The Money Answer Book 2004, 2010 by Itzy

All rights reserved. No portion of this publication may be reproduced, stored in a retrieval system, or transmitted by any meanselectronic, mechanical, photocopying, recording, or any otherexcept for brief quotations in printed reviews, without the prior written permission of the publisher.

Published in Nashville, Tennessee, by Thomas Nelson.

Thomas Nelson, Inc., titles may be purchased in bulk, business, fund-raising, or sales promotional use. For more information, please e-mail SpecialMarkets@ThomasNelson.com

Unless otherwise stated, scripture references are from the New Century Version. 2005 by Thomas Nelson, Inc. Used by permission. All rights reserved.

Scripture quotations marked NKJV are taken from THE NEW KING JAMES VERSION. 1982 by Thomas Nelson. Used by permission. All rights reserved.

Scripture quotations marked NIV are taken from the Holy Bible, New International Version, NIV. Copyright 1973, 1984 by Biblica, Inc. Used by permission of Zondervan. All rights reserved worldwide. www.zondervan.com

ISBN 978-1-4041-8779-5

ISBN 978-1-4185-2680-1 (eBook)

Printed in the United States of America.

13 14 15 16 QC 16 15 14 13

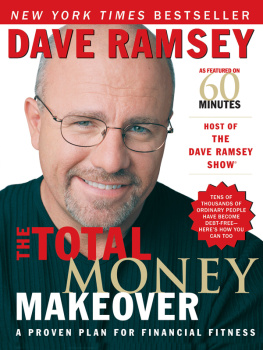

www.daveramsey.com | www.mytotalmoneymakeover.com

CONTENTS

NO MATTER WHAT I dont borrow money.

NO MATTER WHAT I give a tenth of my income to my local church in the name of the Lord.

NO MATTER WHAT I have an emergency fund of three to six months of expenses.

NO MATTER WHAT I dont spend over $300 without first talking to my wife.

Youve got to have some no matter whats in your life. It sounds weird, doesnt it? It used to be called common sense; now its a highly rated talk radio show!

M ONEY. We all need it, but few of us really understand it. If you listen to my daily radio show you know how desperate people are to get a handle on their finances. Maybe youre desperate... or maybe youre just trying to make sure you dont end up that way. Regardless, if youve picked up this book, youre interested in putting money to good use.

In The Total Money Makeover and my other books, Ive guided people on a journey to improve their financial situations. Achieving success in personal finance is a long-term process, not an overnight fix. But in The Money Answer Book, Im offering you a different approach. Instead of walking you through the chronological steps, Ive created a Q&A to help you find your topic-specific answers in an easy, concise format.

I only have one very simple messagebe responsible to God and family, sacrifice the unnecessary to gain the necessary, get rid of debt, and build a financially peaceful future. This message is the heart of all my radio shows, articles, seminars, and books, including this one.

In The Money Answer Book, its easy to find the answers; the challenge is applying them. You see,

personal finance is 80 percent behavior and only 20 percent head knowledge!

If things are going to change, then you have to change. This isnt rocket science!

Whether you are selling something or whether you want to gain control of your personal finances, its all about behavior adjustments. You cant walk through the mall if you have a spending problemits like a drunk hanging around at a bar.

So, get on with it. You future awaits the decisions you make today!

TOP TWO WAYS TO BE MONEY SMART

1. Say no to credit cards.

2. Make a budget. Write it down. Give every dollar a name.

WHAT ARE THE BABY STEPS?

Leaping financial hurdles doesnt come easy or immediately. First you have to get your balance and learn to walk. Here are the Baby Steps.

1. $1,000 in an Emergency Fund

2. Pay off all debt (except the house) utilizing the Debt Snowball

3. Three to six months expenses in savings for emergencies

4. Fully fund 15 percent into pretax retirement plans and Roth IRAs, if eligible

5. College funding

6. Pay off home early

7. Build wealth! (Mutual funds and real estate)

MONEY ACTION

Im on Baby Step #

Ive been on this Step since

I want to get to the next Step by

Believe you can do this!

WHAT COUNTS AS TAXABLE INCOME?

The things that typically count as income are:

Anything from your employer

Tips

Odd jobs

Interest

Profit on sale of stocks and other investments

Profit on sale of property

Alimony

Social Security

Some retirement savings

Settlements from lawsuits

Lottery or gambling winnings

The things that usually dont count as income are:

Scholarships

Inherited money (the estate already paid taxes on this)

Life insurance payouts

DOES THE NATIONAL ECONOMY REALLY AFFECT MY PERSONAL ECONOMY?

The news keeps telling us about the unemployment rate and jobs being lost. We hear about economic indicators that affect the stock market. When the government is concerned about the economy, it lowers interest rates in an effort to keep people spending. Debt is rising.

So what is the truth? News reporters dont give the full truth. They bring the bleeding stories to us to get the ratings. Hardly ever do you hear positive news as a lead story.

The truth is that all those economic factors do affect you, but what you do in your own home will affect you far more.

The reality is that some people have lost jobs, but the beauty of the Baby Steps is that the system works both in good times and in bad times. It is Gods and Grandmas way of handling money. Debt-free living on a plan (a budget), saving for emergencies, investing for long-term goals, living on less than you make, and agreeing with your spouse on spending makes you prosperousnot tomorrow, but over time. Getting rich quick doesnt work.

Wake upyoud better start to prosper now! This is the best economy ever. If you cannot build wealth now, when can you build wealth? Get to work now!

WHATS THE MOST IMPORTANT FINANCIAL PRINCIPLE?

(THE ANSWER MIGHT SURPRISE YOU.)

The Dave Ramsey Show and my company, The Lampo Group, have become very well known for teaching people how to get out of debt, save money, and get on a budget. All of us on staff here are very thankful for the response weve had to these concepts, but another financial concept is the hinge on which the door of successful personal finance swings. I have only begun to realize the full significance of this concept during the last year or so. When you understand this concept, all the other concepts work, and until you implement it, none of them will work. When you stick this concept deep in your soul, it becomes easy to save money, and even have money to invest. Getting out of debt happens quickly once you learn how to apply this concept in your life. Budgeting is made easier and your marriage or relationships regarding money are freed up and made smooth. This is the most important financial concept.

Contentment. Thats right, contentment. Contentment brings peace. Not apathy. Not the deadhead fog of Prozac or Valium. Only contentment brings peace. We live in the most marketed-to society in the history of the world, and the very essence of marketing is to disturb your peace. We say things to ourselves like, Ill be happy when I get that boat or, Ill be happy when I get that china cabinet or, Ill be happy when I get that house. Or, or, or, or!

Not true. Happiness is sold to us as an event or a thing, and consequently, our finances have suffered. Fun can be bought with money, but happiness cannot.

We live among a bunch of people who are deeply in debt and have no money saved because their emotions were tricked. Just like drug addicts, people have been conned into believing that happiness will come with the next purchase. So, Daddy works hundreds of overtime hours and Mommy works forty-plus hours a week, all in the name of

Next page