Dedication

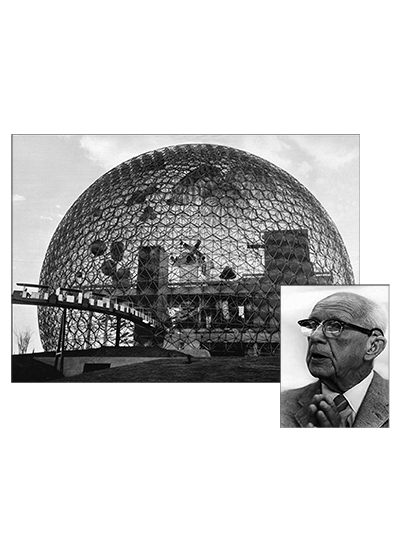

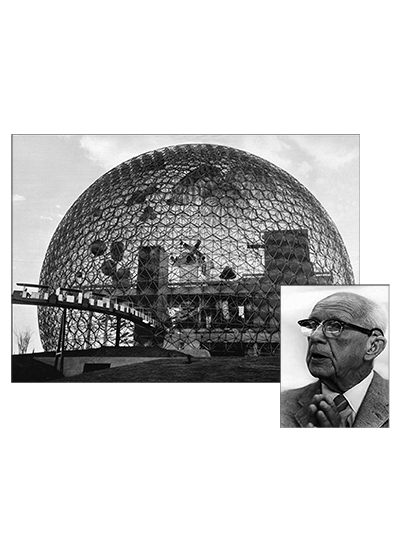

This book is dedicated to Dr. Richard Buckminster Fuller, 1895-1983.

Dr. Fuller is a man who is almost impossible to describe or put into a category. He is referred to as a futurist, an inventor, a teacher, a philosopher, and an architect. Twice he was admitted to Harvard University and twice he was asked to leave.

He has numerous doctorate degrees, U.S. patents, awards and honors, including the Gold Medal from the American Institute of Architects and the Presidential Medal of Freedom from President Ronald Reagan.

Bucky Fuller is most recognized for his work on the Geodesic Dome, a structure used today all around the world. Disney Worlds Epcot Center features one of Fullers domes. He has been called the first futurist, a man who turned predicting the future into a science. Many of his predictions have come true, and many are coming true today.

Most loved for his humanity, Dr. Fuller is often called "The Planets Friendly Genius" and "Grandfather of the Future." In 1982 John Denver wrote and recorded the song What One Man Can Do , a dedication to Dr. Fuller.

Pictured above is Fullers geodesic dome, the U.S. Pavilion at the 1967 Worlds FairExpo 67in Montreal, Canada.

This book, Second Chance , begins with my trip to Expo 67. I hitchhiked from New York to Montreal to see Fullers dome and to see the future.

In Appreciation

A heartfelt thank you to Mike Sullivan, CEO of The Rich Dad Company, and Shane Caniglia, President of The Rich Dad Company, for cleaning up the past and taking Rich Dad into the future.

And for giving The Rich Dad Company its Second Chance.

A special thank you to the team at Rich Dad for supporting Mike and Shane through times that tested our souls.

The Rich Dad Team

Kathy Grady2000

Mona Gambetta2001

Bob Turner2002

Christina Ingemansdotter2004

Greg Arthur2006

Mike Allen2007

Brett Bottesch2008

Ryan Nalepinski2008

Mike Sullivan2009

Shane Caniglia2009

Robert Boorman2009

Robb LeCount2009

Brad Kendall2009

David Leong2009

Rhonda Hitchcock2009

Idalia Fuentes2010

Darrin Moore2010

Jack Koch2011

Zeke Contreras2011

David Adams2012

Derek Harju2012

Matthew Stein2012

Tony Femino2012

Melissa Marler2012

Josh Nesa2014

Matt Quirk2014

Authors Notes

Although this book references government and politics, it does not have a political agenda. The author is not a Republican or a Democrat. If anything, he is an Independent.

This book mentions god and spirit. This is not a religious book. It has no religious agenda. The author believes in the freedom of religion, the freedom to believeor not believein god.

"We are called to be architects of the future, not its victims. R. Buckminster Fuller

Introduction

Once Upon a Time America was the richest creditor nation in the world.

Once Upon a Time The U.S. dollar was backed by gold.

Once Upon a Time Printing money was a crime known as counterfeiting .

Once Upon a Time A person went to school, got a job, retired young, and lived happily ever after.

Once Upon a Time All you had to do was buy a house, and when your house went up in value you were rich.

Once Upon a Time All you had to do was invest in the stock market, and when the stock market went up you were rich.

Once Upon a Time A college degree meant higher pay.

Once Upon a Time Age was an asset.

Once Upon a Time A retired person could count on Social Security and Medicare to take care of them.

Unfortunately, Once Upon a Time is over . The fairy tale has ended. The world has changed and continues to change.

Q: So what does a person do now?

A: Thats what this book is about. This book is about a second chance for you, your money, and your life.

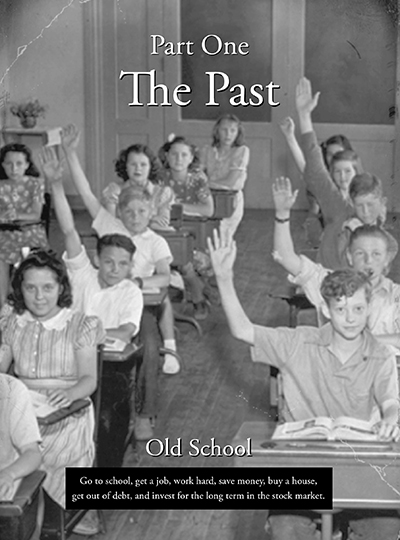

This book has three parts: the Past, the Present, and the Future.

The Past examines the real causes of the financial crisis were facing.

The Present analyzes where you are today.

The Future explores your second chance for your money and your life and how you can use the opportunities that are found in crisis and adversity to create the life you want.

The most important word today is crisis. Remember that there are two parts, two sides, to the word crisis: danger and opportunity .

Your second chance requires that you avoid the dangers that lie ahead and be prepared for the opportunities that exist in a growing , global financial crisis .

Part One: The Past

Introduction

I was in a Starbucks the other day and ran into a friend I had not seen in years. Although happy to see him, I was surprised to find him working behind the counter.

How long have you worked here? I asked.

About five months, he replied as he took my order.

What happened? I asked.

Well, after the market crashed in 2007, I lost my job. I found another one, but that job soon disappeared, too. Finally, after burning through our retirement and savings, we lost our house. We just couldnt hang on. He continued: Dont worry. Weve been working. Were not unemployed. We both have jobs, but were not making much money. So I work here, at Starbucks, to make a few bucks. Get it, I work for bucks at Starbucks? He said, laughing out loud.

Stepping aside so the customers behind me could place their orders, I asked, So what are you doing for your future?

Im back in school. Im getting another Masters degree. Its kind of fun being in school again. I even take a few classes with my son. Hes earning his first Masters degree.

Paid for with student loans? I asked.

Yeah. What else can we do? I know theyre terrible loans. I know Ill be working for the rest of my life, just to pay off my loan. My son has more time to pay off his. But we all need more education if we want high-paying jobs. We have to make money. We need to earn a living. So were in school.

I paid for my coffee and was handed a steaming cup. When I offered him a tip, he refused and I know why he refused. So I wished him luck, and walked out the door.

Part One of this book is about the past. More specifically, how we got into this global financial crisis.

As George Orwell wrote in his book 1984,

In a time of universal deceit, telling the truth is a revolutionary act.

Chapter One

Why The Rich Don't Work For Money

"They're playing games with money Our wealth is stolen via the money we work for." R. Buckminster Fuller

Rich Dad Poor Dad was self-published in 1997. It had to be a self-published book because every major publisher we pitched it to turned it down. A few publishers commented, "You don't know what you are talking about."

Some of the points they objected to were my rich dad's statements such as:

- Your house is not an asset.

- Savers are losers.

- The rich don't work for money.

Ten years later, in 2007, the subprime mortgage crisis hit and millions of homeowners found outfirst handthat their house is not an asset.

In 2008, the U.S. government and Federal Reserve Bank began printing trillions of dollars, causing millions of savers to be losers via the loss of purchasing power due to inflation, higher taxes, and low interest rates on their savings.

Next page