Contents

Landmarks

Print Page List

ACKNOWLEDGMENTS

First and foremost, I want to thank God. There is so much Ive been blessed with that its beyond comprehension. I pray to always be a good steward of my gifts and talents.

Thank you to my parents, Irondi and Sylvia Aliche. You held me to a standard of excellence that has set the tone for the way I navigate life. To my sisters: Karen, Tracy, Carol, and Lisa. You are my cheerleaders, my best friends, and my sounding boards. Even though you said Im smiling too big on the front cover of this book, I still love yall.

To my husband, Jerrell, aka Superman. You always create a safe space for me to fly and fall. I dont have the words to express how grateful I am for you.

To my amazing, generous, and knowledgeable contributors: Kara Stevens, Ash Cash Exantus, Netiva Heard, Sandy Smith, Kevin L. Matthews II, Courtney Richardson, Anjali Jariwala, and Toni Moore. This book could not have come to life without you.

Heather Jackson, my agent, thank you for believing in my ability to do a book like this before I did and for having my back.

Gretchen Lees, thank you so much for helping me transform my thoughts and words into a book I can be proud of. You helped to make this hard process fun and enjoyable.

Thank you to Marnie Cochran, my editor, for fighting for me and this project and for convincing me to be on the cover. And thank you to my Penguin Random House family. I had no idea how involved writing a book like this is and I cant thank you enough for making the process seamless.

Thank you to my book cover crew. Tinnetta, you create art with your camera. Lila Neema, Tracy and Lisa Aliche, thank you for helping me look and feel confident, powerful, and beautiful.

To my team, the Unicorn Squad. All of this is only possible as a result of the magic you bring to the table every single day. I love yall and thank you.

And finally, I want to express a special thanks to my Dream Catcher familythe community of more than one million women that has granted me the privilege and pleasure of helping you on your financial journey. You gave me more than I ever gave you. Im a better teacher, friend, and person because of you.

ABOUT THE AUTHOR

Tiffany Aliche, aka The Budgetnista, is an award-winning financial educator who has transformed the lives of over one million women worldwide. She regularly appears as a financial expert on The Real daytime talk show and cohosts a top-ranked financial podcast Brown Ambition. Tiffany also cofounded an online school, the Live Richer Academy, which teaches women worldwide how to take their finances to the next level and achieve their personal goals.

In 2019, Tiffany partnered with New Jersey Assemblywoman Angela V. McKnight to write a bill that was later signed into law (A1414, The Budgetnista Law), which mandated financial education to be integrated into all middle schools in New Jersey.

Tiffany has been featured in The Wall Street Journal, The New York Times, Fast Company, Reader's Digest, USA Today, Cosmopolitan, InStyle, Forbes, Redbook, Black Enterprise, and U.S. News & World Report, and has been on Today, Good Morning America, CNN, OWN, and CBS. Tiffany currently lives in New Jersey with her husband and stepdaughter.

www.thebudgetnista.com

Facebook: @thebudgetnista

Instagram: @thebudgetnista

Twitter: @thebudgetnista

Appendix

Selected Resources

Get the most updated version of these resources and additional site links via your complimentary Get Good with Money Tool Kit, at www.getgoodwithmoney.com.

Chapter 1: Before We Begin: Get to Know Financial Wholeness

Budgetnista Boosters

Kara Stevens, CEO and founder of The Frugal Feminista: www.thefrugalfeminista.com

Ash Cash Exantus, wealth coach and chief financial educator at MindRight Money Management: www.IamAshCash.com

Chapter 2: 10% Whole: Budget Building

Chapter 4: 30% Whole: Dig Out of Debt

Chapter 5: 40% Whole: Score High (Credit)

Budgetnista Booster

Netiva Heard, aka the Frugal Creditnista, founder of MNH Financial Services, financial educator, certified credit counselor, and licensed real estate broker: www.thefrugalcreditnista.com

Credit Bureau List (the top three and their websites)

Experian: experian.com

TransUnion: transunion.com

Equifax: equifax.com

Chapter 6: 50% Whole: Learn to Earn (Increase Your Income)

Budgetnista Booster

Sandy Smith, personal finance expert and small business strategist: www.iamsandysmith.com

Chapter 7: 60% Whole: Invest Like an Insider (Retirement and Wealth)

Budgetnista Boosters

INVESTING-RETIREMENT:

Kevin L. Matthews II, founder of Building Bread, financial planner and author: www.buildingbread.com

INVESTING-WEALTH BUILDING:

Courtney Richardson, founder of The Ivy Investor, attorney, former stockbroker, and investment advisor: www.theivyinvestor.com

Chapter 8: 70% Whole: Get Good with Insurance

Budgetnista Booster

Anjali Jariwala, founder of FIT Advisors, certified public accountant (CPA), and certified financial planner (CFP): www.FITadvisors.com

Chapter 9: 80% Whole: Grow Richish (Increase Your Net Worth)

Chapter 10: 90% Whole: Pick Your Money Team (Financial Professionals)

My So-Called Financial Life Template

Use this template to create your own and share it with potential certified financial planners before interviewing them.

WHAT IM LOOKING FOR:

Example: I want to use my money to match my values and to fund a great life. Id like to pay (hourly or annually) for advice on how to best do so. I want help creating a retirement plan and a plan to pay for college and to support my special needs child when Im no longer here.

CURRENT (FINANCIAL) SITUATION:

Age, marital status, children

Employment

Homeownership? Renting?

Cars? Whats owed?

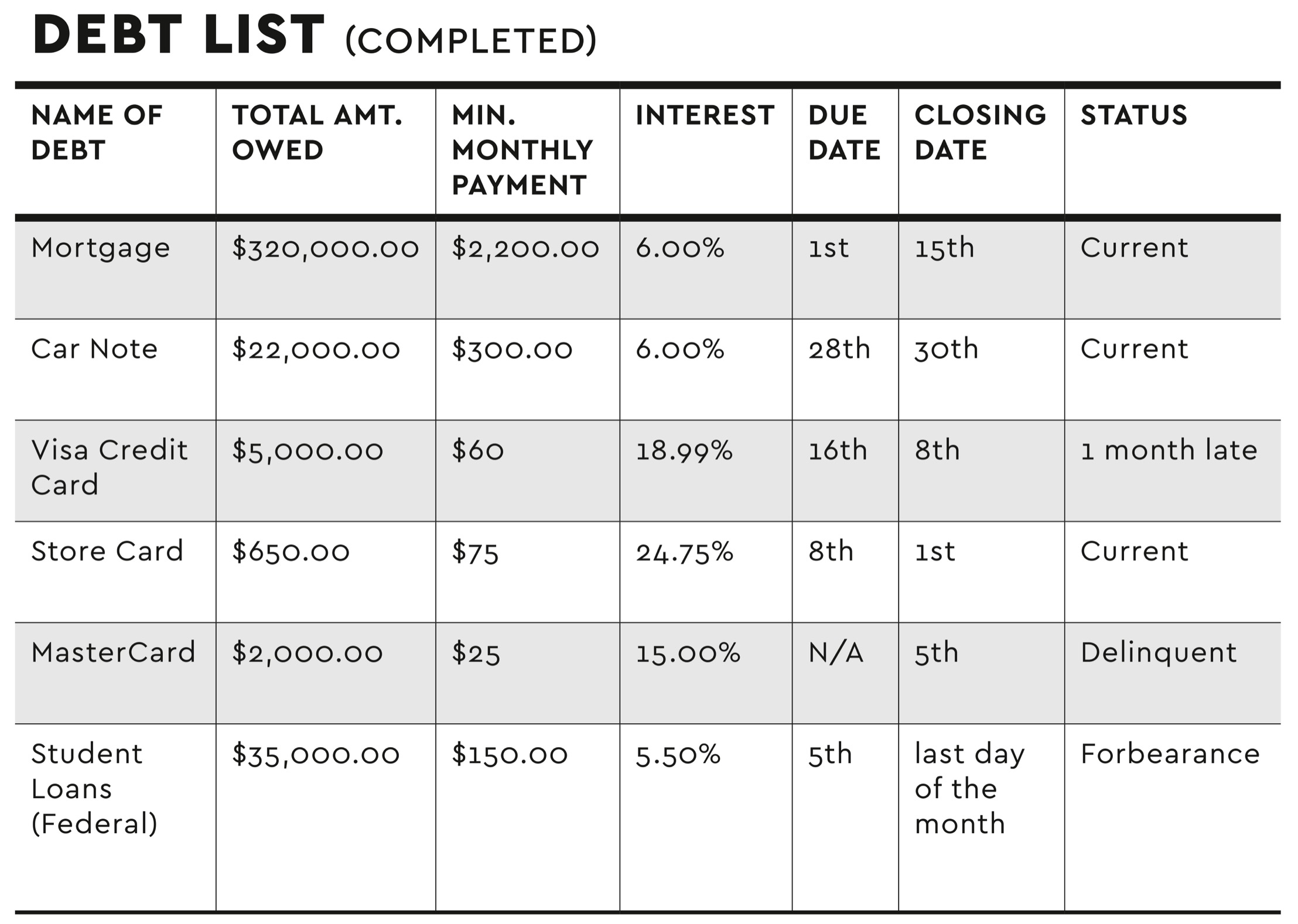

Debt: Student loans, credit cards. Balances? Current status? Current? Behind?

Credit scores:

Retirement accounts: A pension? IRA? 401(k)? Roth? How much? Are there any loans withdrawn? What companies manage them?

Individual stocks? How much do you have invested? What platform are you using?

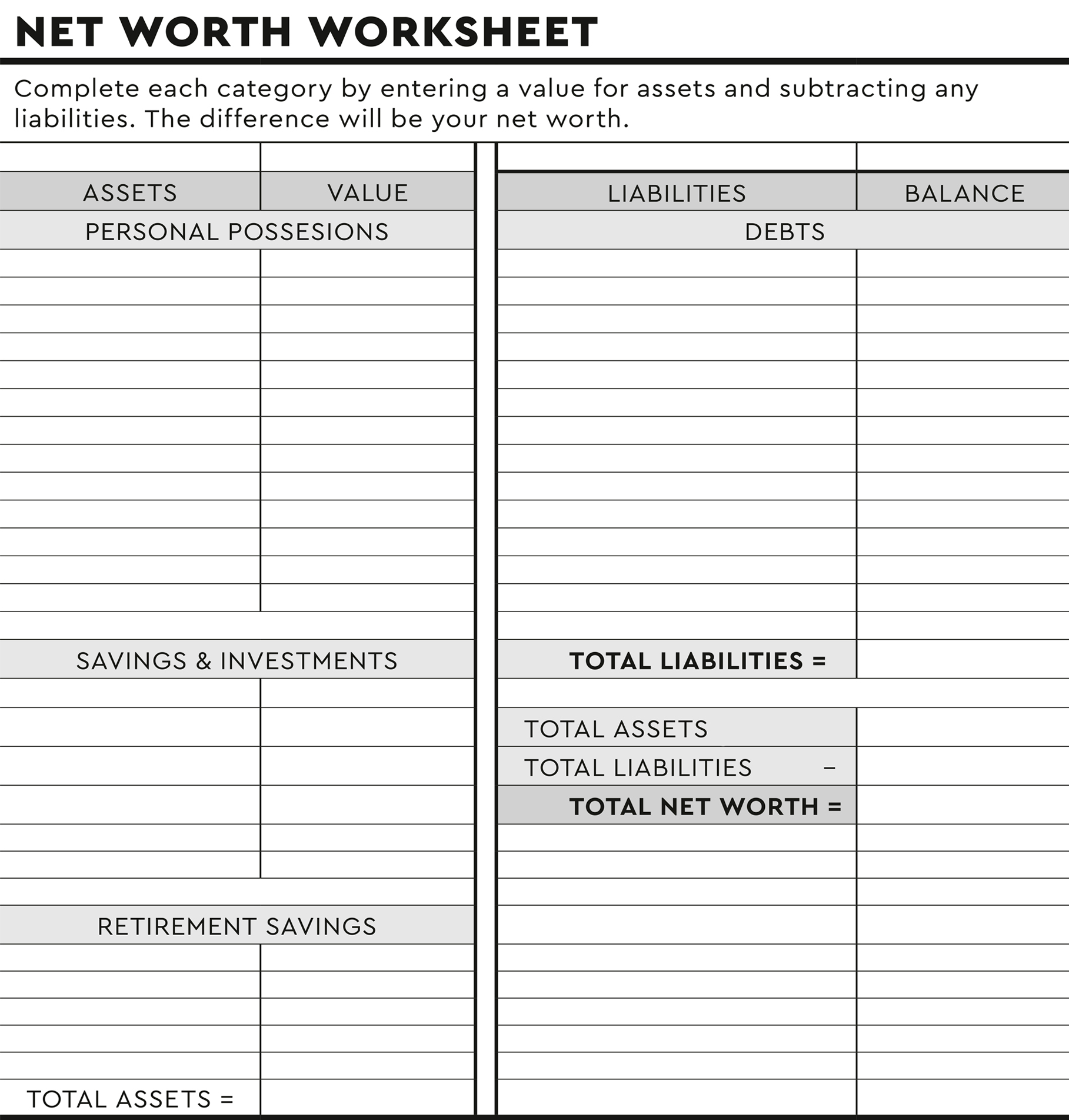

Other investments: Real estate? Other investment accounts? Value?

Insurance: Do you have disability, pet, renters, life, health, term, whole life, etc.? How much? With which companies? Does your job offer health/disability/life insurance? How much? Does your spouse or child have insurance? How much?

What is your and your familys cost to maintain a month?

How much was your adjusted gross household income for last year? (check tax return)

I currently have [insert amount] in savings.