays national policy discourse and in the presidential campaign from the minimum wage, to Obamacare, to remedies for our economic malaise. Here I replay highlights of the punches and counterpunches, by quotation and paraphrase, along with some of the supporting graphics that were presented. I have tried to do justice to Krugmans arguments in this abridged version of our debate. At the end of each topic, I have added brief comments in summary. We offered Krugman the opportunity to add his own additional comments, but he declined.

As you will discover, Krugman is witty, well-versed on the issues, and quick on his feet. He is also a staunch advocate of nearly everything that government does and its fair to say he thinks that unfettered free-market policies lead to severe inequality and ruinous outcomes. He defended the Postal Service, Obamacare, Medicare, the minimum wage, and the welfare state, which he claims is rapidly shrinking.

Im biased, but I believe that on nearly all of the issues I carried the day. Krugman knows more about health care than I do, so that discussion may have been a draw. A poll taken of the attendees after the debate showed me the clear winner. Unfortunately, the day before the debate, Krugman vetoed television cameras in the auditorium no Fox or CNN or C-SPAN. The blackout prevented potentially hundreds of thousands of people from viewing the debate live. Fortunately, a full-length video of the festivities is now available on YouTube. A full transcript is also available on request.

1. Why did we have a recession, and did the Obama stimulus fail?

PAUL KRUGMAN

We just had the mother of all financial crises, or actually the stepmother of all financial crises, because the mother was the 1930s. But this was a pretty close second. And it takes a long time to recover from those even with the best policies, which we did not have. The errors were: We cut government spending too quickly. We failed to have sufficiently aggressive monetary policies. So its been a long hangover. Although compared with anyplace else in the advanced world, the U.S. economy looks pretty good right now.

Economic growth has been much slower over the past 30 years than in the three decades following World War II, but weve done not too badly by many measures. The problem is that the new wealth has not trickled down to ordinary working families, so weve had rapidly rising inequality in the midst of decent economic growth.

STEVE MOORE

Just about everything weve done in Washington for the past seven years has been exactly the wrong thing to do. Weve made the economy much worse with these governmental interventions. And its not just under Barack Obama but under George Bush.

The bailouts were a mistake, creating a great moral hazard for the economy and bringing about a centralization of the banks. The $830 billion stimulus plan did not create jobs. Obamacare, tax increases, cash for clunkers all mistakes. The massive spending added $7 trillion to the national debt in six years. It was a big Keynesian experiment, and did anything go right?

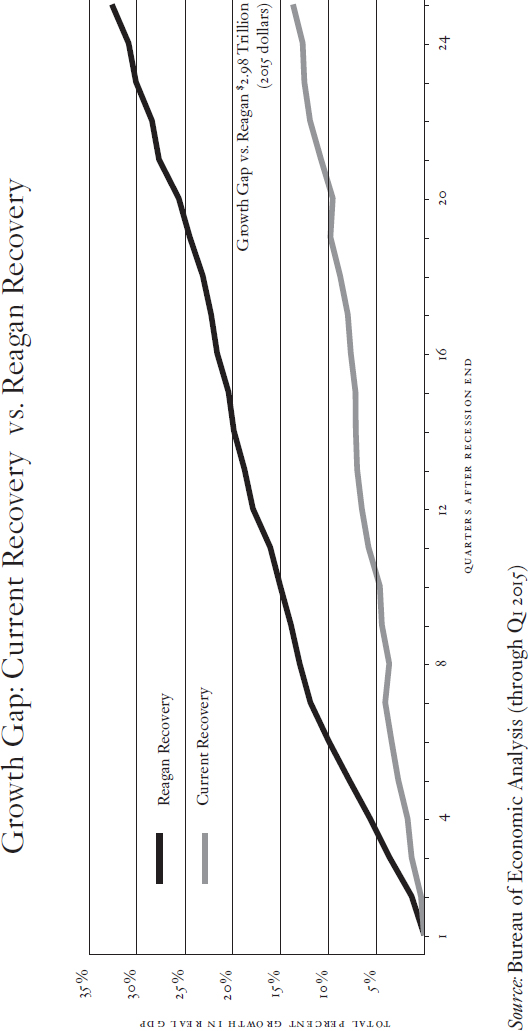

Its true that Obama inherited an economic crisis. But so did Reagan, when we had 20 percent mortgage interest rates and 14 percent inflation, and every economist in the day was saying that America was in permanent decline. And these two presidents used entirely different approaches to dealing with the crisis. Reagans philosophy in brief: the government is not the solution, government is the problem. Obamas philosophy: the government really is the solution to a lot of our problems.

If the Reagan recovery had been replicated under Obama, we would have $2.75 trillion more in GDP and about 5 million more jobs today.

KRUGMAN

The recessions of 20089 and of 198182 were very, very different beasts. In the earlier case, the Federal Reserve wanted to bring down inflation. And it raised interest rates sky high. And then after they felt that the economy had suffered enough, they brought interest rates way down. And so you had a rapid recovery.

In the recent recession, wed had a financial system that ran out of control and crashed. And the Fed tried to cut interest rates. But it ran up against the problem that you cant cut interest rates below zero. And that meant that it was a very, very different story. It was bound to be a much slower, a much more difficult recovery, even with the right policies. I kept writing that the recovery was going to be sluggish.

The advanced countries responded to the crisis in various ways: Some were imposing really harsh austerity, some were not. If you compare the rate of growth of government spending in any individual country and year with the rate of growth of GDP in 201013, and if you dont cherry-pick the data, youll find an obvious, strong, positive correlation in recent years between government spending and growth. If spending should have been cut more, how do you explain these numbers? The cross-country data show a very, very Keynesian reality.

And the Obama stimulus spending was not gigantic in an economy of $17 trillion a year. You had an $800 billion stimulus spread over three years. It maxed out at about 2 percent of GDP. It was not a huge program. In fact, I was tearing my hair out repeatedly on the pages of the