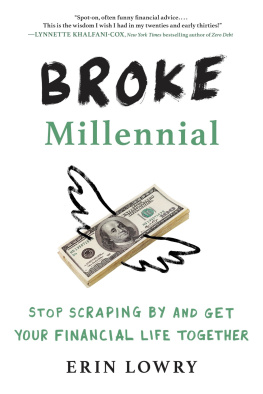

A DVANCE P RAISE FOR

Broke Millennial

If you havent quite got the hang of adulting, follow Erin Lowrys spot-on, often funny financial advice. Youll be inspired by how she successfully sidestepped student loan debt, negotiated a 40 percent (yes, 40 percent!) raise, and managed to tackle a host of thorny money situations in her relationship, her friendships, and even with her parents and bosses. Best of all, Erin reveals how you can do all this too. Broke Millennial is not your typical personal finance book. This is the wisdom I wish I had before I made a financial mess of things in my twenties and early thirties!

Lynnette Khalfani-Cox, cofounder of AskTheMoneyCoach.com and New York Times bestselling author of Zero Debt: The Ultimate Guide to Financial Freedom

Broke Millennial takes the typical preaching out of money lessons and replaces it with humor, empathy, and a fun, pick-your-financial-path twist, for successfully navigating all the financial questions youll face in the real world.

Farnoosh Torabi, financial expert and host of the award-winning podcast So Money

This is the ultimate millennial guidebook on personal finance. Erin Lowry takes you on a journey from basic money concepts to retirement fundamentals, and from salary negotiation to home ownership. She also does a great job of reducing jargon and sharing knowledge that is practical and actionable. If there is a book you must read to get your financial life together, I highly recommend Broke Millennial.

Jason Vitug, bestselling author of You Only Live Once: The Roadmap to Financial Wellness and a Purposeful Life

Broke Millennial is my go-to personal finance book when I am working with millennials. Its filled with practical step-by-step instructions and guides that any twenty- or thirty-something can easily use to change their financial situation.

Lauren Greutman, frugal living expert at LaurenGreutman.com

Lowry brings into sharp focus whats going to matter money-wise to young adults starting out in the world at a time when the odds seem stacked against them. Broke Millennial is rich with specific advice to guide readers on the path to financial wellness. Millennials who may be over-spending because of #FOMO need to read this bookstat!

Bobbi Rebell, author of How to Be a Financial Grownup: Proven Advice from High Achievers on How to Live Your Dreams and Have Financial Freedom

Thinking about money, especially when you dont have much, can be painful. But Erin Lowry shows that you dont need to be a mathematical genius to get on the right track. She makes it easy for people to build a financially healthy plan for life. Spend some time with this book and your financial decisions and confidence will improve, no doubt.

Nick Clements, cofounder of MagnifyMoney.com

An imprint of Penguin Random House LLC

375 Hudson Street

New York, New York 10014

Copyright 2017 by Erin Lowry

Penguin supports copyright. Copyright fuels creativity, encourages diverse voices, promotes free speech, and creates a vibrant culture. Thank you for buying an authorized edition of this book and for complying with copyright laws by not reproducing, scanning, or distributing any part of it in any form without permission. You are supporting writers and allowing Penguin to continue to publish books for every reader.

Tarcher and Perigee are registered trademarks, and the colophon is a trademark of Penguin Random House LLC.

Most TarcherPerigee books are available at special quantity discounts for bulk purchase for sales promotions, premiums, fund-raising, and educational needs. Special books or book excerpts also can be created to fit specific needs. For details, write: SpecialMarkets@penguinrandomhouse.com.

Library of Congress Cataloging-in-Publication Data

Names: Lowry, Erin, author.

Title: Broke millennial : stop scraping by and get your financial life together / Erin Lowry.

Description: First edition. | New York : TarcherPerigee, 2017.

Identifiers: LCCN 2016055468 (print) | LCCN 2017008897 (ebook) | ISBN 9780143130406 (paperback) | ISBN 9781524704056 (ebook) /

Subjects: LCSH: Finance, Personal. | BISAC: BUSINESS & ECONOMICS / Personal Finance / Money Management. | BUSINESS & ECONOMICS / Personal Finance / Budgeting. | SELF-HELP / Personal Growth / Success.

Classification: LCC HG179 .L696 2017 (print) | LCC HG179 (ebook) | DDC 332.024dc23

LC record available at https://lccn.loc.gov/2016055468

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional services. If you require legal advice or other expert assistance, you should seek the services of a competent professional.

While the author has made every effort to provide accurate telephone numbers, Internet addresses, and other contact information at the time of publication, neither the publisher nor the author assumes any responsibility for errors or for changes that occur after publication. Further, the publisher does not have any control over and does not assume any responsibility for author or third-party Web sites or their content.

Cover design: Zoe Norvell

Cover image: JG Photography / Alamy Stock Photo

Version_1

T HIS BOOK IS DEDICATED TO ...

... my dad, for playing his self-proclaimed role of villain so graciously and laying all the groundwork for my financial education.

... my mom, for teaching me how to ask for the order.

... Cailin, for showing me why its important to never give up on your childhood dreams.

... Peach, for knowing the best way to keep me awake on a road trip is to ask about the difference between a traditional and Roth IRA and being happy to listen to the answer.

Contents

The moment in which I attempt to convince you that learning about money can actually be fun.

Learn how to identify, understand, and overcome your psychological blocks when it comes to money.

Discover how youre doing financially so far and ways to take better control of your money.

The basics of budgeting and how to find the budgeting method that suits you best.

Uncover the ways banks are screwing you over and what you can do to stop them.

Get your credit score on fleek without taking on unnecessary debt, and learn how to handle items in collections.

Make sure you actually understand how to use a credit card properly, and learn how to find the best one with perks.

Ditch that debt effectively with one or several tools explained in this chapter.

The title says it all.

Find out why you should save and how to do so if you have debt; if youre debt free, check out the tips on saving and see your net worth skyrocket.

Navigating finances and friendship.

How to have that first awkward money conversation with your partner without you or him/her running for the door.

Living at home can be a financial windfall, but dont let it drive you or your parents crazy.

People cant read your mind, so find out how to tactfully tell them what you deserve and why you should get it.