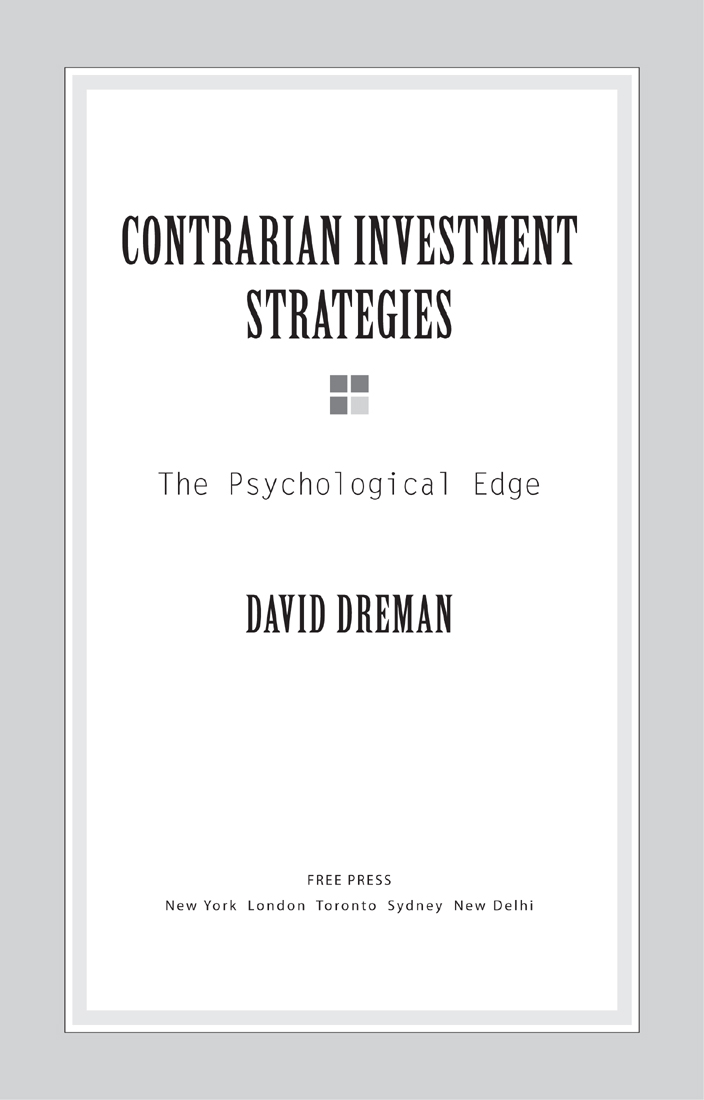

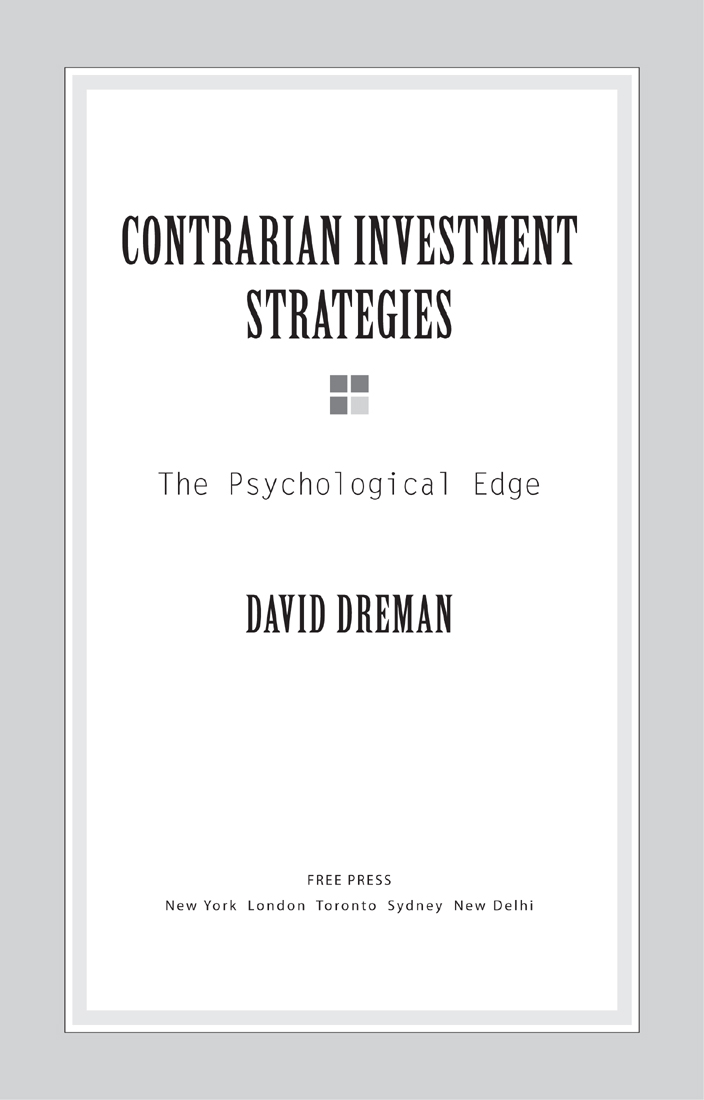

ALSO BY DAVID DREMAN

Psychology and the Stock Market:

Investment Strategy Beyond Random Walk

Contrarian Investment Strategy:

The Psychology of Stock-Market Success

The New Contrarian Investment Strategy

Contrarian Investment Strategies:

The Next Generation

We hope you enjoyed reading this Free Press eBook.

Sign up for our newsletter and receive special offers, access to bonus content, and info on the latest new releases and other great eBooks from Free Press and Simon & Schuster.

or visit us online to sign up at

eBookNews.SimonandSchuster.com

Thank you for purchasing this Free Press eBook.

Sign up for our newsletter and receive special offers, access to bonus content, and info on the latest new releases and other great eBooks from Free Press and Simon & Schuster.

or visit us online to sign up at

eBookNews.SimonandSchuster.com

DAVID DREMAN is the chairman and managing director of Dreman Value Management, LLC, a firm that pioneered contrarian strategies on the Street and manages more than five billion dollars of individual and institutional funds. Regarded as the dean of contrarians, he is the author of the critically acclaimed Psychology and the Stock Market and Contrarian Investment Strategy. Dreman is also the senior investment columnist at Forbes magazine. Articles about the success of his methods have appeared in The New York Times, The Wall Street Journal, Fortune, Barrons, Bloomberg Businessweek, and numerous other publications. He lives with his wife and daughter in Aspen, Colorado.

MEET THE AUTHORS, WATCH VIDEOS AND MORE AT

SimonandSchuster.com

THE SOURCE FOR READING GROUPS

JACKET ILLUSTRATION AL AMY

COPYRIGHT 2012 SIMON & SCHUSTER

D avid Dreman, chairman and managing director of Dreman Value Management, LLC, is one of the most successful and influential investment managers in history, and his name is synonymous with contrarian investing. In this major revision of his investment classic, which Warren Buffett called that rarityan extremely readable and useful book that will be of great value both to the layman and the professional, Dreman introduces vitally important new findings in psychology that explain why the stock market is inescapably given to bubbles, panics, and periods of high volatility. He also shows how we can use these findings to reliably profit from market errors, crash-proof our portfolios, and earn market- beating long-term returns.

The need for these keen new insights and his powerful contrarian strategies has never been more urgent. The market crash of 20072008 left no doubt that there are glaring flaws in the theory underlying all of the other prevailing investment strategiesthe efficient market hypothesisas well as in the long-accepted theory of risk. These twin theories, and all of the popular investing strategies that are based on them, fail to account for major, systematic errors in human judgment that the powerful new psychology research explains, such as emotional overreactions and a host of mental shortcuts in decision-making that lead to wild over- and undervaluations of securities as well as fundamentally f lawed assessments of risk. Dremans contrarian strategies not only account for these dangerous psychological effects but allow investors to take advantage of them. Dreman presents a breakthrough new theory of risk and introduces vital findings about the hidden dangers of high-speed trading and its role in volatility; he also delves into the pernicious risk of flash crashes as well as how to prepare for inflation.

Updating all his signature charts of market movements and stock valuations that prove the remarkable power of his contrarian strategies, he shows how the strategies would have optimized returns during the lost decade that culminated in the 20072008 crash and would have positioned investors for marketbeating returns in the recovery. Enhancing his core methods for choosing stocks with a number of new techniques developed over the last decade, he shows why the best stocks are consistently overvalued while the so-called worst, contrarian stocks are undervalued, and he lays out his proven and simple rules for avoiding the pitfalls and spotting the bargains.

Based on breakthrough research and showing for the first time how the new psychological findings can be directly incorporated into investing strategy, this thoroughly revised edition of one of the most influential books on investment is an essential addition to every investors arsenal.

Praise for DAVID DREMAN

David Dreman has been a keen student of psychology for many years. It is fascinating to see him combine his knowledge of recent advances in cognitive psychology with his vast understanding of financial markets. The result is a thought-provoking book providing valuable guidance for investors searching for opportunities amidst the risk and volatility in todays investment world.

Paul Slovic, PhD, founder and president

of Decision Research and author of The Feeling of Risk

Dreman is the grand master of a simple but psychologically challenging investment strategy: consummate contrarianism.

The New York Times

If contrarian investing was a religionand to many devotees within the Motley Fool community, it isthen David Dreman might be its prophet.

The Motley Fool

Dremans standing among mutual fund investors is almost iconic... Dreman was an early adopter of behavioral finance, incorporating it into his investment philosophy... Dremans dedication to behavioral finance has been profitable for investors. The DWS Dreman High Return Equity Fund is the top-performing equity-income fund of the past 18 years, according to New Yorkbased research firm Lipper.

Institutional Investor

Dave Dreman is a world-renowned value manager. He may be creating even more value in Contrarian Investment Strategies as he focuses on current analysis and opportunity.

A. Michael Lipper, CFA, founder and president of Lipper Advisory Services, Inc.

Skip the academics and just read Dreman.

Don Phillips, director, Morningstar, Inc.

While most of the gurus upon whom my Guru Strategies are based are contrarians, one stands out among all the others: David Dreman. Throughout his long career, Dremanhas sifted through the markets dregs in order to find hidden gems, and he has been very, very good at it... Dreman, perhaps more than any other guru I follow, is a student of investor psychology... By targeting out-of-favor stocks and avoiding in-favor stocks, Dreman found you could make a killing.

John Reese, Seeking Alpha

Dremans contrarian style of investing has earned him accolades from Wall Street as well as hefty returns... Next time youre tempted to buy a red-hot stock, resist the temptation to jump on the bandwagon. According to Dremanthe king of contrarian investingyou would do far better buying stocks that are out of favor. And thats not just his own experience talking: Study after study has proven him right.

Equity

This publication contains the opinions and ideas of its author and is intended to provide useful advice in regard to the subject matter covered. It is sold with the understanding that in this publication the author and publisher are not engaged in rendering legal, financial, or other professional services. If the reader requires expert assistance or legal advice, a professional advisor should be consulted directly.

Next page