PREFACE TO THE ORIGINAL EDITION

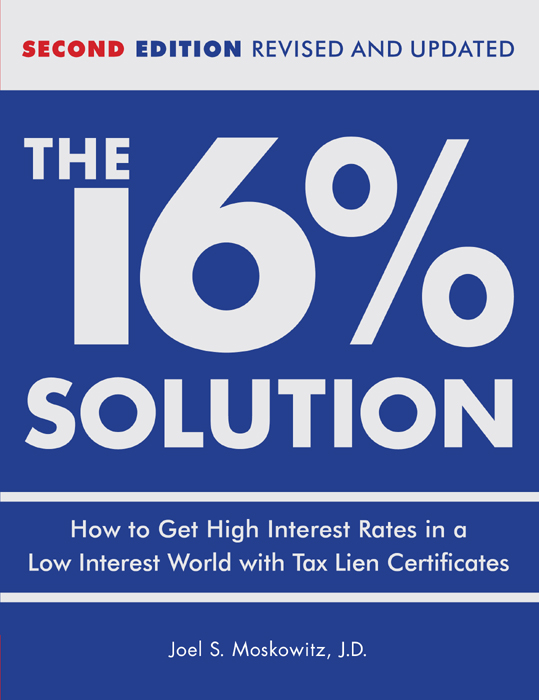

L ike millions of others, you are probably wondering where to put your money in these low interest times. Money market funds, banks, and savings and loans are paying less than 5% interest. After taxes and inflation, a 5% return leaves you with nothing at all.

Eager for higher yields, you may be considering joining millions of others who are rushing into an already overpriced stock market. Or you may be considering buying bonds, options, or more exotic instruments that may one day cost you some or most of your principal.

There is an alternative. An investment that will allow you to reap ultra-high yields. An investment that will allow you to sleep at night. An investment you can get into with very little money. An investment that is fun. I wrote this book to introduce you to that investment, known as tax lien certificates.

Tax lien certificates are not some new invention of a brokerage. They are issued by over 1,000 local governments in a majority of states. Banks, savings and loans, and many knowledgeable investors hold them. Now its your turn to find out about them, and your turn to profit from them.

Frankly, Im excited for you. You are in for a wonderful, profitable discovery, and I am delighted to be your guide and companion.

Joel S. Moskowitz

FOREWORD

A s this revised edition of The 16% Solution goes to press, its a dangerous financial world out there. Counting inflation, the average stock has lost over 50% of its value in a few weeks. Those seeking safety in U.S. Treasury bonds are realizing minimal returns on their investments. Those who hoped that their homes would be a haven for their money have watched that investment turn to dust.

By contrast, tax lien certificates are untouched as an island of safe, high-yield returns. Tax liens dont depend on a strong economy or the success of a rescue plan to make money. They dont depend on consumer spending holding up. There is no need to take a wild and dangerous roller-coaster ride to reap ample returns. And your capital is secured and guaranteed by the state government where you invest. This revised edition of The 16% Solution comes 15 years after the first. There have been many changes in the world of tax liens in that time.

First, now theres the Internet. When this book originally appeared, most of us had never even heard of the Internet. Today, you can get information online about tax lien sales in almost all counties. In most counties, you can find out what tax liens are for sale. In many counties, you can do research on the properties, and in some cases, you can do all your research online. Nowadays, in many counties, you can even buy your tax liens online; you dont even have to show up in the state! (I should add here that I recommend you check out properties in person; thats the only way youll know whether a house has burned down or been washed away in a flood or whether any of a thousand other things has occurred that can affect the value of the property.)

Second, there are now TV infomercials and seminars touting tax lien investing as a surefire way to get rich quick. They show you pictures of lovely homes that someone got for pennies on the dollar by buying tax liens on the property and later foreclosing. Their examples could well be true. But its also true that I could introduce you to a waitress who made $1 million by betting $1 on the lottery. Such examples distort reality; the truth is that its highly unlikely youll ever get a house by investing in tax liens. Ive never gotten one, and nobody I know has ever gotten one. What you will get with tax liens is super-high interest combined with safety.

Third, there have been innumerable changes in the laws and procedures of states and counties that offer tax lien certificates. This new edition will update you extensively on these changes. I would like to acknowledge the assistance of Linda Rosencrance in researching them.

The world of tax lien certificates is an exciting and rewarding place. I remain privileged to serve as your guide.

Joel Moskowitz, J.D.

SECTION 1: Why You Need Tax Lien Certificates

CHAPTER 1: What Are Tax Lien Certificates?

CHAPTER 2: Why Would You Want a Tax Lien Certificate?

CHAPTER 3: How Do Tax Lien Certificates Fit into Your Investment Plans?

CHAPTER 1: What Are Tax Lien Certificates?

A TALE OF TWO BROTHERS

Andys heart sank. When he retired, his retirement nest egg of $100,000 was earning him 8% in the money market. That extra $667 each month, supplementing his Social Security, went a long way toward making his retirement comfortable. But these last years, he had been watching his interest rates steadily drop, until this last month he earned just $220 in interest.

Andy had so many plans: a trip with Carol to visit the kids in California, adding on a guest room for visits from the grandchildren, buying a small boat to go fishing on the lake. Now he and his wife would have to dip deeper into their principal each month just to keep up their present lifestyle. And that would hurt their future income. He could see in the distance a time when their money was gone before they were.

Andys brother Jay, on the other hand, put his money into Arizona tax lien certificates. Although they had saved a similar amount from their jobs, Jays nest egg had been growing and compounding at a steady 16% for many years. At retirement, Jay had $325,000, all of which was still making 16% despite what was happening to interest rates in the rest of the economy. Jay was raking in an additional $50,000 a year! With that money, he and his wife were traveling and had just bought a rental house in the Caribbean.

Today, you will have to search for a certificate of deposit paying more than 5%.

Today, you will have to search for a certificate of deposit paying more than 5%. Although some experts believe that rates will rise in future years, others observe that todays rates are more in line with those that have existed during most of this century.

This presents you with a major problem, particularly if you live on or intend to live on the income produced by your savings.

If you are like most people, you are struggling, without much success, to get the yield back into your savings.

If you are like most people, you are struggling, without much success, to get the yield back into your savings. The places to which you are turning are not producing much relief.

As of this writing, the following are typical yields on common investments:

| 5-year Treasury Note | 2.95% |

| 10-year Treasury Bonds | 3.77% |

| High Grade Corporate Bonds | 3.80% |

| Money Market Funds | 2.50% |

| Utility Stocks | 5.8% |

| 1-year Certificates of Deposit | 2.75% |

Several of these investments present peculiar risks. In , we will consider in detail how to compare investments and combine them into a complete strategy. For the moment, we need to reflect that, particularly after taxes and inflation, these yields are very low.

A TALE OF TWO CITIES

FREEMART, CONNECTICUT: Freemart was in trouble. Maybe not as much trouble as it had been in when the state was forced to step in and guarantee a $35 million deficit bond. Still, the bond money was gone, and this year the city faced a $20 million deficit in its $320 million budget