THE DECISION BOOK

FIFTY MODELS FOR STRATEGIC THINKING

Mikael Krogerus

Roman Tschppeler

Translated by Jenny Piening

WITH ILLUSTRATIONS BY PHILIP EARNHART

CONTENTS

WHY YOU SHOULD READ THIS BOOK

This book has been written for anyone who has to deal with people on a daily basis. Whether you are a teacher, a professor, a pilot or a top manager, you will be confronted by the same questions time and again: How do I make the right decision? How can I motivate myself or my team? How can I change things? How can I work more efficiently? And on a more personal level: What do my friends reveal about me? Do I live in the here and now? What do I want?

WHAT YOU WILL FIND IN THIS BOOK

The fifty best decision-making models well-known and not so well-known that will help you tackle these questions are described in words and diagrams. Dont expect straight answers; be prepared to be tested. Expect food for thought. You will acquire the kind of knowledge with which you can impress friends and colleagues: What is a black swan? What is a long tail? What is the Pareto principle? Why do we always forget everything? How should I behave in conflict situations?

HOW TO USE THIS BOOK

This is a workbook. You can copy out the models, fill them in, cross them out, and develop and improve them. Whether you need to prepare for a presentation or carry out an annual performance review, whether a difficult decision lies ahead of you or a prolonged dispute is now behind you, whether you want to reassess your business idea or get to know yourself better this book will guide you.

WHAT IS A DECISION-MAKING MODEL?

The models in this book fulfil the following criteria:

They simplify : they do not embrace every aspect of reality, but only include those aspects that seem relevant.

They are pragmatic : they focus on what is useful.

They sum up : they are executive summaries of complex interrelations.

They are visual : through images and diagrams, they convey concepts that are difficult to explain in words.

They organise : they provide structure and create a filing system.

They are methods : they do not provide answers, they ask questions; answers emerge once you have used the models, i.e. filled them out and worked with them.

In the appendix you will find the sources of the models, as well as references to books and websites. Models for which no source is given there have been developed by the authors.

WHY DO WE NEED DECISION-MAKING MODELS?

When we encounter chaos, we seek ways to structure it, to see through it, or at least to gain an overview of it. Models help us to reduce the complexity of a situation by enabling us to suppress most of it and concentrate on what is important. Critics like to point out that models do not reflect reality. That is true, but it is wrong to claim that they compel us to think in a prescribed way. Models do not define what or how we should think; they are the result of an active thought process.

You can read this book in the American or the European way. Americans tend towards a trial-and-error approach: they do something, fail, learn from this, acquire theories and try again. If this approach suits you, start at the beginning with How to improve yourself. Europeans tend to begin by acquiring theories, then doing something. If they then fail, they analyse, improve and repeat the attempt. If this approach is more your style, begin with .

Each model is only as good as the person who uses it.

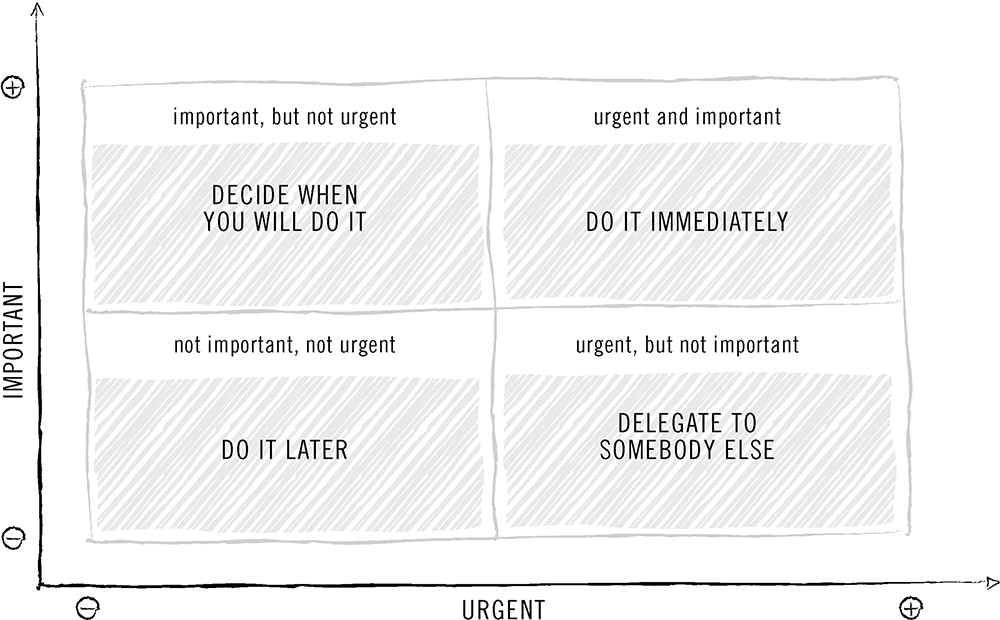

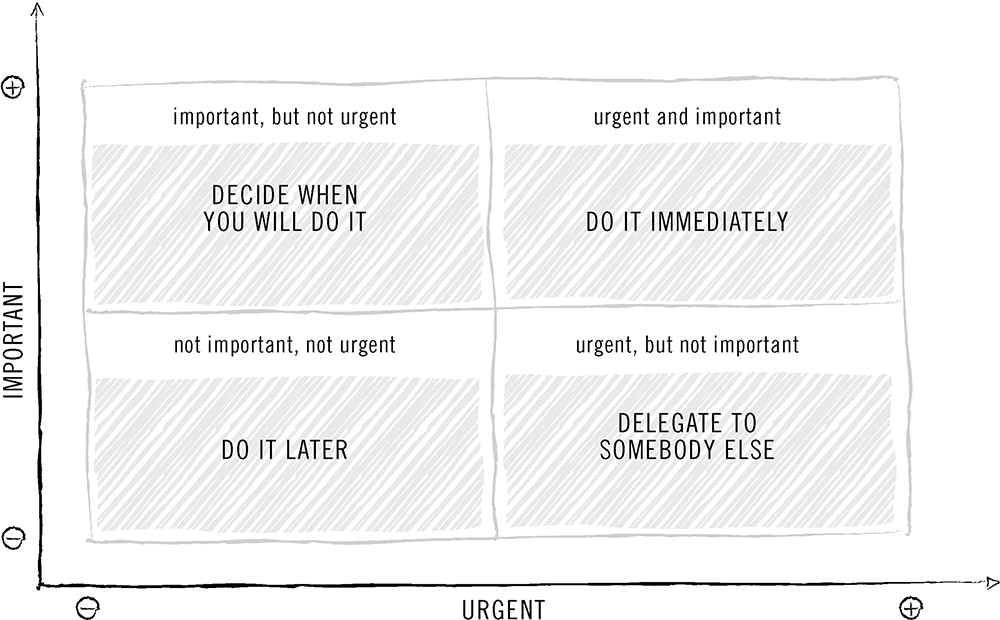

The US President Dwight D. Eisenhower supposedly once said: The most urgent decisions are rarely the most important ones. Eisenhower was considered a master of time management, i.e. he had the ability to do everything as and when it needed to be done. With the Eisenhower method, you will learn to distinguish between what is important and what is urgent.

Whatever the job that lands on your desk, begin by breaking it down according to the Eisenhower method (see model), and then decide how to proceed. We often focus too strongly on the urgent and important field, on the things that have to be dealt with immediately. Ask yourself: When will I deal with the things that are important, but not urgent? When will I take the time to deal with important tasks before they become urgent? This is the field for strategic, long-term decisions.

Another method of organising your time better is attributed to the multimillionaire Warren Buffett. Make a list of everything you want to get done today. Begin with the task at the top of the list, and continue only when you have completed it. When a task has been completed, cross it off the list.

Better late than never. But never late is better.

Fill in the tasks you currently have to deal with.

With SWOT analysis, you evaluate the Strengths, Weaknesses, Opportunities and Threats identified in a project. The technique is based on a Stanford University study from the 1960s which analysed data from Fortune 500 companies. The study found a 35 per cent discrepancy between the companies objectives and what was actually implemented. The problem was not that the employees were incompetent but that the objectives were too ambiguous. Many employees didnt even know why they were doing what they were doing. SWOT was developed from the results of the study to help those involved in a project to gain a clearer understanding of it.

It is worth taking the time to think about each step of the SWOT analysis rather than just hastily fill it out. How can we emphasise our strengths and compensate for (or cover up) our weaknesses? How can we maximise opportunities? How can we protect ourselves against threats?

What is interesting about SWOT analysis is its versatility: it can be applied to business and personal decisions with equal success.

The things we fear most in organisations fluctuations, disturbances, imbalances are the primary sources of creativity.

Margaret J. Wheatley

Think back to a big project in your life and about how you would have filled in a SWOT diagram at the time. Compare that with how you would fill it in today.

In the 1970s, the Boston Consulting Group developed a method for assessing the value of the investments in a companys portfolio. The four-field matrix distinguishes between four different types of investment:

Cash cows have a high market share but a low growth rate. This means they dont cost much but promise high returns. Consultants verdict: milk them.

Stars have a high market share and a high growth rate. But growth devours money. The hope is that the stars will turn into cash cows. Consultants verdict: invest.

Question marks , or problem children, have high growth potential but a low share of the market. With a lot of (financial) support and cajolement, they can be turned into stars. Consultants verdict: a tough decision.

Dogs are business units with a low share in a saturated market. Dogs should be held on to only if they have a value other than a financial one (e.g. a vanity project or favour for a friend). Consultants verdict: liquidate.

The most dangerous words in investing are this time its different.

Sir John Templeton

Next page