www.managingdebtlaws.com

Copyright 2007 - 2015 Global University Publishing

All rights reserved.

Revised edition

ISBN: 978-1-6822287-7-7

This publication represents the authors opinion based on research and experience in regards to the subject matter contained herein.

The author does not intend with this publication to render legal advice. Information presented in this book is for illustrative purposes unless otherwise noted.

Illustrations and financial data by K. D. Nelson

The author disclaims any personal liability, loss or risk incurred as a result of the use and application, either directly or indirectly, of any advice, technique or method presented herein.

No part of this book may be reproduced in any manner, except in the case of personal use, including electronic transmission without the expressed written permission from the author.

Nelson, Keith D.

Laws of Managing Credit Card Debt

Contents

High Performance Strategy:

Calculation method and comparison data

Moderate Performance Strategy:

Calculation method and comparison data

Progressive Performance Strategy:

Calculation method and comparison data

Accelerated Performance Strategy:

Calculation method and comparison data

Preface

This book provides a source of information that you can use to payoff your credit card debt. You can save time and money with comprehensive debt reduction strategies. Learn how to get out of debt and avoid a lifelong financial burden. Study this financial guide to gain the knowledge and skills to maintain better financial management. Review it frequently, and use the performance strategies to help you develop a plan.

The results in Figure A through F are calculated using a regular monthly payment schedule. Different account balances and annual percentage rates are used. They provide a detailed account of the interest charges that accumulate and the number of years it can take to payoff the balance. In section VI, the results, are compared to, the performance strategies that show the amount of time and money you can save.

As cost of living expenses continue to increase, the money you save can improve your quality of life. And help you achieve a better financial future.

Choose from four basic strategies: the High Performance Strategy, the Moderate Performance Strategy, the Progressive Performance Strategy, and the Accelerated Performance Strategy. Each method is designed to save you time and money. Decide which strategy to use based on your budget. Carrying credit card debt can have a negative impact on your financial future. The interest charges that you pay are a huge financial loss. You can maintain a high standard of living and reach your financial goals.

Follow the instructional guidance to analyze your credit card debt. By investing in a complete study of this manual, you can improve your financial well-being.

Adopt the principles that are a benefit to you. And take a hands-on approach to maintain control of your financial future. Use this financial guide as an option other than choosing to file for bankruptcy or obtain a debt consolidation loan.

In section III, list the amount of your monthly expenses and determine the amount of your monthly expenses as a percentage of your income. As a general rule, you should budget five to six percent of your monthly income for monthly credit card payments. For example, if you make $3,000.00 a month, you should budget $150.00 to $180.00 a month.

Keep track of your spending and avoid making unnecessary purchases. If possible, save the amount you need for major purchases. Follow basic guidelines to stay within your budget. The interest on credit card debt can increase two to three times the amount of the balance. And the money you save can be used for other cost of living expenses.

When you use a credit card to pay an expense that is in your budget. Keep the amount of your monthly credit card payment within your spending budget. Avoid acquiring more debt than you can afford. If you max out your credit limit you should reduce your discretionary spending. Opening more accounts will get you deeper into debt.

Making the minimum payment extends the amount of time to payoff credit card debt. Compound interest charges add to the balance that keeps you in debt longer. In section V, the time and interest schedules, show the time value of money and how interest charges accumulate. In section VI, the performance strategies provide a solution to help you save time and money. As your finances improve you can increase your budget or apply a different strategy.

Maintain a spending budget that can help you implement a plan to get out of debt. Purchase the things that you need. And remain focused on achieving your financial goals.

When you use a credit card to make a purchase or have an unexpected expense. And you exceed the spending budget for monthly credit card payments. Develop a plan to payoff the amount of the purchase on a weekly or monthly schedule. And divide the cost among multiple pay periods. Set a specific time frame to achieve your goal. Furthermore, you should save a percentage of your discretionary income for unexpected expenses.

When you have a plan you can achieve success and provide relief from your debt. You may need to use a credit card for an emergency. Making poor financial decisions and using credit cards for daily expenses creates an unnecessary amount of debt. Monitor your spending habits to avoid creating a lifelong financial problem. It is harder to get out of debt when you are on a fixed budget. This can affect your quality of life making it unable for you to provide for your needs.

When your monthly expenses exceed your monthly income, using a credit card can get you through hard times. Solving your financial problems requires you to payoff your debt. Learn how to use the strategies to develop a plan. This book provides a foundation to help you achieve a better financial future.

Follow the process to acquire the fundamental skills to manage your debt.

When you create a spending budget include an amount for major purchases, periodic and miscellaneous expenses. Such as, repair and maintenance, holiday gifts, and travel expenses, etc. You can divide the cost among multiple pay periods to minimize the risk of accumulating credit card debt.

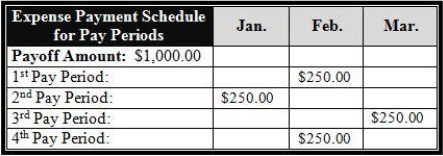

For example, when you purchase holiday gifts or have travel expenses. Use the money from your budget to payoff the amount. Using the expense payment schedule can help you keep track of the amount to be paid from each pay period. Include a note of the expense for your records. (See example below)

Note:

For: Holiday gifts $400.00, Travel expenses $600.00

Maintaining a budget of your expenses requires discipline. Saving money for an emergency fund can provide financial security. At a minimum, you should save four to six months of living expenses within three years. You can add a cost of living increase of two to three percent. Determine the amount you need to save each month. And include it in your budget.

For example; if you have $1,800.00 a month in expenses. You need to save $200.00 a month for thirty-six months, for four months of expenses, $7,200.00. Or, you need to save $300.00 a month for thirty-six months, for six months of expenses, $10,800.00. Multiply your total monthly expenses by the number of months you are saving for. And divide this amount by the number of months you are saving it in. This amount should be added to your budget.