Table of Contents

ALSO BY GENEEN ROTH

Women Food and God

The Craggy Hole in My Heart and the Cat Who Fixed It

Breaking Free from Emotional Eating

When You Eat at the Refrigerator, Pull Up a Chair

Appetites

Feeding the Hungry Heart

When Food Is Love

Why Weight?

To Matt and Celeste, for always finding me

PROLOGUE

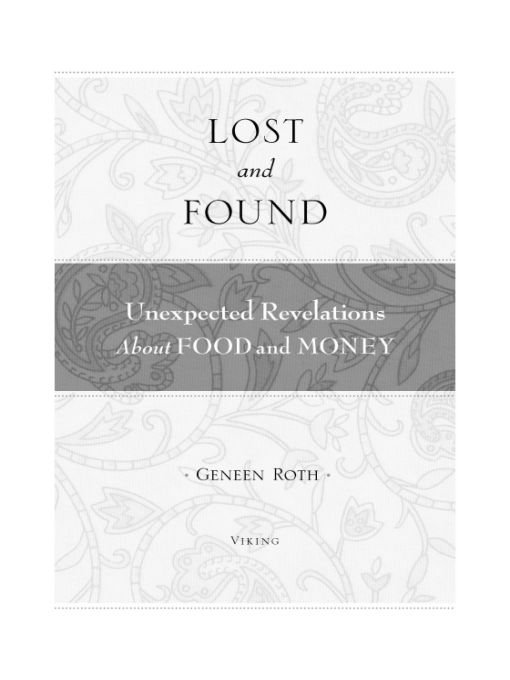

What Was Lost

I was standing in my kitchen wondering what to have for lunch when my friend Taj called.

Sit down, she said.

I thought she was going to tell me she had just gotten the haircut from hell. I laughed and said, It cant be that bad.

But it was. Before the phone call I had thirty years of retirement savings in a safe fund with a brilliant financial guru. When I put down the phone, my savings were gone and my genius financial guru, Bernie Madoff, was in handcuffs. I felt as if I had died and, for some unknown reason, was still breathing.

Since Madoffs arrest on charges of running a sixty-five-billion-dollar Ponzi scheme, Ive read many articles about how we Madoff investors should have known what was going on, how believing in Madoff was no different from believing there were WMD in Iraq. And I wish I could say I had reservations about Madoff before the Call. I wish I could say I knew better about getting such consistently good returns, but I did not. Besides, everything I knew better aboutstocks, smart financial advisers, real estatehad also proved disastrous: Our financial adviser embezzled a quarter of our money years ago, I lost another third in the stock market during the boom times, and we bought our house at the top of the market and sold at the bottom. Considering that, Madoff seemed like a respitehis fund showed occasional losses along with small, steady gains. (Im keeping a list of people who want to be notified of our next investment so they can sprint in the other direction. Feel free to add your name.)

It was always more important for me to find work that I loved than to be rich. I know this is an attitude that reflects enormous privilege, since so much of the world lives on less than a dollar a day and must concern itself with getting food. But I was (and still am) unspeakably fortunate: Ive always had clean water, sweaters to spare, more than enough to eat.

Although my parents were so poor when they married that they ran out of food money each week by Saturday night, my father worked his way up the corporate ladderand by the time I was fifteen, our main metric of worth, both in the community and with one another, was our collection of new, shiny things. Cars, shoes, popular people. But like many baby boomers, I spent my college years protesting the Vietnam War, rejecting consumerism and various other activities (like hiring a plastic surgeon to break my nose so that it could look like everyone elses) for the many iterations of finding myself: therapy, living in India, and meditation. In my late twenties, I spent a year washing dishes and being a maid at a local inn and two years as an avocado-and-cheese sandwich maker in a health-food store so that I could spend early mornings writing. After that, I started my first groups for compulsive eaters in my friends Harry and Sues house; since I was working as a nanny and living in the bedroom next to their two-year-old daughter, they gave me the use of their living room to begin what seemed like a far-fetched idea: meeting with women like me to explore our relationships to food and weight.

Was I able to reject the pursuit of shiny things because I knew that if I ran out of money or luck, my father could rescue me? I dont know because I dont know what it would have been like to grow up in any other family. What I do know is that I saw what money cost: parents who were cruel to each other; addiction to alcohol and drugs; infidelity; physical and sexual abuse; and self-loathing all around. It was impossible to know if the pursuit of more caused the wretchedness, but the connection between misery and money was scalded in my brainas well as the need to find out if there was more to being alive than being rich and sleeping with your best friends wife or husband.

During the first year I learned to meditate, my Buddhist teachers took our class to graveyards so we would viscerally understand that we would end up exactly like the people in the ground: dead, very dead. After those excursions, Id wake up every day and ask myself what I would regret not doing if I died that day, that week, that year. The answers were always the same: figure out the meaning of life (if there was one) and find out why I was here. And write, always write. Making more than enough money wasnt ever part of the mix.

Eventually, after a few years of teaching groups about compulsive eating and having my book proposal rejected by twenty-five publishers, an editor at Bobbs-Merrill accepted my first book. I spent the next ten years teaching workshops and writing more books, doing well enough financially to rent an apartment, drive a used Volvo, and buy as much chocolate as I wanted. In 1992, my fourth book sold enough copies in paperback to spend two weeks on the New York Times best-seller list, and when I received the check for this windfall$106,000it was like getting a paper bag filled with Monopoly money. I had no idea what to do with it, no way of relating to the fact that I was now one of the ones with money that I didnt like, didnt trust. Or, as James Grant, editor of Grants Interest Rate Observer, says, Insofar as there is a lesson in history, its that human beings are not good with large sums of money, anything over $136.

Up to that moment, I had had the luxury of not paying much attention to money, partly because I was making enough to pay my bills, after which Id put what was left over in a savings account, and partly because I had met and married my partner, Matt, and I relegated the money part of our lives to him. He made more money than Ienough to put a down payment on a small house in Berkeleyand I assumed that people who could afford to buy a house knew what they were doing in the financial arena. Not only did I feel money dumb, but I also felt that focusing on moneyeither on ways to make more of it or on how and where to invest itwas complicated, shallow, and spiritually bankrupt. Although I wasnt aware of this until recently, I didnt believe that it was possible to be interested in consciousness and interested in money, to care about deforestation and care about money. I believed that any kind of awakening from what my teachers called samsara, or the delusion of conditioned reality, needed to be separate from money, as if money were as deadly as the plague and even thinking about it would lead me to being one of the bad guys. So I kept making choices based on my unconscious beliefs, and since those beliefs lumped being an aspirant of the contemplative life with remaining ignorant about money, I chose ignorance again and again. Since I couldnt admit that I was making money and was, therefore, like all the moneyed people who I was convinced had no integrity, I just stopped thinking about it. And I stopped taking any responsibility for having it or deciding what to do about it.