This publication is designed to provide competent and reliable information regarding the subject matter covered. However, it is sold with the understanding that the author and publisher are not engaged in rendering legal, financial, or other professional advice. Laws and practices often vary from state to state and if legal or other expert assistance is required, the services of a professional should be sought. The author and publisher specifically disclaim any liability that is incurred from the use or application of the contents of this book.

Copyright 2006 by Carmen Wong Ulrich

All rights reserved.

Warner Business Books

Warner Books

Hachette Book Group

237 Park Avenue, New York, NY 10017

Visit our Web site at www.HachetteBookGroup.com.

First eBook Edition: January 2006

ISBN: 978-0-446-55687-3

The Warner Books name and logo are trademarks of Hachette Book Group, Inc.

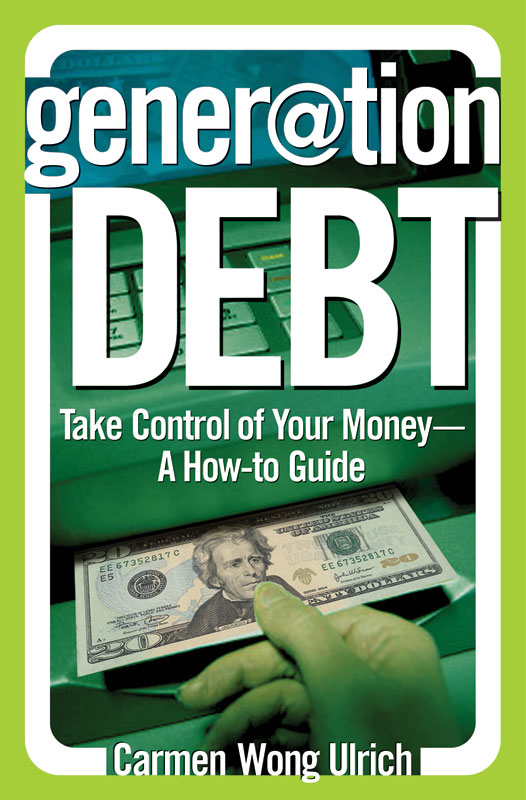

DID YOU KNOW?

- In 1970 the average credit card holder owed $185. Today, that number is $7,500.

- College tuition fees have gone up faster than any other consumer cost in the past ten years.

- People with no health insurance die younger than the insured.

- Without reform, Social Security funds will be gone by 2042.

- Consumers between the ages of twenty-five and forty-four are the most likely to be victims of fraud.

BUT DONT PANIC

- You can deduct some of your student loans from your taxes.

- You can save money by banking online.

- You can buy the car of your dreams for less by shopping on the last days of the month.

- You can start planning now to buy a homebecause the average home value increases 6 percent a year.

- With secure, smart investing, your $100 can grow to $142,768just in time for retirement.

TAKE CONTROL OF YOUR FINANCIAL LIFE!

Rich with commonsense insights and easy-to-implement plans brings a critically important topic to life in a helpful, fun package.

Bob Safian, executive editor, Fortune

This is financial information that everyone needs. Read it to learn, then keep it as a reference.

Rita Emmett, author of The Procrastinators Handbook and The Clutter-Busting Handbook

GENERATION DEBT is the perfect compass to navigate the financial pitfalls that swallow so many young adults.

Datwon Thomas, editor in chief, King magazine

For the G Girls,

Nina, Mickey, Josie & Lola

Shhhhhh You hear that? Thats the sound of millions of eighteen- to thirty-four-year-olds getting sucked in, pulled down, and held under by debt.

But wait, arent these flush times? The market is up, job creation and hiring rates are getting back on track, interest rates and inflation remain low, spending continues to rise, and homeownership is at record levels.

Damn those dastardly baby boomers and their dividend tax cuts, outsourcing drama, looming retirement, and cheating CEOs. Theyve stolen the countrys economic spotlight for too long. Its time to turn some serious attention to young adultsthe next generation of big consumers, earners, taxpayers, homeowners, parents, and CEOs. Because America, were in trouble.

It behooves me to call this book Generation Debt. But the sad, sick truth is that young adults today are drowning in debtso if the phrase fits (and helps), lets wear it. And contrary to what many (older) folks believe, this debt is not mostly credit card debt. According to Student Monitor, a leading market research firm, a 2002 survey found that of the average $18,560 graduating college students expect to owe when they leave school, 99 percent is student loan debt.

From there, the picture only gets worse. To add to that giant five-figure debt load that starts drawing blood six months after graduation, a newly minted college grad needs sharp clothes to interview in, an up-to-date computer and cell phone, and a car to drive to work or monthly pass to commute on public transport. If the option of living at home is not there, theres first and last months rent to pay, furniture to sleep and sit on, clothes to wash, insurance to buy, and food to eat. And lest we forget, many young adults need to pay for their own health insurance.

ANGRY YOUNG & POOR

printed on a sweatshirt by Newbreed Girl in Alloy catalog, 2004

All this, starting at around $28,000 a year.

We are the most debt-burdened generation ever produced (Im talking about the young adult generation of eighteen to thirty-four-year-olds). We are also the most highly educated, technologically advanced, ethnically and racially diverse, creative group of adults on the planet. Our contributions in technology, culture, entrepreneurship, social services, and media are already immense and revolutionary.

Yet we are fined for our ambition. Up straight, we are fined for the costs demanded of us in order to get ahead. Its a quasi-tax levied on us for wanting a college education, a good career, getting paid well for something we enjoy doing, the security of health care, a piece of the fat and tasty American pie.

It has become too easy for young adults in this country to get trapped by the cycle of ambition. The state of the American job market now requires a minimum of a college degree to get an interview for an upward-track post that pays us barely enough to get bynot to mention paying the loans we had to get for the degree to get the job in the first place. And when it comes to advanced degrees, weve all heard about the state of doctors, graduating with an MD and already six figures in debt. At least they can typically look forward to a high starting salary. Imagine the new PhD who ends up more than $100,000 in debt and whose next rung on the career ladder is a fellowship research position at $30,000 a year. Absurd.

We need cell phones and the latest computers. We have to look good and present ourselves as the brand of me. We have to compete in the workforce with Joe and Jane, whose parents probably paid for their college education and living expenses in full and now pay for their rent and credit cards, too.

Does anyone else see a disparity here?

What about retirement? Ask a room of eighteen- to thirty-four-year-olds about retirement and youll hear everything from Huh? to Re-what-ment? to Man, Im just trying to pay my rent. In the fairly recent past, as soon as a young adult landed a solid full-time job it was the norm to start saving for retirement, because heck, it was only twenty to thirty years away. Now well probably live past eighty-five, the thought of a stereotypical retirement is akin to a slow death, and, as the U.S. Government Accountability Office recently reported, without reform Social Security funds will be gone by 2042. Were a different bunch. Working nine-to-five, a lifelong career at a public company with a pension, a single job track for life: These things dont ring very true for us today.

So wheres our payoff? Why are we penalized so expensively for wanting to get a college education or even a graduate education? Why are our bank accounts punished if we need and want internships in creative or academic fields that pay almost nothing, forcing us to live off our credit cards, pay for our own health care costs, and work second and third jobs just to get ahead? Unlike the generations before us who had much lower education costs and nearly twice the amount of help from the government (Pell Grants, at their inception in the early 1970s, financed up to 84 percent of college tuition, whereas the max Pell Grant now contributes closer to 40 percent), why are we subject to an ambition tax? Why are we paying such a big, painful price for wanting to get ahead? And what can we do about it?