Get Out of Debt!

Book Three: Improving Your Quality of Life

DAVID AND MARCIA RYE

A division of F+W Media, Inc.

INTRODUCTION

Do you ever wake up at night worried about the financial setbacks and conflicts that youre having with your creditors? Do you become aggravated over the fact that you never seem to have enough money to live on? What are you going to do to control the confrontations that erupt when you address the subject with family members? What steps can you take to eliminate the financial mess that you are in?

Unfortunately, tens of millions of Americans are in your shoes. Like you, they are headed for financial disaster if they dont figure out a way to get out of debt.

This third installment of Get Out of Debt! has been written to answer your questions. As you read the material in this book, you will quickly learn how to assess the magnitude of your debt problems so that you can determine where youve been, how you got there, and, more important, where you want to go. When you plunge into these questions about how to avoid debt traps and how to create a realistic spending plan that works for you, you will discover the answers youve been looking for. Youll find out how you can dramatically improve the overall quality of your life once you eliminate your debt load.

The Get Out of Debt! series contains all of the elements you need to consider to get out of debt and improve your financial well-being. Each installment includes a set of questions that builds on what you learned from the previous one. Based upon your own situation, select the installment and questions that cover the subjects that are most important to you. That will allow you to maneuver through your personal debt-related issues and make the right decisions to avoid economic catastrophe. All four installments of Get Out of Debt! are filled with real-world examples and supplemented with detailed heres why it works illustrations.

The sooner you start mounting an assault on your personal debt, the sooner you will see your debt numbers heading down rather than up. When that happens, you will feel great!

Chapter

ACQUIRING A CAR

Next to your home, a car is one of the most expensive purchases youll ever make. And, unlike your home, a car typically does not appreciate in value. Before you set out to buy a car, decide what kind of vehicle you will need, what options you must have, and what payments you can afford. How will you use the vehicle? Does the purchase of a new car fit into your budget and financial plan at this time? Should you consider buying a used car? Maybe you should lease one? These are just some of the questions addressed in this chapter.

#1. What questions should I ask before I geta car?

There are several questions to ask yourself and anybody else in your family who will be driving the car:

What kind of transportation do you need? If you travel a lot, youll probably want a large interior and a smooth-riding car.

Will the car be used primarily for commuting to work? Will it be sitting out in the sun all day while youre at work?

Is fuel economy important to you? How many miles do you drive a year? What will you spend on gasoline per year if you buy a gas-guzzler versus a fuel-efficient car?

If youre thinking about a four-wheel-drive vehicle, will you really use that option? Over 80 percent of four-wheel-drive vehicle owners will never use this expensive option. How much more will four-wheel-drive cost, and is it worth the extra money?

What price are you willing to pay for the car you want and what monthly payments can you afford? How long are you willing to finance the vehicle?

What will it really cost you to run this vehicle annually? Dont just think in terms of gas and oil. Can you afford to maintain the type of vehicle that you want? Check the Consumer Reports guides to find out what the maintenance history is on the type of cars youre considering.

#2. What does it cost to own a car?

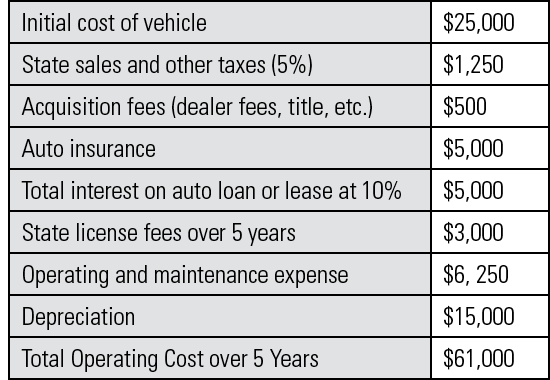

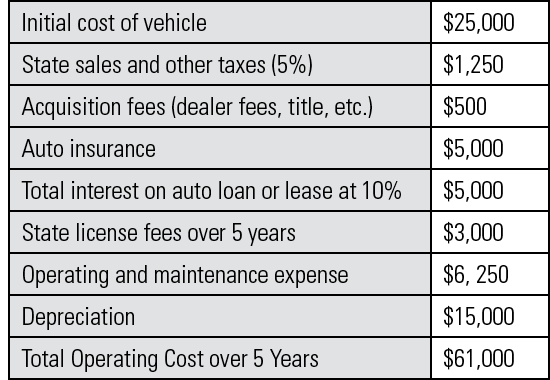

When a friend asks How much did your car cost? you can either tell her what you paid for the thing or tell her what the real cost will be. If you just bought a $25,000 vehicle and are planning on keeping it for five years, your real cost of owning the car will be more than double that amount, or $61,000 to be precise. Using national cost averages collected by the American Automobile Association, here is how that staggering figure was calculated:

The Average Cost of Owning a $25,000Vehicle over 5 Years

If you need additional information or help in determining the cost of owning a car, buy a copy of The Complete Car Cost Guide that is published by Intellichoice. Edmunds car-buying guides are available on the web (www.edmunds.com). Edmunds has long been considered one of the best resources for its outstanding reviews of new and used vehicles.

#3. How can I get the best car loan possible?

Dont finance a car for longer than you expect to keep it. If you plan to keep it for four years, take out a four-year loanor, better yet, take out a three-year loan. Youll save on interest payments and wont be upside down in the car, the industrys term for owing more on the car than its worth if and when you trade it in. Watch out for up-front fees that some lenders add to raise the cost of their loans.

Credit union loans. If you belong to a credit union, these loans are sometimes hard to beat. The amount of money that you have for the down payment can dramatically affect the interest rate that youll pay. Youll pay a premium if you have less than 10 percent down and many lenders wont even talk to you unless you have at least that.

Dealer financing. The best time to finance a new car is when dealers are advertising finance rates that are significantly below the market rates. Their very best rates usually carry a short repayment term like two years, so youll need a good payment-free trade or lots of money for the down payment.

Bank financing. You wont get the title to the car until the loan is paid off, and you will be required to carry collision and comprehensive insurance with perhaps lower deductibles than what you normally carry. The best type of a bank loan to get is a simple interest loan with no prepayment penalties.

#4. Ive decided to get rid of my car. Whatoptions and issues should I consider?

If youve decided to get rid of your current vehicle, one of the nagging questions in your mind is how you will dispose of Old Faithful. You can sell it to a private party or dealer, trade it in for another car, or donate it to a charity and take the tax deduction. Whats your asking price and the lowest offer youll accept? If you want a premium price, then why does it deserve that higher price? Low mileage definitely deserves a higher price. Add at least 10 percent to 15 percent to your price so that you have room to negotiate. The Kelley Blue Book provides pricing information on new and used vehicles. Its available in most major bookstores, or you can visit their web site at www.kbb.com.

If youre thinking about trading it in to a dealer for another car, youll be lucky to get Kelleys Blue Book wholesale price for it. Dealers can buy cars just like yours at wholesale auctions any time they want, so dont expect them to give you a premium for your one-of-a-kind jewel. You are usually better off selling it on your own rather than trading it in. Whichever way you decide to go, wash and polish everything including the tires. Nothing will turn off a buyer faster than a car that looks like the inside of a garbage can, so clean everything, including the interior.