Table of Contents

ABOUT THE AUTHORS

Seth Tobocman has been drawing comic books about serious issues for three decades. He founded the political comic book World War 3 Illustrated in 1980 with Peter Kuper. Tobocmans books include You Dont Have to Fuck People Over to Survive, War in the Neighborhood, Portraits of Israelis and Palestinians, and Disaster and Resistance.

Eric Laursen is an independent journalist and activist with an extensive background in financial and public-affairs reporting. His work has appeared in The Village Voice and The Nation, among other publications.

Jess Wehrles work can also be seen in Disaster and Resistance, The Bush Junta: A Field Guide to Corruption in Government, and the upcoming epic Return to Crunch Island, among other titles.

Dedicated to our grandparents, who were witness, to the Great Depression:

Helen Tobocman, Jacob Tobocman, Frida Perloff, Aaron Perloff,

Rosemary Wehrle, Maryjane Finlay, Tage Laursen, Dagmar Jensen Laursen,

Harold Sherwin, and Edna Crow Sherwin

(Above: portrait of Helen Tobocman, painted by Seth Tobocman, 1975)

FOREWORD

by Doug Henwood

As Im writing this, in January 2010, its looking like the worst of the financial crisis is over and the real economy is staging a recoverya very weak one, though. My guess is that the economy, which for most people means the job market, will stink for quite a while, perhaps years, so the difference between recession and recovery may seem academic to both the unemployed trying to find a job and the employed trying to make ends meet. Still, its better than things falling totally apart, which is the way it felt at the beginning of 2009.

Yet despite the worst financial and economic troubles since the Great Depression, Americans seem to have learned almost nothing from their economic brush with death. At the elite level, the response has mainly been to spend enormous wads of public money on trying to restore the status quo ante bustum. Theres been almost no effort to reform finance, which would require reregulating it in a serious way to avoid future catastrophes. In fact, in early 2010, it looks like Wall Street has gone back to business as usual. In a truly strange historical irony, Paul Volcker, one of the engineers of The Great Crackdown described in the chapter of the same title, is now being identified as the avatar of a new populisma toothless effort to reregulate the banks driven more by the Obama administrations political desperation than any serious structural overhaul.

And there have been few New Deal-style efforts at job creation or infrastructure investment. Yes, there was a $787 billion stimulus package passed in the early days of the Obama administration, but spending has been scattered and of dubious effectiveness. Obamas people bragged that they were trying to create private-sector jobs, not those evil public-sector ones like back in the 1930s. As a result, if you use their own numbers, theyve created or saved fewer than a million jobsagainst 8.5 million lost from December 2007 through December 2009at a cost of $250,000 a job. The government could have created five times as many jobs had it hired people directly instead of relying on tax breaks and subsidies.

At the non-elite level, much of the population has been passive while the bankers got billions and the jobless got unemployment benefits (average weekly check in 2009: $305)if they were lucky. Unlike in the 1930s, theres been no upsurge of union organizing, plant occupations, or solidarity with those facing foreclosure. Most of the noise has been coming from the far rightfrom, for example, the Tea Baggers, nicely described by Ben McGrath in The New Yorker as a collection of footloose Ron Paul supporters, goldbugs, evangelicals, Atlas Shruggers, militiamen, strict Constitutionalists, swine-flu skeptics, scattered 9/11 truthers, neo-Birchers, and, of course, birthersthose who remained convinced that the President was a Muslim double agent born in Kenya. They appear to be a movement of middle managers, professionals, and retireesnot the 80 percent of the workforce classified as nonsupervisory, the people who take orders on the job rather than giving them. (Those people, perched on the lower rungs of the economic ladder, now seem even more disenfranchised than ever.)

If this economic crisis has legs, which I think it does, then things may change. (Actually, if it is going to stick around, crisis is probably the wrong word to use to describe the new normal.) How long can people be expected to put up with enormously high levels of economic insecurity and crushing levels of debt? If people start recovering from the shocks of the last two years and want to begin to figure out what happened to them, then they could do no better than to pick up this fine book. It lays out not only what lawyerly types call the proximate causes of the crisis, such as the housing bubble and the mortgage mania, but the more enduring causes as well, such as deregulation and the assault on wages.

Though this crisis looks like its of recent vintage, in fact its roots go back into the late 1970s. Thats when elites decided that theyd had enough of insolent workers and rebellious colonies. At home, wages were slashed; abroad, entire continental economies were restructured into capital-friendly targets for foreign investment. Faced with sagging incomes, people borrowed to maintain their standards of living. And those restructured foreign economies became the new homes for the manufacturing plants that were shuttered in the Midwest. But we borrowed heavily to import all the stuff we used to make at home, and now U.S. households are massively in debtand a lot of that money is owed to creditors abroad. Not only is it a brutal economic model, it no longer looks sustainable even on its own terms.

But Americans, elite and otherwise, havent really figured this out yet. Instead, they imagine either a return to the boom of 2006 or the insular small-town all-white world of the 1840s. Wed be a lot better off if the people who picked up this book to figure out how we got here also took onboard the conclusionthe importance of tightening up financial regulation and of reinventing a culture of solidarity to replace the current survival-of-the-fittest model thats been imposed on us. Thats a tall order, I know, but if we dont get started on the project now, well be back in crisis againmaybe before we even get out of this one.

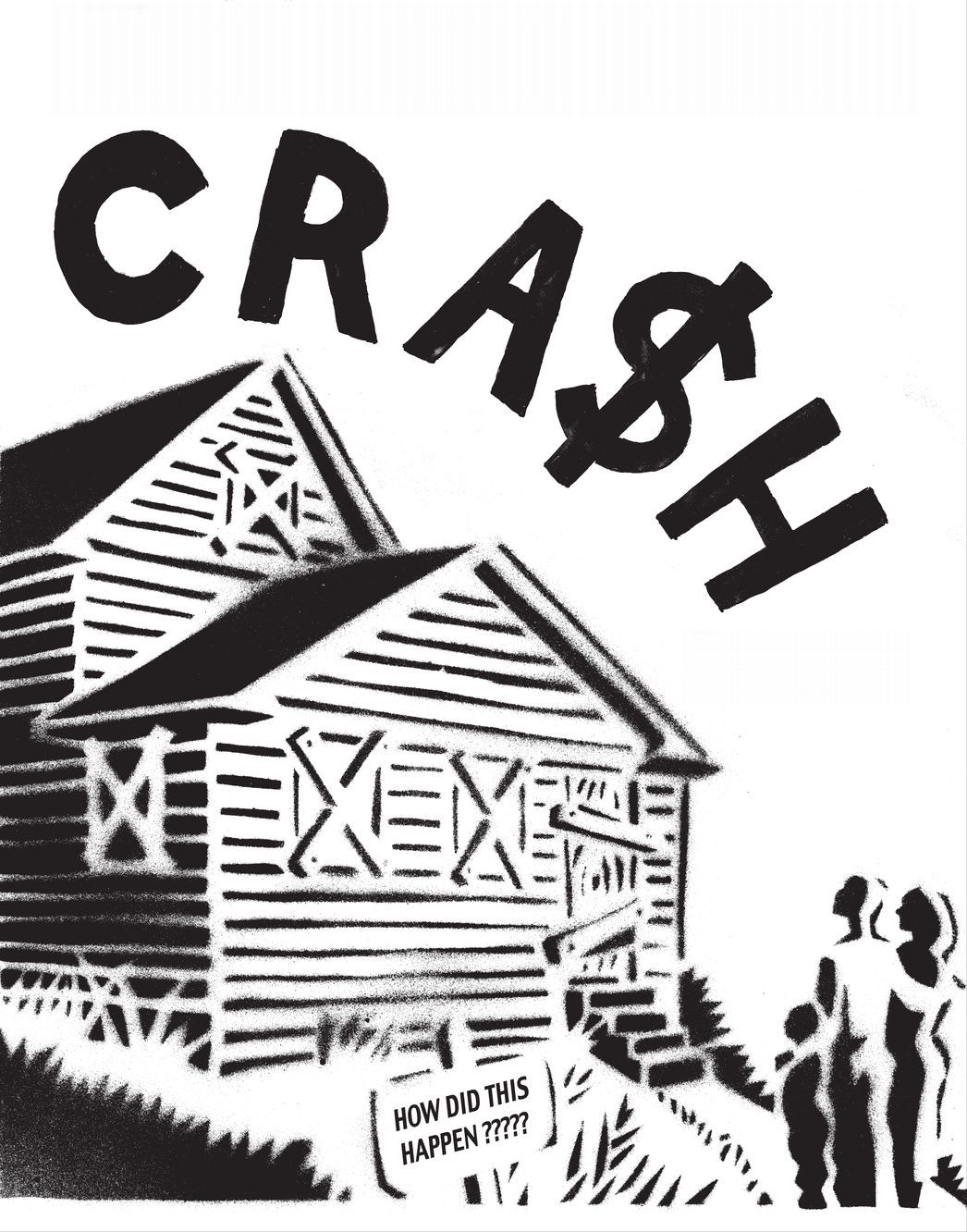

INTRODUCTION