ADVANCE PRAISE FOR

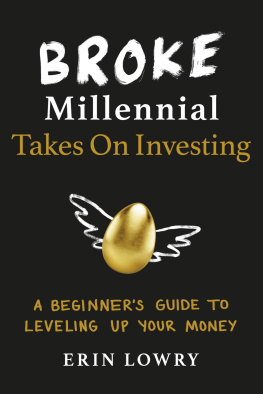

Broke Millennial Takes On Investing

A great intro for newbies to the terribly complicated financial world, mixed with personal advice on how to handle debt and emulate the mindset of the wealthy. A wonderful resource.

Danielle Town, author of New York Times bestseller Invested and founder of The Invested Practice

Erin is uniquely capable of making even the most difficult-to-understand financial concepts into something you actually want to talk about, and investing is no exception. If you are intimidated (or, frankly, bored) by the idea of investing, let Erin prove you wrong on both counts with this fantastic book.

Chelsea Fagan, cofounder of The Financial Diet and coauthor of The Financial Diet

Erin delivers exactly what she promises in this easy-to-digest, conversational book. If youre a millennial who wants to invest but dont want a boring tome to put you to sleep, this guide gets you started without drowning you in technical jargon. Level Up your money by reading this book!

Kristy Shen, cofounder of Millennial Revolution and coauthor of Quit Like a Millionaire

Broke Millennial Takes On Investing is the beginning investing book youve been waiting for. Not only does she break down investing terms, but she also explains the why in a way that will resonate with millennials and non-millennials alike. What most impressed me is Erins ability to explain how to invest in a way that is easy to understand and implement. As a former preschool teacher turned financial educator, I can say that this book has all the hallmarks of a great, transformative read. If youre starting your investing journey, bring this book along with you.

Tiffany The Budgetnista Aliche

Erin compares asset classes to craft beers. Need I say more? She explains investing in a way thats simple and easy-to-grasp without being simplistic. She entertains you with stories of Dutch tulips and Ask Jeeves, introduces you to new technologies, walks you through ethical investing, and explains the investment landscape so well, youll feel like an expert by the time you finish reading this book.

Paula Pant, founder of AffordAnything.com and host of the Afford Anything podcast

PRAISE FOR

Broke Millennial

Its the youthful perspective that makes this book so refreshing. Its well written and researched by a millennial for millennials. You hear their voices and their concerns without the judgment, sarcasm, and superiority we older folks too often convey when we talk to young adults about money.

The Washington Post

Erin Lowrys Broke Millennial is a charismatic guide to personal finances for people seeking a modern, thorough introduction to the topic.

Refinery29

A new book about money that teens and millennials will actually read.... This not only has great insights and tips about handling money, but its written in a casual, relatable way.

Time

An imprint of Penguin Random House LLC

penguinrandomhouse.com

Copyright 2019 by Lowry Media LLC

Title page art: Golden Egg by Sashkin/Shutterstock.com

Penguin supports copyright. Copyright fuels creativity, encourages diverse voices, promotes free speech, and creates a vibrant culture. Thank you for buying an authorized edition of this book and for complying with copyright laws by not reproducing, scanning, or distributing any part of it in any form without permission. You are supporting writers and allowing Penguin to continue to publish books for every reader.

TarcherPerigee with tp colophon is a registered trademark of Penguin Random House LLC.

Library of Congress Cataloging-in-Publication Data

Names: Lowry, Erin, author.

Title: Broke millennial takes on investing : a beginners guide to leveling up your money / Erin Lowry.

Description: New York : TarcherPerigee, 2019. | Includes bibliographical references and index.

Identifiers: LCCN 2018050287| ISBN 9780143133643 (paperback) | ISBN 9780525505433 (ebook)

Subjects: LCSH: Finance, Personal. | Investments. | BISAC: BUSINESS & ECONOMICS / Personal Finance / Investing. | BUSINESS & ECONOMICS / Personal Finance / Money Management. | SELF-HELP / Personal Growth / Success.

Classification: LCC HG179 .L6963 2019 | DDC 332.6dc23

LC record available at https://lccn.loc.gov/2018050287

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional services. If you require legal advice or other expert assistance, you should seek the services of a competent professional.

While the author has made every effort to provide accurate telephone numbers, Internet addresses, and other contact information at the time of publication, neither the publisher nor the author assumes any responsibility for errors, or for changes that occur after publication. Further, the publisher does not have any control over and does not assume any responsibility for author or third-party websites or their content.

Version_1

To Peach, my partner in building wealth

Contents

Preface

Is This Book Right for You?

H ELLO THERE ,

Are you someone who is already maxing out your 401(k), making use of multiple investment apps, running a net worth update once a quarter, and reading Morningstars website for fun? Awesome! Youre crushing the game and are certainly more than welcome to read this book, but its probably fairly rudimentary for you.

Or are you a rookie investor who may not even know what a brokerage account is but really wants to learn how to level up your money game in order to build wealth? Great! Welcome to the perfect beginner investing book.

Infomercial-like start aside, this book is my response to all the emails, DMs, and tweets Ive received since publishing my first book, Broke Millennial: Stop Scraping By and Get Your Financial Life Together. People got their financial lives together and then they wanted to do more, and more meant investing. But I couldnt just say, Start investing, because then the next, logical question was Okay, but seriously, how do I start?

I pondered that same question myself once, and I found it more difficult to answer than it shouldve been. Too many of the investing books on the market are jargon-heavy, assume that the reader has a base-level understanding of the markets, or, frankly, dont address Millennial-specific pain points like whether it makes sense to invest while paying off a student loan. (Yeah, theres an entire chapter dedicated to that question in this book.)

There will be jargon in this book. There will be stats and numbers. But were also going to take things from what I consider the actual beginning: determining if now is truly the right time for you to start investing. Well talk it out, and if its not the right moment, then this book will still be here for you when youre ready.

If it is time, well, youve got 221 pages of fun waiting for you.

Yours in building wealth,