Praise for this book

The number of savings groups local savings-and-loan clubs promoted and refined by NGOs and others is growing fast, and their potential to help millions of poorer people manage their money better is clear. This well-written book skilfully balances the thrill of witnessing an exciting new movement emerge with a sober and carefully documented assessment of the challenges it faces.

Stuart Rutherford OBE, founder of SafeSave, author of The Poor and their Money

The Arusha Savings Group Summit spawned this excellent book not just to gather together what we now know about savings groups but also as a manifesto of confidence that savings groups offer a very powerful way for the poor to help themselves and each other.

Chris Dunford, Director of The Evidence Project at Freedom from Hunger

Nelson and friends provide a refreshing view of a niche in the microfinance industry where saving, rather than lending, is featured. The savings groups, so ably discussed in this book, are proving to be an inexpensive way of providing financial services to poor people, particularly in rural areas.

Three features of the book appealed to me: the emphasis on savings as a way of easing poverty; the recognition that informal finance provides valuable lessons for those designing programmes for poor people; and the solid body of knowledge that exists about how to design, promote, and support savings groups.

Dale W. Adams, Professor Emeritus, The Ohio State University

Microfinance has for too long been focused on microcredit, that is, getting poor people into debt. We are at last realizing that savings must be the starting point for financial inclusion, and saving money, like losing weight, is most easily done in groups. This book shows us what should have been the beginning of microfinance.

Malcolm Harper, Emeritus Professor of Enterprise Development, Cranfield University, UK

For practitioners, facilitators and donors who are already engaged or intend to become engaged with savings groups, the book presents a practical analysis of different implementation methods, monitoring frameworks, costs, sustainability strategies, and the impact of savings groups. This is a useful guide about an approach that is reaching people in more remote and rural areas who have little or no access to financial services.

Ann J. Miles, Director of Microfinance, The MasterCard Foundation

This eBook is licensed to stacey.davies05@googlemail.com, Stacey Davies

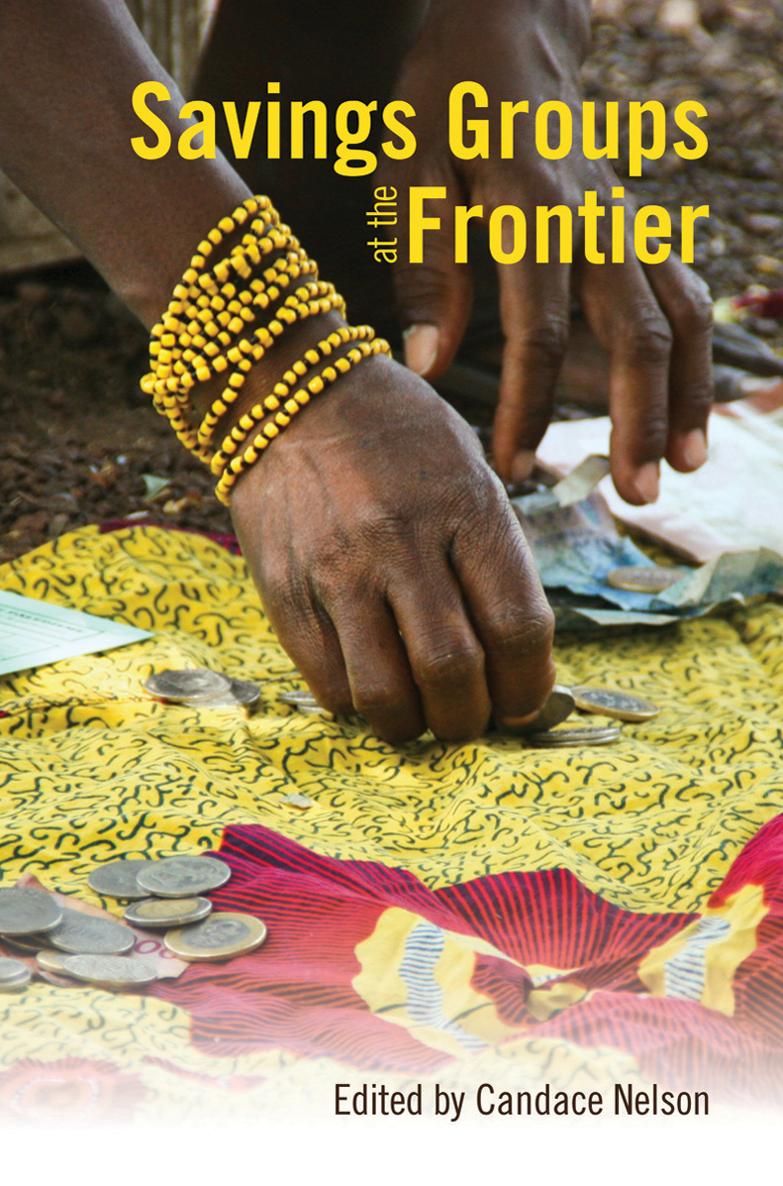

Savings Groups at the Frontier

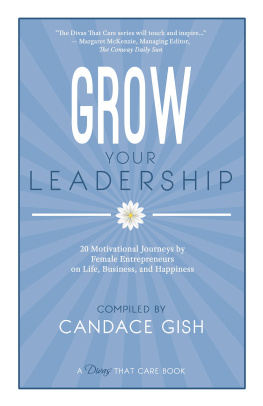

Edited by Candace Nelson

This eBook is licensed to stacey.davies05@googlemail.com, Stacey Davies

Practical Action Publishing Ltd

The Schumacher Centre

Bourton on Dunsmore, Rugby,

Warwickshire CV23 9QZ, UK

www.practicalactionpublishing.org

Copyright The SEEP Network, 2013

ISBN 978 1 85339 776 9 Hardback

ISBN 978 1 85339 777 6 Paperback

ISBN 978 1 78044 776 6 Library Ebook

ISBN 978 1 78044 777 3 Ebook

Book DOI: http://dx.doi.org/10.3362/9781780447766.000

All rights reserved. No part of this publication may be reprinted or reproduced or utilized in any form or by any electronic, mechanical, or other means, now known or hereafter invented, including photocopying and recording, or in any information storage or retrieval system, without the written permission of the publishers.

A catalogue record for this book is available from the British Library.

The contributors have asserted their rights under the Copyright Designs and Patents Act 1988 to be identified as authors of their respective contributions.

Candace Nelson, ed. (2013) Savings Groups at the Frontier, Practical Action Publishing, Rugby, UK.

Since 1974, Practical Action Publishing has published and disseminated books and information in support of international development work throughout the world. Practical Action Publishing is a trading name of Practical Action Publishing Ltd (Company Reg. No. 1159018), the wholly owned publishing company of Practical Action. Practical Action Publishing trades only in support of its parent charity objectives and any profits are covenanted back to Practical Action (Charity Reg. No. 247257, Group VAT Registration No. 880 9924 76).

Cover photo: A woman participates in a savings group in Mali

Credit: Jeffrey Ashe / Oxfam America

Typeset by S.J.I. Services

This eBook is licensed to stacey.davies05@googlemail.com, Stacey Davies

Contents

Jeffrey Ashe and Candace Nelson |

Joanna Ledgerwood and Alyssa Jethani |

Susan Johnson and Silvia Storchi |

Paul Rippey and Hugh Allen |

Kim Wilson |

Megan Gash |

David Panetta |

This eBook is licensed to stacey.davies05@googlemail.com, Stacey Davies

Figures

Tables

Boxes

This eBook is licensed to stacey.davies05@googlemail.com, Stacey Davies

In 2011, CARE celebrated the 20th anniversary of the first Village Savings and Loan Association (VSLA), created in Niger in 1991. Of course back then the women didnt call their programme a Villages Savings and Loan Association; they much more wisely named it Mata Masu Dubara (MMD) Women on the Move. For them, the savings and loan part was less important than the fact that they were taking collective action to improve their lives. I think of those women often, and I know they are proud to see how far the industry they created has come in empowering women, particularly African women. They are all still members of MMD groups, and still teaching other women in Niger the value of group savings and borrowing, just the way they taught CARE.

When this small handful of women started the first VSLA over 20 years ago, they had no idea they were starting a global movement aimed at achieving financial inclusion for some of the poorest people in the world. But thats just what they did, with savings groups now reaching over 6 million people, predominantly in Africa. These women couldnt access financial services that worked for them, so they started something that would.

While Bangladesh is well known as the home of microcredit, Africa is truly the birthplace of the microsavings movement. Savings groups are a uniquely African solution to poverty and financial exclusion. Savings groups have convinced me that the answers to poverty eradication will come not from the developed world, but from the developing countries themselves.

I first met one of the original MMD members in 2009, at the MicroCredit Summit meeting in Nairobi. We had invited her to attend the summit as our guest and share her learning with us. Her story was utterly unique, yet in some ways it is a story I have heard from nearly every VSLA member I have met. She recounted her desperate poverty as a young wife, and how she was forced to marry off her youngest teenage daughters because her family could no longer afford to feed them. Then she joined an MMD group, and started to save just pennies a week. She used some of those savings to feed her family during the lean months, and invested in growing crops and petty trading. As she grew her small business, she increased her weekly savings. At the same time, she got involved in her village council, and then the district council. And something else started happening; the MMD groups in her community began to network with each other, identifying women in the groups to stand for election in local government to represent their interests. Eventually, one of her fellow MMD members was elected to parliament. She also had the opportunity to speak to parliament about womens issues in her community. And now she was travelling to Kenya to share the story of how MMD had empowered so many women in Niger to change their own lives, their communities, and even their country. By whatever name Village Savings and Loans, Saving for Change, Saving and Internal Lending Communities these groups of women, and increasingly men, are taking charge of their lives by using their own resources more effectively.