This book was published with the assistance of the Authors Fund of the University of North Carolina Press.

2018 The University of North Carolina Press

All rights reserved

Set in Espinosa Nova by Westchester Publishing Services

Manufactured in the United States of America

The University of North Carolina Press has been a member of the Green Press Initiative since 2003.

Library of Congress Cataloging-in-Publication Data

Names: Walsh, Camille, author.

Title: Racial taxation : schools, segregation, and taxpayer citizenship, 18691973 / Camille Walsh.

Description: Chapel Hill : University of North Carolina Press, [2018] | Includes bibliographical references and index.

Identifiers: LCCN 2017021190 | ISBN 9781469638935 (cloth : alk. paper) | ISBN 9781469638942 (pbk : alk. paper) | ISBN 9781469638959 (ebook)

Subjects: LCSH : Educational equalizationUnited States. | African AmericansEducationUnited StatesHistory. | Segregation in educationUnited States. | TaxationUnited States. | EducationUnited StatesFinanceHistory.

Classification: LCC LC 213.2 . W 26 2018 | DDC 379.2/6dc23

LC record available at https://lccn.loc.gov/2017021190

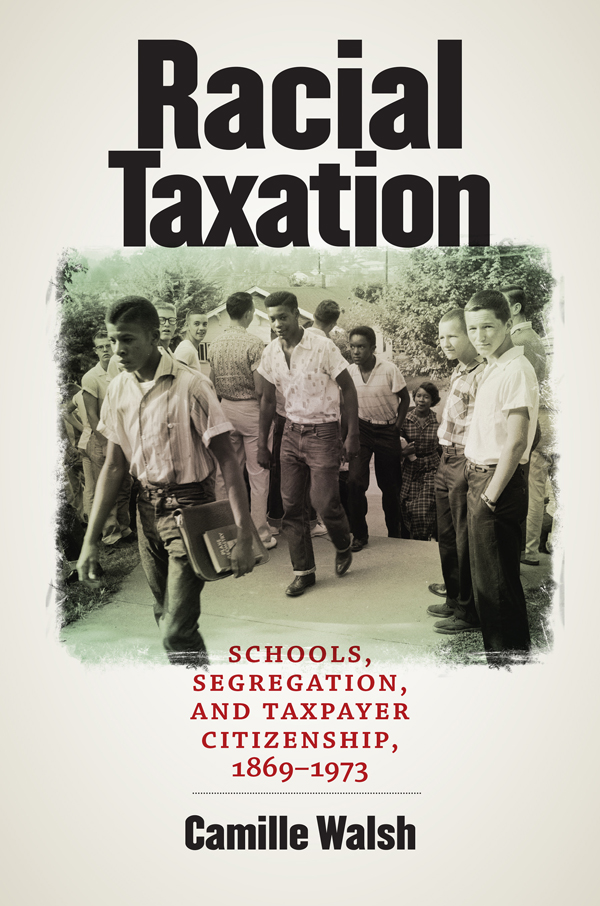

Cover illustration: Clinton, TN. School integration conflicts (1956) by Thomas J. OHalloran (courtesy of the U.S. News & World Report Magazine Photograph Collection, Library of Congress Prints and Photographs Division, LG DIG ppmsca-03089).

Portions of chapter 5 were previously published as White Backlash, the Taxpaying Public, and Educational Citizenship, Critical Sociology 43, no. 2 (2017): 23747. Portions of chapter 7 were previously published as Erasing Race, Dismissing Class: San Antonio Independent School District v. Rodriguez , La Raza Law Journal 21 (2011): 13371; in Rodriguez in the Court: Contingency and Context, in The Enduring Legacy of Rodriguez: Creating New Pathways to Equal Educational Opportunity , ed. Charles J. Ogletree Jr. and Kimberly Jenkins Robinson (Cambridge, MA: Harvard Education Press, 2015); and in The Poor People Have Lost Again: San Antonio Independent School District v. Rodriguez (1973), in Poverty Law Canon: Exploring the Major Cases , ed. Marie Failinger and Ezra Rosse (Ann Arbor: University of Michigan Press, 2016). All material used here with permission.

Acknowledgments

I am a proud product of a public school education, and my ability to engage and be inspired by my teachers was the direct result of the public tax funds that paid their salaries, built my classrooms, and bought the textbooks that opened up the world for me outside my small rural town. I am also the result of the taxpayer money that fed, sheltered, and clothed me through much of my childhood from programs like Aid to Families with Dependent Children, as well as the federal grants and loans that allowed me to pursue higher education at public and private universities I couldnt have imagined existed as a child. Having spent much of my life as a taxeater, I am compelled to first acknowledge the many people whose participation in a faceless system of public taxation gave me the capacity to grow, learn, and become who I am. This book is one small dividend from that investment.

My adviser, Peggy Pascoe, passed away shortly after she chaired my dissertation defense, and her wisdom and guidance on everything from research to revising to teaching to mentoring still reverberate with me every single day. She was an astonishingly generous and thoughtful scholar, mentor, and teacher, and this book is dedicated to her memory. I also owe an enormous debt of gratitude to my many graduate school teachers, mentors, and colleagues, including Ellen Herman, Joe Lowndes, and James Mohr, who each supervised me with grace and insight, and Chris Brooks, Matthew Dennis, Margaret Hallock, Torrie Hester, Elizabeth Medford, Daniel Pope, Elizabeth Reis, Veta Schlimgen, Martin Summers, and many others. Thanks to the Mellon Foundation, the Spencer Foundation, the University Club of Portland, the Risa Palm Fellowship, the University of Oregon History Department, and the Wayne Morse Center at the University of Oregon Law School for the community, research support, and camaraderie they provided.

I was fortunate to be a Jerome Hall Postdoctoral Fellow in Law, Society, and Culture at Indiana Universitys Maurer School of Law under the mentorship of Ajay K. Mehrotra and Michael Grossberg. Between them, they were experts in just about every field covered in my book, and their warmth, encouragement, and support cannot be overstated. Sadia Saeed and Jen Erickson were wonderful comrades in arms as we explored Indiana that year and worked to develop our book manuscripts and research agendas as scholars, and Jeannine Bell and Kevin Brown provided insight into the process.

My colleagues at the University of WashingtonBothell have been a constant source of companionship, camaraderie, and support for many years, and I feel fortunate to work at an institution where hard questions and critical thinking are our guiding light, and empathy and justice our foundations. Janelle Silva and Johanna Crane, thank you for toasting and cheering me on at every step, as well as for all the adventures, the commiseration, and the new things you always brought to the table for me to learn about research, teaching, and life. I also appreciate the incredibly generous camaraderie, support, and wisdom of too many colleagues to name, among them Wayne Au, Nancy Beadie, Dan Berger, Bruce Burgett, Charu Charusheela, Martha Groom, Dan Jacoby, Ron Krabill, Alka Kurian, George Lovell, Keith Nitta, Wadiya Udell, and so many others. The Royalty Research Fund at the University of Washington generously provided me with a summer free of teaching to focus on my research. Finally, thank you to the Interdisciplinary Arts and Sciences staff for endless support in navigating academic life; and to Joren Clowers for a terrific index.

I am very grateful for the guidance, patience, and support of the editorial team at the University of North Carolina Press, in particular Brandon Proia. Parts of this book have been presented in a number of forums, invited talks, and conferences, including Institutes for Constitutional History at Stanford Law School and George Washington University School of Law; Centre for Citizenship, Civil Society, and Rule of Law at the University of Aberdeen, Scotland; Workshop on Vulnerability and Education; Conference on Civil Rights and Education at Pennsylvania State University; Organization of American Historians Annual Meeting; American Historical Association Annual Meeting; Policy History Conference; History of Education Society Conference; Class Crits Conference; Social Science History Association; American Society for Legal History Conference; Lat Crit Conference; Critical Tax Theory Conference; Poverty Law Conference; Fiscal Sociology Workshop; Law and Society Association Annual Meeting; and numerous others. I would like to thank the organizers and participants of each of these events and panels for including me and discussing this work at various stages of development. Thank you in particular to Dorothy Brown, Mary Dudziak, Martha Fineman, Risa Goluboff, Kenneth Mack, Isaac Martin, Serena Mayeri, Monica Prasad, and many others for their insightful comments on my work at different stages.