The Tariff Trap: Taxing Millions to Enrich a Few

Blockading squadrons are a means whereby nations seek to prevent their enemies from trading; protective tariffs are a means whereby nations attempt to prevent their own people from trading. What protectionism teaches us, is to do to ourselves in time of peace what enemies seek to do to us in time of war.

Henry George

I m a tariff guy.

President Donald J. Trump

T ariffs are usually thought of as an arcane element of economic policy. But today, tariffs are making headlines and attracting a national debate. It started when President Trump declared himself a tariff guy and began using tariffs as a tool of economic and foreign policyfirst against American allies, like Canada, then against rivals like China. The presidents self-proclaimed trade war against China has leaned heavily on the use of tariffsto the detriment of American citizens, since the tariff fees paid by companies are almost always passed through to consumers in the form of higher prices.

In the year 2000, tariffs levied on imports into the United States cost each American between $269 and $660 a year, depending on income.

By 2019, with the imposition of more and more tariffs, Nien Su, a former chief economic adviser to the House Foreign Affairs Committee, projected yearly costs of between $800 and $1,000 per consumer due to President Trumps ongoing trade war, but this number was likely understated; according to a 2019 Trade Partnership Worldwide analysis, the trade war with China alone will cost American families about $2,300 a year.

Trumps trade war has sparked a n ational debate.

But the perverse harm done by tariffs is nothing new. The U.S. has always had a long list of tariffs that tend to discriminate particularly against people of low to modest income. Tariffs raise prices and consumers pay more. Many of the products that have traditionally carried the highest tariffs are basic necessities like inexpensive shoes (duties on shoes range from 6 percent to 48 percent) and basic food items that low-income citi zens depend on.

Dan Ikenson, Director of Trade Policy Studies at the Cato Institute, noted in 2016 that The United States has relatively low tariffs on averageless than 2 percent. But tariffs on clothing (18 percent), footwear (14 percent), and food products (10 percent) are especially high Imports of lifes basic necessitiesfood, clothing, and shelterare subject to some of the h ighest taxes.

A 2017 study on the impact of tariffs gives this example of the hurdles for low- and middle-income Americans: [F]or a family doing their back-to-school shopping, backpacks of man-made fibers carry tariffs of 17.6%; non-mechanical pencils and crayons about 4.3%; markers 4%; mechanical pencils 6.6%Meanwhile, there are no tariffs applied on imports of cross-country snow skis, sailboards, or arche ry equipment.

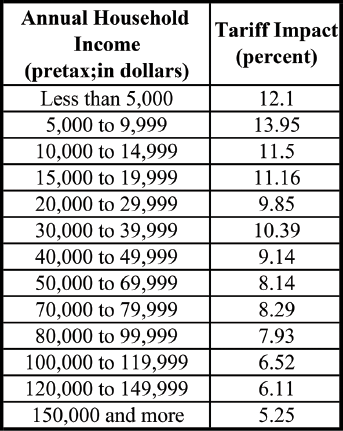

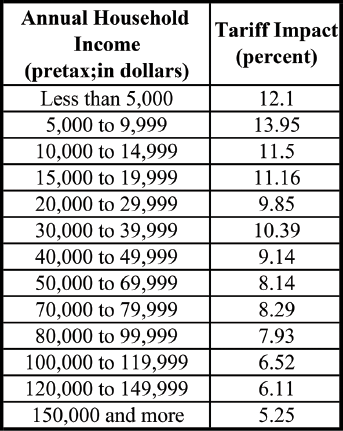

In 2018, Tyler Moran, an economist at the Peterson Institute for International Economics, analyzed the impact of tariffs on Americans by household income (Figure 2-1). He found that the less money a family earned, the higher the percentage that goes towards paying the cost of tariffs on the goods they purchase. Thus, those earning less than $10,000 pay the highest percentage of their income as a result of tariffs (1214 percent), while those earning over $150,000 pay the least ( 5.25 percent).

Figure 2-1: The impact of tariffs on households at various levels of pretax income.

Source: Bureau of Labor Statistics, Consumer Expenditure Survey; United Nations Conference on Trade and Deve lopment, TRAINS

Its hard to imagine that any rational legislator would deliberately propose such a scheme.

The Tariff SystemMind-Nu mbingly Complex

The U.S. International Trade Commission maintains a list called the Harmonized Tariff Schedule, which in its ninety-nine chapters and twenty-two sections lists over seventeen thousand items that are subject to a tariff. These do not include the additional tariffs imposed by President Trump. U.S. Customs and Border Protection is the age ncy responsible

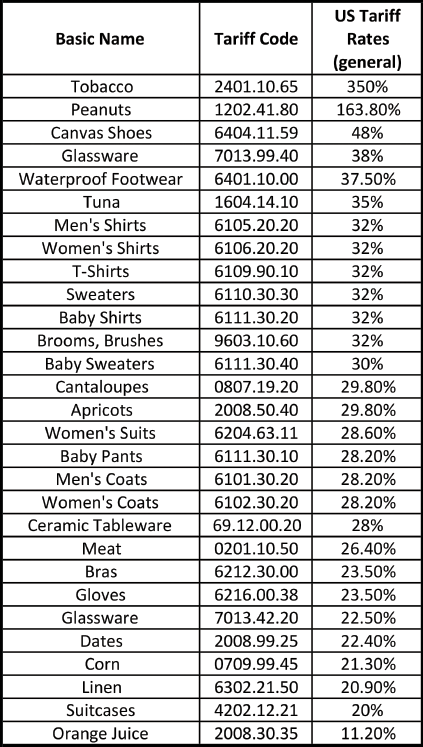

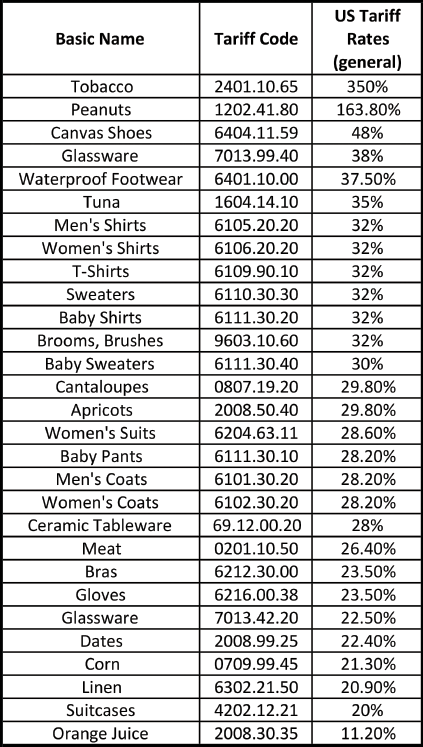

Figure 2-2: U S tariff rates.

Source: U.S. International Trade Commission Harmonized Tax Schedule, 2019

for interpreting the traditional tariffs and advising businesses trading in potentially dutiable goods. Available online, the schedule is mind-numbingly complexan example of what happens when government policies are set in response to political pressure and lobbying efforts by an array of competing interest groups, each seeking to bend the system in their favor. Figure 2-2 is a table showing some of the highest and most disruptive tariffs prior to President Trumps trade war, culled from the three thousand -page schedule.

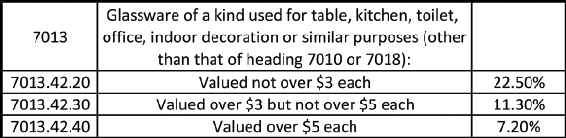

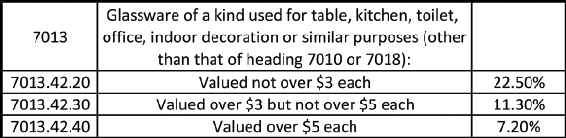

Some tariffs decrease by formula as the value of the item being imported increases, which means that the cheaper version is automatically slapped with a higher tariff rate than the more expensive one. Glassware is one exampl e (Figure 2-3):

Figure 2-3: US tariff rate s on glassware.

Source: U.S. International Trade Commission Harmonized Tax Schedule, 2019

There are many examples of the startling advantages enjoyed by many makers of upscale products. For instance, the Apple Watch, costing $399, is completely exempt from tariffs, as is perfume. Cars are taxed a reasonab le 2.5 percent.

Interpreting the Harmonized Tariff Schedule is the job of employees of the International Trade Commission. The following sample correspondence provides a hint of the complexity and effort involved in maintaining these well-entrenched tariffs. The author, Gwenn Kirschner, a tariff expert whose job is to impose tariffs on imported goods, received a request to classify one mens knit jacket from China. The minutiae of detail included in her reply gives us a small sense of the impact of the harmonized tariff schedule. Every variation requires a classification and a tariff determination. And of course, all such work is done by federal government employees on the taxp ayers payroll.

Ms. Elizabeth Orzol

D iesel USA, Inc.

RE: The tariff classification of a mens knit jac ket from China.

Dear Ms. Orzol:

In your letter dated February 4, 2014, you requested a tariff classif ication ruling

Style 05D308FABERDEEN is a mens jacket constructed from 51% cotton, 49% polyester, finely knit, French terry fabric. The garment has a lined self-fabric hood with a drawstring; a full front opening with a zipper closure; long raglan sleeves with rib knit cuffs; front pockets below the waist; and a close fitting r ib knit bottom.

The applicable subheading for Style 05D308FABERDEEN will be 6101.20.0010, Harmonized Tariff Schedule of the United States (HTSUS), which provides for: Mens or boys overcoats, carcoats, capes, cloaks, anoraks (including ski-jackets), windbreakers, and similar articles, knitted or crocheted: other than those of heading 6103: of cotton: mens. The rate of duty will be 15 .9% ad valorem.

This ruling is being issued under the provisions of Part 177 of the Customs Regulations ( 19 C.F.R. 177).

Sincerely,

Gwenn Klein Kirschner

Acting Director

National Commodity Speci alist Division

Bear in mind, however, that practically all imported products were in danger of getting hit with tariffs in late 2019. As well explain later, the uncertainty of how tariff rules may change in the future adds to the dysfunctional nature of the tariff system, making life more complicated for business managers, and creating an extra drag on the na tional economy.