Noel Whittaker - Making money made simple

Here you can read online Noel Whittaker - Making money made simple full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2019, publisher: Noel Whittaker Holdings Pty Ltd, genre: Religion. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Making money made simple

- Author:

- Publisher:Noel Whittaker Holdings Pty Ltd

- Genre:

- Year:2019

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

Making money made simple: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Making money made simple" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Making money made simple — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Making money made simple" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

In a country like Australia where there are social security benefits to cover unemployment, sickness and old age, people show a lack of urgency preparing for these events. It is far easier to live for the moment and say, Why go to all the bother of saving and learning about investments? Ive paid taxes all my life when I get old Ill sit back, get the pension, and let the government take care of me.

If that is what you think, you could be in for a big shock. Things may look rosy now, but our society is constantly changing. If you stop for a moment and look at the way things are going you may not feel so confident. Here is a short history.

In 1945 World War II ended, and people started to have families at an ever-increasing rate. This rapid birth rate continued until around 1964 when the pill became the norm, and birth control was much easier. As these baby boomers grew up they created a housing boom, which drove unprecedented expansion in real estate, shopping centres and infrastructure.

Its different now. The baby boomers are ageing and leaving the workforce, while birth rates in most developed nations are low and falling. Now there are more and more older people expecting and needing financial help from the government, but fewer people in the workforce to pay the taxes that fund those payments.

According to the Australian Bureau of Statistics (ABS), by 2057, there will be more than 8.8 million people aged 65 and over. Thats forecast to be 22% of Australias total population of 40.1 million. In 2017, it was just 15%.

In 2008 Lehman Brothers collapsed and the global economy found itself in unprecedented turmoil. Property values and stock markets around the world collapsed, and many people lost a big chunk of their life savings.

To stimulate their economies, central banks slashed interest rates in some countries rates even dipped below zero! It was particularly difficult for retirees, whose investments dramatically reduced in value, while at the same time the interest they could earn on savings dropped below 1%.

Pension funds now found themselves in trouble: they had based their forward projections on most people dying before they turned 80, and forecast returns on their funds assets of around 7% a year. But suddenly members were living much longer than had been expected, and during the global financial crisis (GFC), returns were way less than forecast. It was the perfect storm.

That was not the end of it. Governments everywhere had borrowed vast sums of money to stimulate their economies, and in the third quarter of 2017 global debt hit an all-time high of $233 trillion, according to the Institute of International Finance (IIF). The consequence of all that borrowing is most countries now have massive interest bills, which make it impossible to balance their budgets.

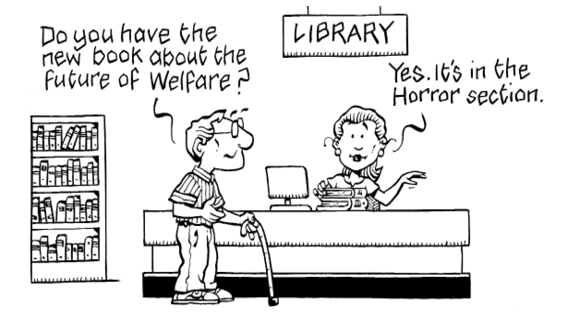

Yet everywhere, people are blissfully going about their business without giving a thought to a future where an increasing number of people over 65 are expecting their governments to provide welfare for them for 30 years or more. It is just not possible.

The age pension was introduced in Australia in 1908 for people aged 65 and over. It was a safe bet for the government of the day, given that average life expectancies then were around 50. Since that date there has been a never-ending stream of changes to the pension system, all in one direction reducing eligibility. In 2009 it was announced that pensionable age was being increased over time; by the year 2024 it will be 67 for everybody.

In January 2017 the assets test was tightened considerably, and the Pension Loans Scheme was revamped (taking effect from 1 July 2019) so that home-owner age pensioners and self-funded retirees can borrow money from the government at 5.25% via a government reverse mortgage scheme. This means the retiree makes no repayments of principal or interest, and the loan is paid back when the property is sold. In my view, this is the first step towards treating the age pension in a similar manner to a students HECS debt.

When the age pension was first brought in, it was regarded as a right, but now all parties regard it as welfare. Currently, a couple could have financial assets worth $800,000 plus a home and still qualify for a part-pension it is my bet that at some time in the not-too-distant future the question will be asked: Why should a person with nearly $1 million in assets be eligible for welfare?

Will there be a pension for you? Who knows? What we can say is, based on what has happened to date, it probably wont be much.

The choice is yours make the effort to become financially independent or put yourself at risk of being a victim of ever-increasing cuts to welfare.

Your motivation for your goals plays a significant part in your success. You need a clear understanding of where you are now, and an equally clear understanding of where you want to be. The difference between them sets up a tension that draws you towards the desired state. Keep your focus on where you are going. |

First published in Australia in 1987.

This edition published in 2019 by Noel Whittaker Holdings Pty Ltd

Font size:

Interval:

Bookmark:

Similar books «Making money made simple»

Look at similar books to Making money made simple. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Making money made simple and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.