Contents

Guide

Adams Media

An Imprint of Simon & Schuster, Inc.

57 Littlefield Street

Avon, Massachusetts 02322

www.SimonandSchuster.com

Copyright 2020 by Simon & Schuster, Inc.

All rights reserved, including the right to reproduce this book or portions thereof in any form whatsoever. For information address Adams Media Subsidiary Rights Department, 1230 Avenue of the Americas, New York, NY 10020.

First Adams Media hardcover edition February 2020

ADAMS MEDIA and colophon are trademarks of Simon & Schuster.

For information about special discounts for bulk purchases, please contact Simon & Schuster Special Sales at 1-866-506-1949 or .

The Simon & Schuster Speakers Bureau can bring authors to your live event. For more information or to book an event contact the Simon & Schuster Speakers Bureau at 1-866-248-3049 or visit our website at www.simonspeakers.com.

Cover design by Victor Watch

Cover images clipart.com; 123RF

Library of Congress Cataloging-in-Publication Data

Names: Cagan, Michele, author.

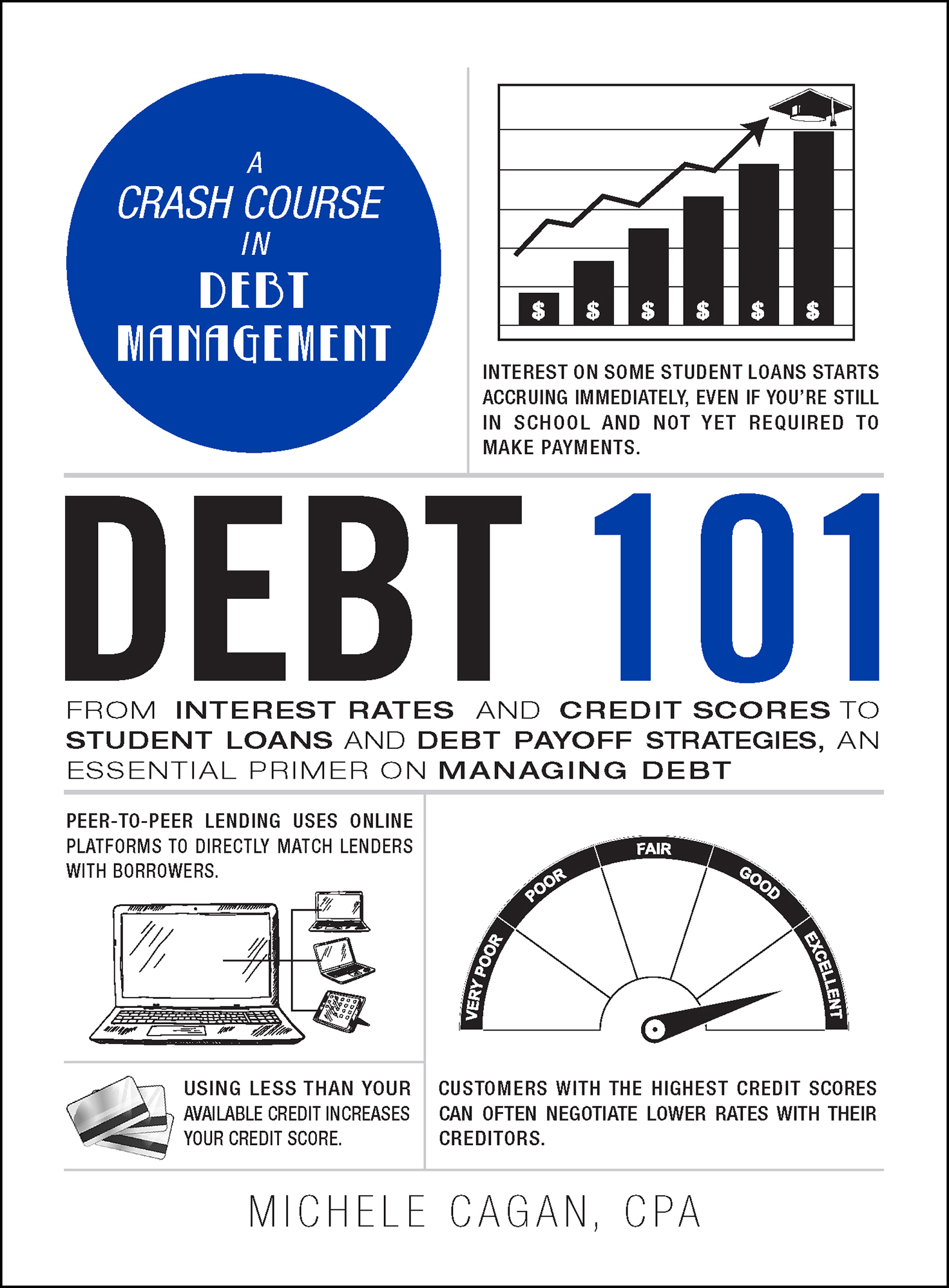

Title: Debt 101 / Michele Cagan, CPA.

Description: First Adams Media hardcover edition. | Avon, Massachusetts: Adams Media, 2020.

Series: Adams 101.

Includes index.

Identifiers: LCCN 2019046051 | ISBN 9781507212660 (hc) | ISBN 9781507212677 (ebook)

Subjects: LCSH: Finance, Personal. | Debt. | Saving and investment.

Classification: LCC HG179 .C34 2020 | DDC 332.024/02--dc23

LC record available at https://lccn.loc.gov/2019046051

ISBN 978-1-5072-1266-0

ISBN 978-1-5072-1267-7 (ebook)

Many of the designations used by manufacturers and sellers to distinguish their products are claimed as trademarks. Where those designations appear in this book and Simon & Schuster, Inc., was aware of a trademark claim, the designations have been printed with initial capital letters.

This publication is designed to provide accurate and authoritative information with regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

From a Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers and Associations

INTRODUCTION

If youre like most people, the word debt can sound scarybut it doesnt have to. The truth is that debt will probably play an important part in your life, and as youll discover, there are ways to use debt to your advantage. In this book, youll find information about:

- The difference between good debt and bad debt and why, in some circumstances, it makes financial sense to borrow money and invest in your future (mortgages, student loans, and business loans, for example)

- What secured debt is and why it generally has lower interest rates than unsecured debt

- The best ways to make payments on different types of debt

Once you know more about debt, it will be easier for you to evaluate your own finances and figure out what to do about them. The information in this book will help you as you create a road map to financial security. Debt 101 shows you how to design a personal path leading to that goal; along the way, youll learn how to form a plan for dealing with different kinds of debt. Sometimes that plan includes cutting back on expenses and getting rid of drains on your finances. Other times, it means finding new income streams, such as side gigs; investing in rental properties; or other ways of bringing more money into your household. Youll be able to achieve financial security and freedom by understanding the best ways to borrow money, matching your expenses to your income, and saving for the future.

Dealing with debt head-on will help take anxiety out of your money management. You can get rid of the stress that comes with facing your monthly bills and build up savings to cover emergencies, goals (like buying a house or going on vacation), and retirement. The financial confidence that comes with understanding debt will help you overcome challenges that have been keeping you from getting ahead and accumulating a healthy nest egg.

To know when its smart to take on good debt and how to rid yourself of bad debtwhether its an excessively high mortgage payment, personal or payday loans, or credit cardsyou need to set a clear course. Debt 101 will help you get wherever you want to go.

Chapter 1 How Loans Work

A loan, at its most basic, is borrowed money thats expected to be paid back in the future with interest (extra money). Loans usually come with more rules and features than this simplified version, but at heart, theyre just promises to return something.

Every loan has two sides: a lender and a borrower. The lender gives something, usually money, to the borrower. The borrower agrees to give back what she or he borrowed plus a bonus (whether thats extra money, an extra goat, or five days of labor) for the lender.

A BRIEF HISTORY OF DEBT

Ancient IOUs

Back before humans created money, they bartered to get everything they needed. Every trade was completed at once, and no one owed anything. As soon as the idea of currency came on the scene (long before actual currency appeared), all of that changed. The concepts of debt and credit began more than five thousand years ago, and theyve continued to dominate the way people manage their money.

SHEEP AND SHELLS AND SHEAVES OF WHEAT

The idea of money showed up long before coins and paper currency. As far back as 9000 B.C.E ., people all over the world used sheep and cows as cash. Some societies used cowrie shells, others used beads or feathers. People werent out shopping with this money, though. They were using it to settle disputes and arrange marriages.

Copper Coins

Metal coins first appeared between 600 and 500 B.C.E . when Chinese craftsmen created cowrie shells out of copper and bronze. Those shells soon evolved into coins, normally threaded on strings so theyd be easy to carry.

As societies solidified, merchants began to emerge. People began to purchase goods and services, with most purchases related in some way to farming. Very soon, customers fell into a buy nowpay later pattern, and the concepts of credit and debt were born.

Enter Debt

The first sign of debt appeared in 3500 B.C.E. in Mesopotamia. Various merchants recorded debts on clay tablets, confirmed by borrowers personal seals. Merchants often used those debts as a form of currency to buy what they needed. Whoever ended up holding the ancient IOU got to collect the debt.

In about 1754 B.C.E ., the Code of Hammurabi spelled out the rules regarding credit and debt. Instead of casual clay tablets, loans now required witnessed, written contracts. Loans now carried interest, and the code set strict interest rate caps (for example, interest on grain could not be more than 33 percent). Borrowers could pledge property to assure lenders that their debts would be paid. These early forms of collateral included: