Ad Broere - Ending the Global Casino?

Here you can read online Ad Broere - Ending the Global Casino? full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2010, publisher: Eburon Business, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Ending the Global Casino?

- Author:

- Publisher:Eburon Business

- Genre:

- Year:2010

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

Ending the Global Casino?: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Ending the Global Casino?" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Ending the Global Casino? — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Ending the Global Casino?" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Ending the Global Casino?

| Copyright 2010 | by Humane Economy Publishings, The Netherlands |

| Website: | www.endingtheglobalcasino.org |

| Author: | Ad Broere |

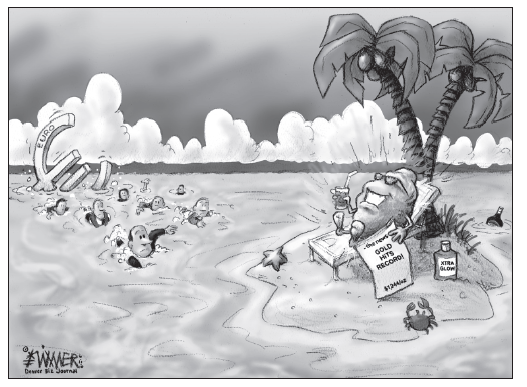

| Cartoons: | Jos Collignon, Karl Wimer |

| Editing: | Marja Anderton Ph.D., Michelle Ledford |

| Process coach: | Michelle Ledford |

| Cover design/layout: | Peter Beemsterboer |

| ISBN: | 978-90-816280-1-3 (paperback) |

| ISBN | 978-90-5972-473-0 (ebook) |

| Distribution: | Lightning Source |

| First edition: | December 2010 |

| CONTENTS |

Acknowledgements

I thank Anneke for her patience, and

for the support she has given me

during the writing process. Her

answers on my questions helped me

a lot to make the right choices.

Thank you Michelle for your

constant belief in my ability to write

my second book in English. You have

encouraged me to go on when there

were the inevitable dips, and you gave

me your honest, always useful

feedback, each time I did send you

evidence of the work in progress.

Marja, thanks to you the quality

of the written English is on the level

the reader may expect from a book

with a message intended to be taken

seriously.

Further, I thank Jos Collignon

and Karl Wimer for their brilliant

cartoons, and Peter Beemsterboer

for his excellent cover design.

T he worlds financial systems are shaking. At this moment, autumn 2010, the focus is on the euro. That does not mean that the dollar, yen, sterling and other currencies are not under pressure. It appears that the attention is being distracted from those other currencies in a many fold action that looks like a deliberate attempt to destroy the euro. It seems that those who have considered this have been rather successful up till now. In spite of the 1 trillion euro support given by the European Central Bank and the IMF to sustain the weak countries such as Greece, there is evidently a deep lack of confidence in the future of the Euro.

The economy of Greece and the Greek people are at the edge of total disaster. Attempts to re-arrange the economic structure are not successful. If the enormous debts Greece have are written off a wave of problems will come over the financial world, especially the Northern European countries and banks. They are deeply involved in the problems of the so-called PIIGS countries (Portugal, Italy, Ireland, Greece, and Spain). At the same time there are the problems between China and the U.S.. China is the biggest creditor of the U.S. The debt of the U.S. is immense, a total of many trillions of dollars. It is the consequence of decades of purchases of U.S. treasury paper to support the financial position of that country, keeping the dollar high against the Chinese currency (yuan) and thus sustaining the massive Chinese exports to the U.S. Yet, the emerging markets are flooded with out of thin air created dollars, now that the economies of the rich western countries appear to be unable to find the way up again, and dollars can be borrowed at low interest rates. The ever growing money supply of the U.S. has increased Chinas fear of the downfall of the dollar. Because of this China is trying to reduce their dollar balance. One of the methods to realise reduction is to decrease the trade in dollars. Therefore it is not in Chinas interest for the eurozone to be in big trouble. Also Japan and the U.K. play a role in the game. Both countries struggle with high government debts, and failing exports.

Where it all will end is hard to predict, but somewhere and somehow it will happen. The financial and political instability worldwide and the lack of international consensus are the main reasons that it will go wrong. And possibly sooner than we think as we dont really want to be hoping for the downfall.

In the mean time speculators go on with their activities. Big private investors, hedge funds, investment banks keep on gambling on anything. As long as it brings cash returns it is all right. It is clear that they contribute to a great extent to the instability of the financial system. Trade in gold and silver is booming. People try to save their capital by investing in those precious metals. The demand for gold and silver is much higher than the supply, leading to ever increasing prices. More institutions and analysts are warning of a collapse. In a report issued by McKinsey in February 2010 titled Debt and Deleveraging this institute concludes that the Argentine scenario is the most probable one. This means that the artificially low inflation policy of the central banks will fail, hyperinflation will follow, and as in Argentina all of a sudden the value of currencies will drop to virtually zero. This is the biggest fear of all governments, all over the world. Because it will lead to massive uprisings, protests, instability, and more major problems.

What might be the consequence of this? I think it is in the mind of the in this book referred to as new world order planners. In my opinion what is unfolding now on the world stage has been foreseen by people in powerful positions. They have designed strategies on what to do after the total collapse of the present financial economic system. Most probable is the issuance of a new world currency. Ordinary people all over the world may pay the price for this, by losing most of their properties, because the majority of private households have gone deeply in debt in order to finance their homes and other purchases they could not afford to pay out of their savings. It speaks for itself that this radical change will not go without upheavels. It is therefore reasonable to think that the planners will use control and restriction of freedom as instruments to introduce the new world order smoothly. Probably they will eliminate negative elements that obstruct the development of a world of peace and prosperity. Who the negative elements are is of course in the eye of the beholder.

Whatever will come it will not be a democracy, where people have real liberty. If a new system reigns, it will be led by a few as it is impossible to allow people themselves to decide about their own lives, because such a system will be based on rules, laws and control. A completely different scenario would be a world where people are willing to cooperate without selfishness and greed and directed to a sustainable world that they can leave happily to their children. An economy wherein wealth is also measured by the extent of happiness and health might develop. No control, no rules, nor propaganda. This would be a future to dream of. However, reality is different. Unlimited greed, unrealistically high bonuses, making money with money, it all goes on. And it would be an illusion to think that things would suddenly change through a collapse. Of course there are people who are striving for a better world. Unfortunately they are too scattered and act too much on a stand-alone basis. It would be great though, if we collectively would not have to go through the bitter experience of a centrally led financial economic system. Hopefully this book will contribute to the radical change in mindset necessary to make us free from compulsion and lack of freedom.

Font size:

Interval:

Bookmark:

Similar books «Ending the Global Casino?»

Look at similar books to Ending the Global Casino?. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Ending the Global Casino? and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.