Penguin supports copyright. Copyright fuels creativity, encourages diverse voices, promotes free speech, and creates a vibrant culture. Thank you for buying an authorized edition of this book and for complying with copyright laws by not reproducing, scanning, or distributing any part of it in any form without permission. You are supporting writers and allowing Penguin to continue to publish books for every reader.

Text and cover illustrations copyright 2017 by Penguin Random House LLC. Interior illustrations of Boston Tea Party copyright 2013 by Lauren Mortimer. Remaining interior art copyright by Penguin Random House LLC. Published by Penguin Workshop, an imprint of Penguin Random House LLC, 345 Hudson Street, New York, New York 10014. PENGUIN and PENGUIN WORKSHOP are trademarks of Penguin Books Ltd, and the WHO HQ colophon is a trademark of Penguin Random House LLC.

Befuddled by a headline that keeps zipping across the news ticker?

Wondering whats true or false in the latest Twitter war?

Cant remember what hallowed history a holiday celebrates?

What do you want to know?

Sometimes you just need a quick primer or refresher on a certain point in order to really understand what youre reading, watching, or listening to. But research is tricky and takes time. Google something? Sure. But what if you get a bazillion hits? Which do you click and how do you know what site to trust?

Good questions need good answers from a reputable sourceand that would be us, the big-head, big thinkers deep inside WHO HQ. Weve developed these fun, single-focus e-books to answer important questions factually and fast. Well help you get a handle on essential concepts, inventive ideas, interesting people, innovative social and political movements, and breakthrough science, so youre ready to roll.

Start here...

Who Pays Taxes?

Americans come in many shapes and sizes, and from places near and far. But we all have one thing in common: taxes.

A tax is a fee legally charged by the local, state, or federal government to pay for services that everyone uses. These include things like hospitals, roads, schools, streetlights, fire stations, the arts, scientific research, the space program, and national parks. Tax money pays for the operation of governments, too.

Most people arent crazy about paying taxes. In fact, the United States of America was founded because of a disagreement over taxes. Nearly 250 years ago, colonists in America were asking the very same questions people argue about today: Who should pay taxes, how much should they pay, and how should these funds be spent?

A Revolutionary Tea Party

The original thirteen American colonies were ruled by Great Britain. This meant that when the British Parliament imposed taxes and colonists paid them, the money went straight to Englandmore than 3,000 miles away!

Many colonists felt this was unfair. Much of their tax money was used to fund the British national debt. The colonists tax money even helped pay for a British war! Worst of all, American colonists had no direct representation in the British government. Without this, they had no control over how much money they paid in taxes and where that money was spent.

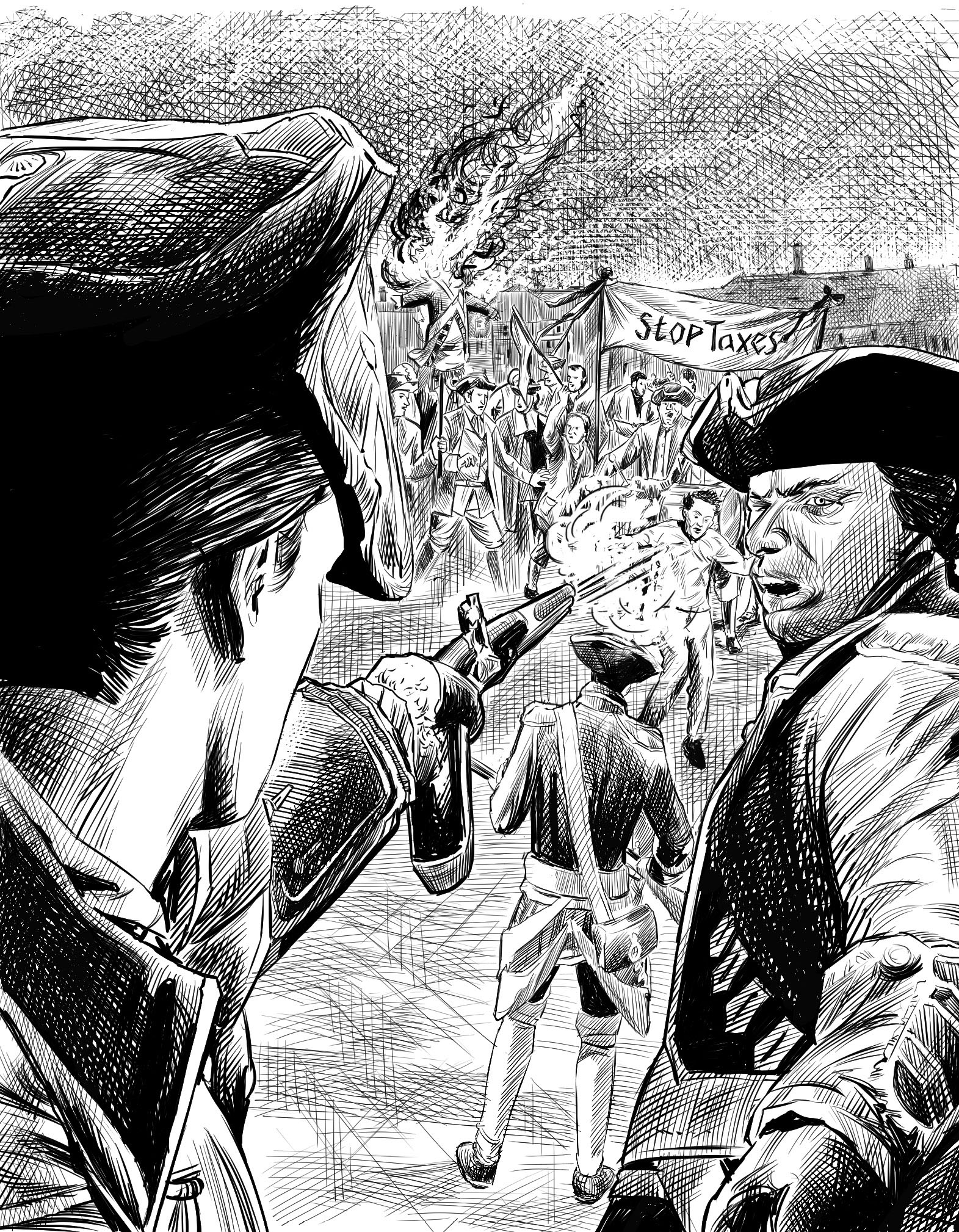

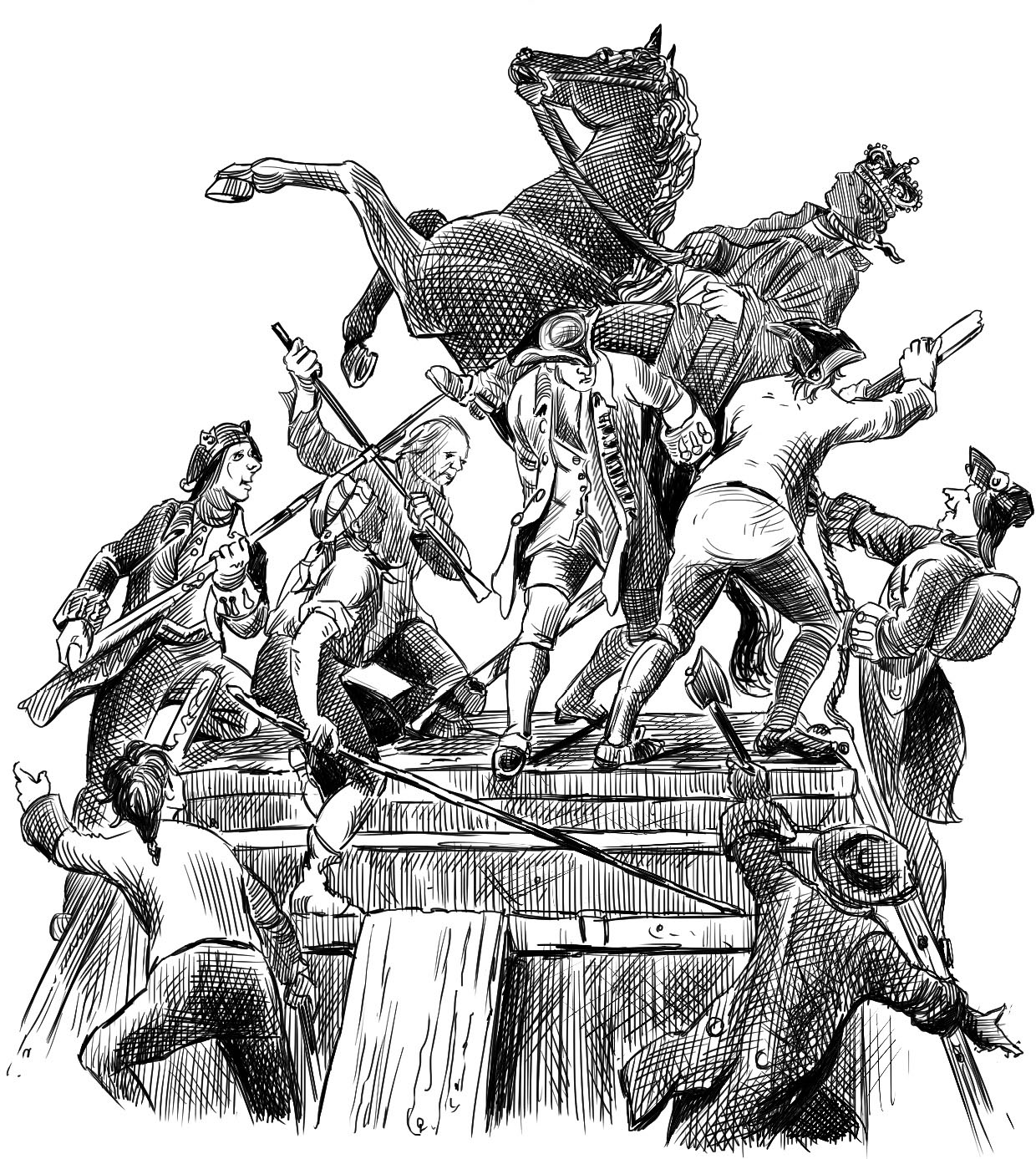

By the 1770s, the colonists had had enough of taxation without representation. They rejected Parliaments tax laws in colonial assemblies and in more forceful protests such as the Boston Massacre (1770), which pitted angry patriots against British soldiers.

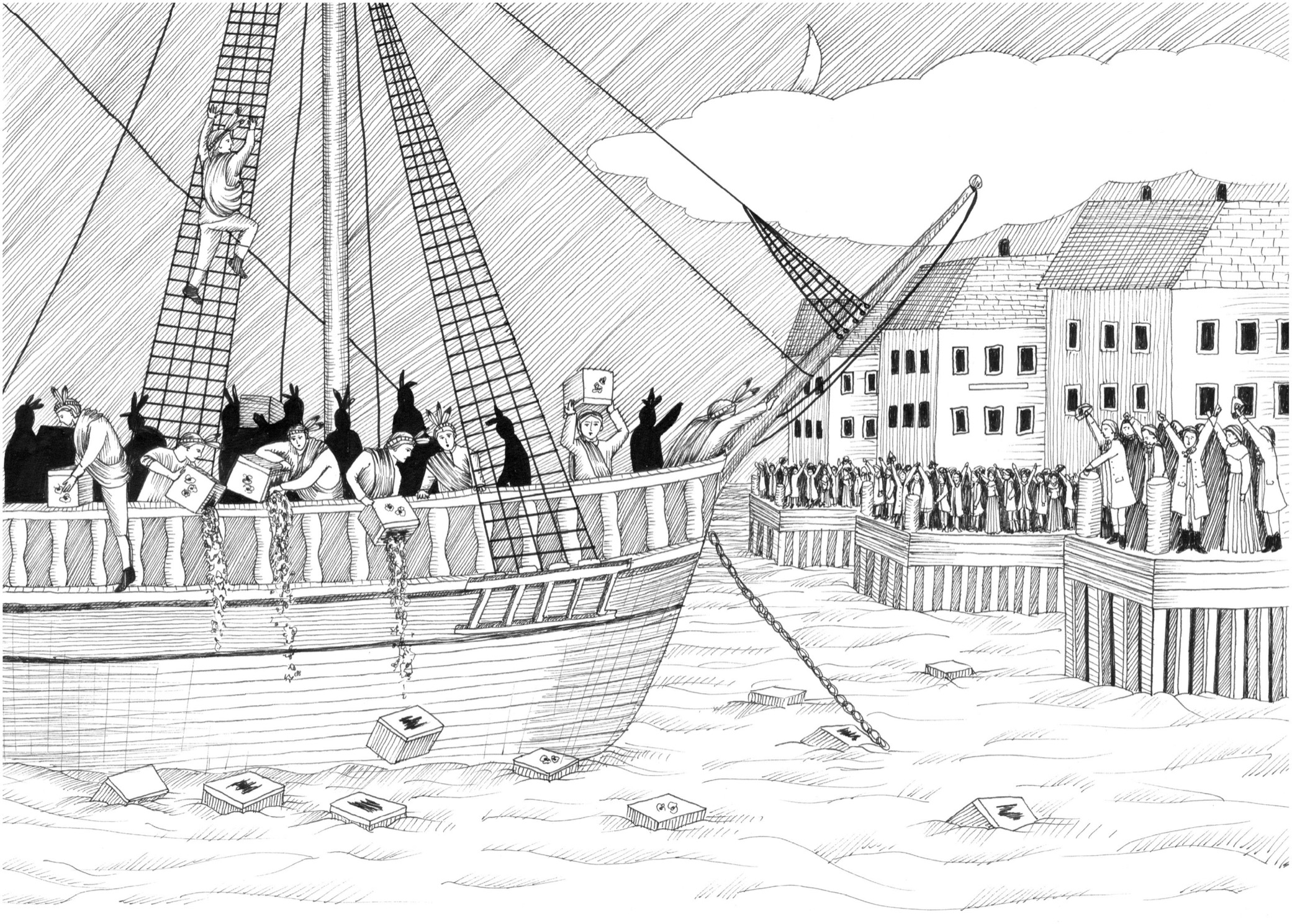

At the famous Boston Tea Party of 1773, the Sons of Liberty donned disguises, hopped aboard British East India Company ships, and dumped boatloads of tea into the harbor.

These actions helped ignite the American Revolution and guide our tax laws today.

... Plus Tax

Do you shop? Work? Stay in hotels? Eat at restaurants? Own a home? If so, youre going to have to cough up the tax dough, because there are many types of taxes collected in the United States.

- Sales tax is the small percentage of the total price that most states in the country charge when you buy goods and services. These taxes are placed on everyday items like candy, clothing, electronics, and more. Feeling lucky because you live in a state that doesnt charge sales tax? Youll still have to pay it if you buy something in a state that does.

- Income tax is money owed to the local, state, and federal governments based on how much money you earn. This money is usually taken out of a paycheck. No matter what your state or local government decides about taxes, everybody in the United States is subject to federal income tax, thanks to the Sixteenth Amendment, which took effect in 1913. The Internal Revenue Service oversees this collection, and April 15 is usually Tax Day, when Americans need to file their tax returns. Want to know more about the IRS? (They very likely know about you!) Click on www.irs.gov.

- Import tax applies to any item shipped into the United States from another country.

Youll Pay... Or Not

Many other types of taxes exist, like property taxes, hotel taxes, gift taxes, estate taxes, and more. Individuals pay taxes and so do businesses. But not everyone is writing checks on April 15. Legal deductions allow some taxpayers and businesses to reduce what they owe in taxes. For example, homeowners can write off the interest they pay on their mortgages. Workers can contribute to retirement savings plans, which reduces the income on which they are taxed. Small business owners can claim a Graduated Corporate Income to pay less in taxes so more money stays in their businesses. Some people and companies go really wide on the loopholes by investing money overseas, for example, and avoid paying US taxes altogether!

In the Clear!

Tax-exempt organizations dont have to pay taxes because this helps protect a constitutional right, such as freedom of religion, or the groups offer something important and of service to a greater community. Tax-exempt groups include: