To my mother, Marie, and late grandmother, Kathleen Grace.

Thank you for making me every bit of the woman

I humbly am today.

To my daughter, Reagan.

Being your mommy is the absolute greatest joy of my life.

I hope I live and leave a legacy that will inspire you always.

To the thousands of women who have trusted

me to counsel, coach, and mentor them.

Your resilience inspires me daily.

PCW

CONTENTS

Guide

THIS IS BIGGER THAN YOU

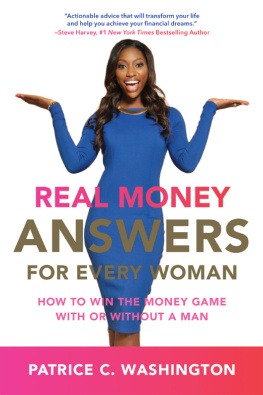

I must have appeared confident and in control as I took the stage at the kickoff of the Act Like a Success tour to face the largest audience Id ever addressed. Hair and makeup flawless, I looked pulled together and self-assured, but my knees felt like they could buckle at any moment. More than six thousand men and women who wanted to do more with their lives, people who wanted to have more purpose, more fulfillment, and more material success, sat at attention.

Ive done a lot of speaking over the last several years, but this moment was surreal. I was the opening act to the man who had once been my boss when I was just a college intern. I shared my story and some specific strategies, and as I left the stage, applause lingered behind me. I was enjoying the satisfaction of knowing Id touched people, inspired them to believe in their potential, and given them tools to take ownership of their financial well-being, when I ran into the man theyd all come to see. Id just opened for the founder of the Neighborhood Awards, nationally syndicated radio host, television personality, and media mogul Steve Harvey.

Hed chosen me, the little girl from South Central, Los Angeles, a neighborhood infamous for illegal drugs, street gangs, and civil unrest following the Rodney King verdict, to speak on the main stage of his premier event. Hed chosen me to teach people how to shift their money mindsets. It was a far cry from where I had come from in South Central, and a long way from my situation six years earlier, lying on my bathroom floor, crying and feeling guilty and ashamed because everything wed earned and built was gone.

My husband and I were young up-and-comers, building our empire together, when the 2008 recession hit. And it hit us hard. Our seven-figure real estate business closed its doors, leaving sixteen employees out of work at the worst possible time. We lost all the investment properties wed accumulated and faced foreclosure on our home. We had to turn in those matching Range Rovers we enjoyed driving. Things got so bad so quickly, I considered pawning my wedding ring to make ends meet. When all was said and done, we went from living in a six thousand square-foot home in Southern California to a six hundred square-foot apartment in Metairie, Louisiana. It was a long, hard, and fast fall.

You might say I lost everything in the 2008 recession, and I did lose all of my material wealth. But I still had my skills and education, the work ethic my mother instilled in me at a young age, my ability to build relationships, my steadfast husband, and my determination to do my part to take care of our family. Most of all, I had the knowledge that rebuilding my wealth would begin by facing reality, owning up to the choices that led me to this financial downfall, strengthening my positive money attitudes, and rejecting the money myths that so many people were falling for in the face of similar setbacks.

I reflected on the part Id played in our downturn, and I worked to build an unshakable money mindset, allowing me to make the most of all those other gifts. In that state of humility, my previous passion for financial education also developed into a deeper sense of compassion for the money struggles I saw so many people fighting to overcome.

During that dark time, I took what work I could find to bring in some cash. The jobs werent always pleasant, but I learned something from each one. Whether it was a new skillset, a new relationship, or some new knowledge I would later use to build my own business, I stayed alert and took home more than a paycheck. I continued to nourish and strengthen my money mindset with positive affirmations, personal and professional development, and a network of people who believed, as I do, that we all have the power to improve our circumstances.

My family doesnt live in that tiny apartment anymore, and I no longer worry about whether or not Ill have enough money to put food on the table, but it was not an easy journey. It took work. It took sacrifice, but since that setback, just six years ago, Ive built a career as a speaker, coach, and personal-finance educator. Ive written three books and published articles in Black Enterprise, the Huffington Post, and numerous other publications. Ive been interviewed by Forbes, SUCCESS magazine, and Bloomberg Television, to name a few. Ive spoken on several radio shows and landed a regular segment on The Steve Harvey Morning Show, sharing the mic with the people I once served as a college intern. Ive even stepped onto the set of The Steve Harvey Show to share my personal finance expertise with his television audience. Along the way, Ive had the privilege of sharing the stage with some of todays personal development superstars, including Lisa Nichols, Valerie Burton, and Angela Jai Kim.

My goal in writing this book is for every woman to be able to hone their money mindset, so that no matter what life throws them, theyre able to bounce back and be better off than they were before. Ill answer all of your most pressing money questions, even the ones you didnt know you should ask.

Im offering you a more balanced approach to your relationship with money. Youve heard all the experts say you should budget and cut back on spending, but those are just two obvious parts of financial empowerment. To really win the money game, you have to understand multiple aspects of personal finance. The four sections of this book will help you master the ones I believe to be the most fundamental.

In the first section of this book, Create Wealthy Habits, well take a deep look at your current financial situation. This examination will help you identify the roots of your money problems and replace them with wealthy habits. These are the things wealthy people consistently do, feel, and think to create a rich life. These habits will lay the foundation for everything else youll do. When you eliminate the fear, shame, anger, and false modesty polluting your money mindsets, youll position yourself to take complete control of your personal finances. After that, there are no limits on what you can achieve.

I intentionally placed this consideration of your mindset at the beginning of this invaluable guide because the fact of the matter is that you can master all the other areas, but if you fail at this one, youll fail with money. Perhaps you know someone who won a large lawsuit settlement, only to end up broke a few years later. Of course, weve all seen movie stars and musicians face public humiliation as their bankruptcy filings are splashed all over the news, while everyone tries to figure out what happened to the millions of dollars they earned over the years. Mastering your money mindset is the key to keeping you out of this sad position.

In Earn More Money, I explore ways you can increase your income. I show you how to earn more in the job you have or make the leap to a job that pays what you deserve. I help you to consider options such as creating a side hustle while you continue to work your nine-to-five, so you can supplement your income and possibly cultivate that side gig until its a flourishing entrepreneurial venture that replaces your day job.