USA | Canada | UK | Ireland | Australia | New Zealand | India | South Africa | China

First published by Portfolio / Penguin, a member of Penguin Group (USA) LLC, 2015

Penguin supports copyright. Copyright fuels creativity, encourages diverse voices, promotes free speech, and creates a vibrant culture. Thank you for buying an authorized edition of this book and for complying with copyright laws by not reproducing, scanning, or distributing any part of it in any form without permission. You are supporting writers and allowing Penguin to continue to publish books for every reader.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional services. If you require legal advice or other expert assistance, you should seek the services of a competent professional.

INTRODUCTION

NOT long ago I was e-mailing back and forth with Dan Heath. Hes a writerand a successful one at that. Together with his brother Chip, he has a few New York Times bestsellers under his beltso he asked me what I was working on. I told him about two ideas I had been thinking about for books, and then, almost as an afterthought, I mentioned something Id had in the back of my mind for ten years. It was a book I was thinking about writing someday called The One-Page Financial Plan.

Id buy that, he replied almost immediately.

Surprised by his response, I asked him to tell me more. I was curious since Id only told him the title. What exactly did he think hed be buying? Why the sudden interest?

Creating a financial plan just seems so overwhelming, he responded. Im going to have to meet with a lawyer and a financial planner and decide what my goals are for the rest of my life, and then face the overwhelming and depressing truth about planning for retirement (it seems you need to have $7.8 million saved by age sixty-five or else get ready to eat dog food), and then pick among a thousand mutual funds, but then there is the 401(k) plan at work with these Latin American government bond funds and such, and so the only rational response is not to create a financial plan.

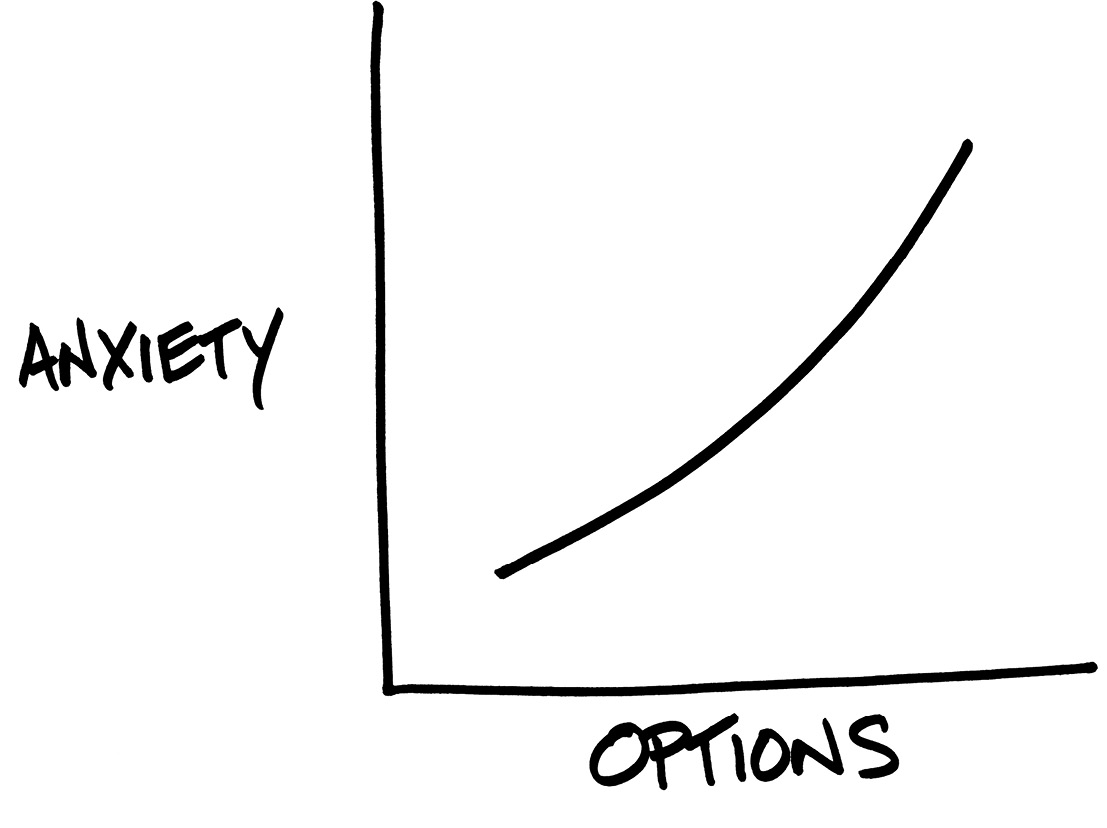

It doesnt surprise me that he would respond this way, given how inundated we are with countless choices. Even a trip to the grocery store can lead to our feeling overwhelmed and exhausted. I have a friend in New York who lives a few blocks from a fancy mayonnaise store. How many kinds of mayonnaise do we really need? (My friend admits that shes tried numerous flavors, and theyre all delicious.)

Of course, things get really frustrating when the stakes are higher than what were going to put on our BLTs. Take my recent experience with my dog, Zeke. He was having some stomach problems (Ill spare you the details of how I knew), and it was clear we needed to take him to the vet to get him checked out. Im probably a lot like you: busy. When Zeke got sick, my family was getting ready to leave on vacation, work was piling up, and the kids needed to be shipped back and forth between a bunch of activities.

But luckily the vet is located literally two hundred yards from my office. When I dropped him off, I told the vet I had a ton of errands to run. Why dont I come back in a few hours once youve had plenty of time to fully check him out?

When I returned, the vet informed me that they had time to do a full diagnosis and theyd run all kinds of tests.

Then she said, You have three options.

That was the moment everything fell apart.

As soon as she said three options, I felt myself start to panic. In fact, I felt like my head was about to explode.

As I tried to collect myself, she started to walk me through option one. About halfway through her description of the treatment, I couldnt take it anymore. I held my hands up in the air, looked her in the eyes, and said, Stop. Just tell me: If Zeke were your dog, what would you do?

She went back to walking me through the options. I stopped her again. She did it again: more options.

Finally, I put my finger to my lips and I actually shushed her. Then I said, very slowly, No. Really. I mean it. Stop giving me options Im not qualified to evaluate. Please. Im begging you.... Just tell me what to do.

Most financial books and magazines and Web sites are like that vet: they give readers a long list of options that just add to their confusion. No wonder my friend had given up on coming up with a financial plan: he didnt even know where to start.

And hes not the only one. Whether Im eating dinner with friends or telling someone what I do, the conversation inevitably turns to how hopeless they feel about their retirement or investment plans. More than once, people have asked me the same thing I asked the vet: Just tell me what to do.

These people are smart. Theyre great at what they do. Many are total stars in their fieldsexperts in business, science, and the artsand yet, when it comes to their own finances, theyre stuck. Theyre often paralyzed by the fear of making the wrong decision.

It doesnt surprise me that my most successful friends are confused when it comes to savings and retirement. When they do something, they want to do it right. They dont just want good advice, they want the best advice. Theyve often got a shelfful of books about investing or finance, but they simply dont have the time to really dive inso, rather than do the wrong thing, they do nothing.

Of course, its not just fear of making a mistake that holds us back from taking actionits also the mistakes weve already made that we dont want to own up to. Often, just the idea of having to open our bank statements can be stressful so we let them pile up, hoping that something will happen to change our situation. Of course, what actually needs to change is our own behaviorbut thats easier said than done.

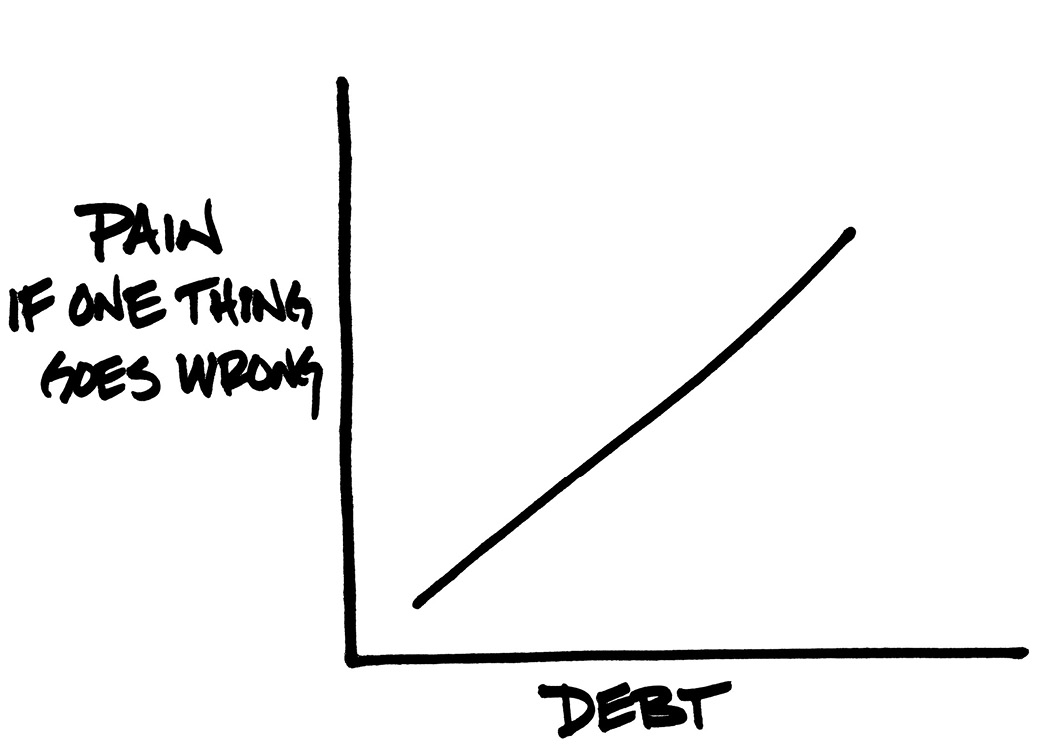

There are many stories these days of people who lost their financial bearings during the housing boom and the crisis that followedbut when I lost my own house in 2010, it was a little bit different.

Im a financial advisor. I get paid to help people make smart financial choices. I should have known that we couldnt afford a house that cost almost twice what wed originally set out to spend. I should have known that there was something wrong with being able to borrow 100 percent of the purchase price. I should have listened to my gut when it told me, Somethings wrong.

Im a financial advisor, and yet I never sat down to figure out what it would take to make this work. I just wanted to believe our real estate agent, despite the fact that he was making money on the deal. And it was so easy to believe he had been right, at least at first. We loved our new house. The children went to an awesome public school, and we made some great friends. I could ride my bike to Red Rocks, the wilderness area outside of town. And for a time, the real estate market erased any doubt I may have had.