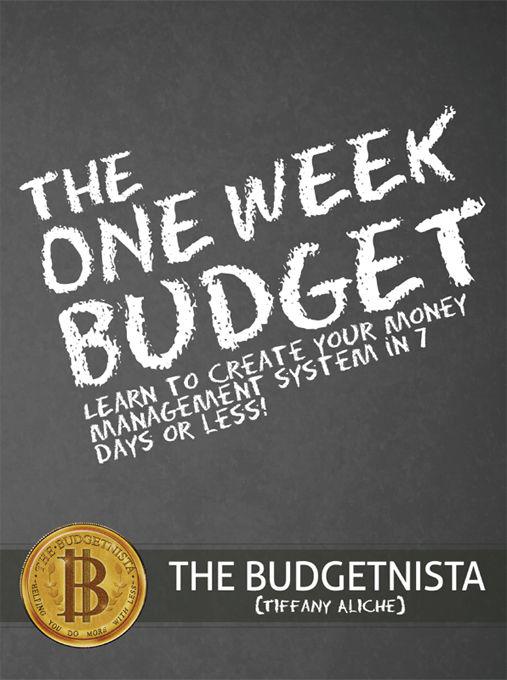

Praise for The One Week Budget

Sensible, professional, sophisticated, intelligent. These are just a few words to describe Tiffany. I call her the Suzie Orman of our generation! Her daily money tips are not only helpful, but extremely educational. I learn something new everyday! I would absolutely recommend her if you are serious about getting your finances in line.

Jacqueline Nwobu

Publisher/Editor-in-Chief, Munaluchi Bridal Magazine

Tiffany was the first person who gave me real advice on how I should manage my finances. As a friend, she decided to share her opinion about why I should save. I never took this seriously until she brought it to my attention. Rarely do you meet friends who decide to look out for YOUR best interest. Her easy advice of saving 20% of your income made all the difference in my life. Real planning and self control has now given me the ability to buy my first house at age 27. I believe finance is equally as important as your health, and Tiffany made me realize this firsthand. I cant thank her enough

Chris Anokute

Senior Vice President, A/R Universal Motown Records

After making financial sacrifices to start my dream non-profit, The One Week Budget showed me how to transform pennies into dollars by making simple fiscally conscious decisions. The Budgetnista wont tell you how to make millions, shell show you how to save the millions you already haveand her charismatic writing style will keep you laughing all the way to the bank!

Diesa E. Seidel

Founding Director, United Initiatives for Peace

First and foremost: This book should be on EVERYONEs bookshelf! This should be the FIRST book anyone that wants to find his or her way to financial freedom reads. The budget process is mapped out in a way where everyone from the stay-at-home mom - to the young professional just starting out in corporate America - to the sophisticated investor can use. The simple steps put the system in place, and will help the reader reach their long and short-term financial goals and objectives. Soon to be on multiple Best-Seller lists and well worth the one week!

Chike Uzoka

Founder, Valentine Global, LLC

THE ONE WEEK BUDGET. Copyright 2010

eBook ISBN: 978-1-61916-834-3

C.L.D. Financial Life Publishing

The Budgetnista and its logo, a $B are trademarks of Tiffany Aliche

No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanically, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. For more information, contact Tiffany Aliche at thebudgetnista@gmail.com.

Disclaimer:

This book is designed to provide accurate and reliable information on the subject of personal finance. While all the stories and antidotes are based on true experiences, most of the names have been changed. Some situations have been altered for educational purposes and to protect each individuals privacy. This book is sold with the understanding that neither the author nor the publisher is engaged in representation of legal, accounting or other professional services by publishing this book. As each individual situation is unique, questions relevant to personal finance and specific to the individual should be addressed to an appropriate professional. Doing so ensures that the particular situation has been evaluated professionally, carefully and properly. The author and publisher specifically disclaim any liability, loss, or risk that is incurred as an outcome, directly or indirectly, through the use and application of any contents of this work.

Visit the website:

www.thebudgetnista.biz

To anyone that has ever asked me,

Tiffany, when is the book coming out?

I finally have the answer.

Thank you for your love, support and suggestions.

God makes all things possible.

To my parents, Irondi and Sylvia Aliche

You are the inspiration behind all that I strive for.

Thank you for setting the bar so high.

And to the Aliche Girls, Sistars are doing it!

10% of each book sold will be donated to a local charity.

INTRODUCTION

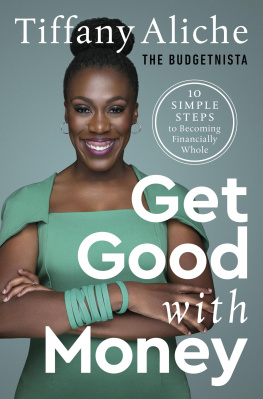

First, I want to say congratulations for trying to change your current financial situation. Even if you are here by force, the fact is that you are here! In any new undertaking, education is the most important aspect of attaining success. By beginning to educate yourself, you have taken the first step towards financial empowerment. It doesnt hurt that you chose me, The Budgetnista (humor me), to get you started. As you are well aware, there are thousands of books on real estate, stocks, mutual funds, entrepreneurship, and various other money-making pursuits. Like many of you, my thirst to learn more about money drove me to read many of these books. Admittedly, I read most of them for free at the bookstore. But dont follow my lead, go out and buy mine! Most of those books assume that you already have a money management system in place and lets be honest, you dont.

This is where I come into the picture. I want you to consider this book as the prerequisite to all other financial books. This book will teach you step by step, how to manage your day-to-day finances, and all in one week! The ability to properly manage your own money is the first step in a long journey toward making your financial dreams a reality. I wrote this book because this is the book I wish I had read when I was beginning my own financial journey. I can distinctly remember (cue dream sequence music).

I had recently graduated college, acquired my first real job and just moved out of my parents home. Whooo hooo! It was the first time in my life that I had complete financial responsibility for myself. I was scared, really scared. Although I was not frivolous with my money (does a $5 dollar a week candy habit count?), I knew there had to be a better way to manage it. Until that point, the only knowledge I had about money was what I learned from my parents and by making my own mistakes along the way.

Despite my fear, I recognized how blessed I was: I was young, gorgeous (unrelatedI know) and I had no debt, sans a small student loan. I also grew up in a household where money management was openly discussed during family meetings (yeah). I was raised in the North East, one of the most expensive regions of the United States, yet my sisters and I lacked for nothing; (well I never did get that pony, but Im so over it now). My parents emigrated here from Nigeria and were far from rich. With hard work, they were successfully able to raise, provide for, and college educate themselves and five daughters. Through all of that, they still managed to lend assistance to family and friends in their native country.

My father, an accountant by trade turned Executive Director of a New Jersey based nonprofit, has his Masters in Business Administration (MBA) in Finance. He taught my sisters and I about money on a daily basis, i.e. breaking down the cost of each toilet flush and warning us not to waste our flushes (true story)! We were held accountable for our financial choices like withdrawals made from our accounts, purchases, and any irresponsible credit card usage. My mother, on the other hand, taught me the practical side of money. From her, I learned about negotiating store discounts, buying in bulk and eliminating unnecessary spending. She was truly a master haggler. I always felt sorry for the mere mortal sales people that dare challenge her. My parents always spoke openly and honestly about the state of our familys finances, whether good or bad. Through them I learned valuable lessons about money, life and the obligation of service. They truly lived the mantra: To whom much is given, much is required.