Burkhardt - Private Equity Firms: Their Role in the Formation of Strategic Alliances

Here you can read online Burkhardt - Private Equity Firms: Their Role in the Formation of Strategic Alliances full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. City: London, year: 2019;2018, publisher: John Wiley & Sons, Incorporated;Wiley-ISTE, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Private Equity Firms: Their Role in the Formation of Strategic Alliances

- Author:

- Publisher:John Wiley & Sons, Incorporated;Wiley-ISTE

- Genre:

- Year:2019;2018

- City:London

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

Private Equity Firms: Their Role in the Formation of Strategic Alliances: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Private Equity Firms: Their Role in the Formation of Strategic Alliances" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Burkhardt: author's other books

Who wrote Private Equity Firms: Their Role in the Formation of Strategic Alliances? Find out the surname, the name of the author of the book and a list of all author's works by series.

Private Equity Firms: Their Role in the Formation of Strategic Alliances — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Private Equity Firms: Their Role in the Formation of Strategic Alliances" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Kirsten Burkhardt

First published 2018 in Great Britain and the United States by ISTE Ltd and John Wiley & Sons, Inc.

Apart from any fair dealing for the purposes of research or private study, or criticism or review, as permitted under the Copyright, Designs and Patents Act 1988, this publication may only be reproduced, stored or transmitted, in any form or by any means, with the prior permission in writing of the publishers, or in the case of reprographic reproduction in accordance with the terms and licenses issued by the CLA. Enquiries concerning reproduction outside these terms should be sent to the publishers at the undermentioned address:

ISTE Ltd

2737 St Georges Road

London SW19 4EU

UK

www.iste.co.uk

John Wiley & Sons, Inc.

111 River Street

Hoboken, NJ 07030

USA

www.wiley.com

ISTE Ltd 2018

The rights of Kirsten Burkhardt to be identified as the author of this work have been asserted by her in accordance with the Copyright, Designs and Patents Act 1988.

Library of Congress Control Number: 2018951292

British Library Cataloguing-in-Publication Data

A CIP record for this book is available from the British Library

ISBN 978-1-78630-312-7

I would like to extend my gratitude to a number of people. First, those without whom this endeavor would never have achieved its current state. These include, on the one hand, the researchers who accompanied me throughout the development of this project. On the other hand, there were many professionals in the field of French private equity without whom my empirical study could not have been carried out. Second, I would like to thank the people who have been alongside me all these years, both near and far, and who contributed to my wellbeing and to the establishment of very favorable conditions for the completion of this research project. In particular, I would like to address:

- Professors Grard Charreaux and Philippe Desbrires for their follow-up and all the support they provided through their presence, whether it was in the form of listening, reading, advice or words of encouragement. Their feedback allowed me to guide the project and present it in its best form, in addition to teaching me a privileged lesson. I am deeply grateful to the following people: Professor Mike Wright and Drs. Kevin Amess and Louise Scholes for welcoming me and following me around during my stay in England at the Centre for Management Buy-Out and Private Equity Research (CMBOR) at Nottingham University; Professors Martine Girod-Sville and Alain Desreumaux for agreeing to be the examiners of my work and Professors Peter Wirtz and Bernard de Montmorillon for their participation in the jury as voting members;

- the private equity professionals and managers of private equity-backed firms who participated in the study, and the statistics department of Invest France, the former Association franaise des investisseurs pour la Croissance (AFIC), for agreeing to support my econometric study;

- my spell-checkers for their extensive proofreading.

This study analyzes the role of private equity firms in the formation of strategic alliances within the French private equity market. We start by providing evidence of its importance from new survey information, before offering an explanation of the organizational phenomenon. The study addresses the questions of how and why private equity firms act as relational intermediaries to help their portfolio companies form alliances. Both questions are investigated in light of private equity firms contribution to the value creation process that comes with alliance formation. Answers are provided by means of three jointly used theoretical frameworks: (1) mainstream theories (transaction cost theory and the positive theory of agency); (2) the knowledge-based view; and (3) social network theories to complement the results from joint use of the previous two theories. The theoretical construct is then tested empirically by means of a multimethod study with explanatory design based on the pattern of joint evidence from both statistical tests and a multiple case study. Results show that French private equity firms do play a role in alliance formation. This role can be intentional as well as non-intentional. Furthermore, although arguments from the knowledge-based perspective find more support in explaining this behavior than from the mainstream theories, our study highlights the benefits of the joint use of these theories and the complementary nature of them in better explaining the phenomenon as a whole.

Cooperative approaches in the shape of strategic alliances between companies are a source of innovation and a factor for economic growth in developing economies. Alliances are particularly important for the development of SMEs, which are predominant in Europe, and for which internal resources are often limited [SCH 06].

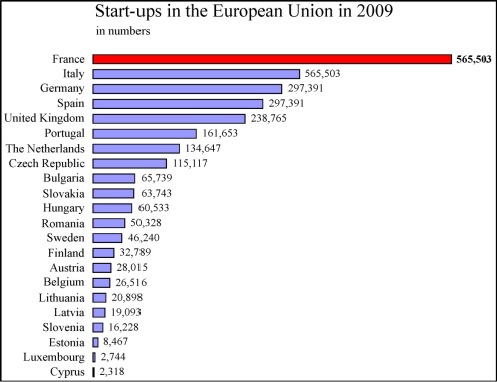

In France, small and medium-sized enterprises (SMEs) account for nearly 99.9% of all companies (2010 data). Nationally, they employ 52% of employees and generate 38% of turnover, which is almost half of the value added (49%) [POR 10]. The creation of SMEs is on the rise. In 2012, France recorded nearly 549,976 new business start-ups [APC 13]. According to the latest Eurostat comparison in 2009, France had the highest number of business start-ups in the European Union ().

These figures highlight the importance of economic policies and measures aimed at SME development [MCC 10]. Several policies have been put in place to foster alliances and networking among SMEs [SCH 06]. The European cluster policy is an example of such a policy, as well as its French counterpart, the Ples de comptitivit policy, which was launched in 2004. In the wake of Silicon Valley, they aim to encourage interactions between various actors through the creation of appropriate environments for intensive knowledge exchange and synergies between them. Within a given territory, they help to bring together private equity firms (PEFs, that usually specialize in venture capital), SMEs, large groups, and research institutions such as universities.

Business start-ups in the European Union in 2009

(source: Insee, Eurostat)

Private equity is relevant in this field because it is one the most significant source of financing for SMEs (which are usually unlisted) and therefore innovation. By their very nature, PEFs are active investors. In addition to providing capital, they provide managerial assistance to the companies they support. McCahery and Vermeulen [MCC 10] highlight the importance of the contribution of these complementary services through the example of the Japanese private equity market, where the performance is lower than in the United States and Europe. Unlike in the latter two countries, Japanese PEFs are passive investors and are therefore limited to capital injections. The authors also suggest that there are signs that governments are aware of the importance of the non-financial services provided by PEFs for the development of SMEs and innovation. After the financial crisis, government policies aimed at promoting private equity or, as mentioned above, networking among stakeholders were strengthened in various countries, including France [GLA 08; MCC 10, pp. 1314].

Next pageFont size:

Interval:

Bookmark:

Similar books «Private Equity Firms: Their Role in the Formation of Strategic Alliances»

Look at similar books to Private Equity Firms: Their Role in the Formation of Strategic Alliances. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Private Equity Firms: Their Role in the Formation of Strategic Alliances and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.