INTRODUCTION

T HIS BOOK IS NOT a mystery novel, so let me start by giving away the ending. Is the tax cut being proposed by George W. Bush a good idea? No. It is much too large, even given optimistic forecasts of future surpluses. And it is all the more irresponsible given the high probability that those forecasts, like all long-run budget forecasts in the past, will turn out to be wrong.

Will the tax cut destroy Americas prosperity? Probably not. As Adam Smith observed, theres a deal of ruin in a nation. We have a huge, resilient economy that can survive and recover from even quite bad government policies.

Yet while the tax cut may not be a matter of economic life or death, it is a very serious issue. For one thing, like it or not, the tax cut has become the central political issue in the United States right now. Conservatives who want to reshape America view passage of a large tax cut as a first step toward realizing their vision. For that reason, those who do not share this vision feel, rightly, that they must oppose the plan.

The drive for tax cuts also has a dire influence on the rest of policymaking, distorting the debate on many other subjects. How should we respond to the current economic slowdown? We cant discuss that rationally, because the administration insists that the slowdown this year justifies a huge tax cut over the next ten years, and it wont allow proposals for a temporary tax cut to boost the economy to be considered separately from its long-run proposals. How should we deal with the need to extend Medicare to include prescription drugs? The administration cannot present a realistic plan, because that would too obviously cut into the large surplus it claims is available for tax cuts. How should we plan our defense policy? The administration cannot discuss this objectively, because the numbers that would emerge would cast doubt on the affordability of the tax cut... well, you get the point.

And its not just a matter of concrete proposals. Theres something about the tax cut crusade that gives the crusaders a disdain for petty concerns, like telling the truth about their own proposals. Maybe they feel that the end justifies the means, or maybe they feel that white lies dont matter in the service of a higher truth. Whatever the reason, the arguments made for tax cuts have been startling in their intellectual dishonesty. One might dismiss the untrue things Bush said during the campaign as par for the political coursethough I dont know of any campaign in modern times that has been quite so cynical in its misrepresentations. But what has happened since Bush moved to Washingtonthe deliberate misstatements and suppression of the factsis, as far as I know, unprecedented in the history of American economic policy. It would be a shame if this style of governing succeeds, because it will set a precedent for future administrations.

The debate over tax cuts also provides an opportunity for a kind of civics lesson, one that is badly needed. It has become clear that even people who should know betterfor example, reporters and television commentatorsdont understand the basics about the federal government: where the money comes from, where it goes, how Social Security works. And if the voters are also confused, one can hardly blame them: most people are focused not on politics but on their daily lives, our politicians have done their best to confuse us, and our press has done nothing to keep the politicians honest. But perhaps the tax cut debate offers an opportunity to get beyond catchphrases like big government and protecting Social Security and to have a genuine debate about what we want and what we dont want the government to do, and how society should pay for the things we want. On a more personal note, this book offers me an opportunity for a longer form of discussion that cant be squeezed into 735-word columns in the New York Times.

Since this book is in part a civics lesson, it begins with the deep background: the political logic that has made tax cuts such an imperative for conservatives even though they are not a popular cause, and the economic impactreal and imaginedof tax cuts in general. It then moves on to shallower background: the realities of the U.S. budget as it is, the origins and plausibility (or lack thereof) of those huge surplus forecasts for the next decade, and the long-run perspective. Only then do I move on to the tax cut proposals on the table: the Bush plan and the alternatives.

Obviously this book has a point of view. But it is not a diatribe: it is intended to be a citizens guide. As we will see, there is a case for tax cuts; there is even a case for the Bush tax cut, though it is not the case the administration is making. The main purpose of this book is to inform; what you do with that information is up to you.

7

THE BUSH PLAN

THE BASICS

G IVE G EORGE W. B USH points for consistency: his tax plan has remained almost unchanged since it was first conceived as a Forbes defense shield. In this chapter I will review some of the basics of the plan, and I will also turn to the key question of its affordability.

Three Tax Cuts

To get a rough picture of how the Bush tax plan works, it helps to realize that it really consists of three components that need not have any connection with one another. This is a point that the administration sometimes tries to conceal, insisting that the whole plan must be considered as a unified package; at other times the administration plays mix-and-match itself, presenting numbers that apply to only part of its plan. But more on that later.

Meanwhile, here are the three parts of the plan:

An income tax reduction. When you fill out your 1040 form, you begin by calculating a series of exemptions, deductions, and credits; income after those exemptions and deductions is then taxed on a sliding scale that applies successively higher tax rates on higher levels of income. Most people either pay no income taxes or are in the 15 percent bracket. The highest tax bracket, which kicks in at an income in excess of $300,000 for a couple with two children, is 39.6 percent.

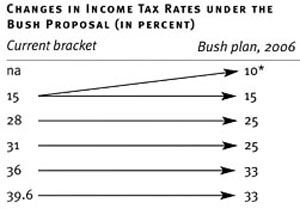

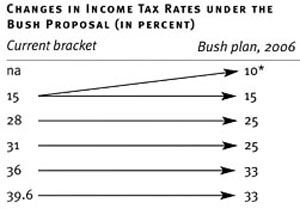

The Bush plan would reduce the tax rate within most of those brackets, and would also create a new bottom bracket for part of the range now taxed at a 15 percent rate. Table 3 summarizes the changes.

For families that do not pay income taxes, none of this would make any difference. For families near the middle of the income distribution, who currently pay a 15 percent rate on their taxable income, the effect of the Bush tax cut would be to reduce the tax rate on part of that income from 15 to 10 percent. This carve-out would apply to the first $6,000 of income for individuals, $12,000 for couplesso for median-income taxpayers the income tax cut would amount to either $300 or $600.

Table 3

*new bottom bracket ( carve-out )

Meanwhile, the rate in the top tax bracket would be reduced from 39.6 to 33 percent. This means that very high-income families, most of whose income would fall into that top bracket, would get a tax break approaching 7 percent of their taxable income.

Overall, about half of the budget cost of the Bush tax plan, once it is fully phased in, would come from reductions in income tax rates.

A complicating feature of the Bush plan is that it would also try to reduce the marriage penalty. This takes a bit of explaining. The income tax is progressivethat is, the tax rate is higher on taxpayers with higher incomes. But any progressive tax creates a dilemma: how do we calculate the tax bracket of married couples? Consider a couple with a combined income of $100,000: do we consider them to be in the $100,000 bracket, or do we put them in the $50,000 bracket, because income per adult is $50,000?