The Debt Resolution Handbook

ISBN: 9781617929489

We have written The Debt Resolution Handbook, a step by step guide to debt reduction. Weve produced an easy to follow resource designed to assist you in reducing debt through negotiation, disputing uncollectable debt, and eliminating thousands of dollars in debt by understanding and beating the legal debt collection system.

Always bear in mind that your own resolution to succeed is more important than any other thing, Abraham Lincoln

You are reading the Debt Resolution Handbook because you want to learn how to deal with your creditors on your own behalf, and you want to do that without reading an encyclopedia or spending a lot of money; so, weve kept this book simple as a do-it-yourself manual.

We are real debt negotiators and we do this for a living. We have helped hundreds of people reduce their debt successfully against the collectors and attorneys that try to squeeze every penny out of our clients.

Take these steps and get the most out of this book:

There are many powerful chapters in this handbook from How to Start Your Negotiation to Statute of Limitations by State to Answering (Pro Se) ; a guide to winning a debt collection lawsuit using our attorneys prepared legal documents. We use everyday language avoiding the legalese to make an over-complicated legal system easy to comprehend.

In the debt collection process, time is of the essence; you may have less than 30 days to respond; so skip to the section you need right away or read the entire book before you take action; but take action and win your case!

Expand your knowledge by Reading:

What you dont know can end up costing you thousands of dollars. So continue to explore and expand your knowledge; it will keep you focused on improving your financial well-being.

Legal Disclaimer and Notices

So heres the bottom line legal statement.

We wrote The Debt Resolution Handbook as debt negotiators that have successfully negotiated over a million dollars of debt from our clients accounts; and although we negotiate with attorneys for our clients; we ourselves are not attorneys and are not offering any legal advice.

The debt negotiation strategies in this publication are a result of our research and experience gained from our debt negotiation service. Sample forms and procedures are only to be used as examples and may not specifically apply to the laws and statutes of your state; and they are to be used at your own discretion.

The documents contained here should be considered as research for educational purposes only; we cannot offer any warranty that the suggestions or sample documents in this handbook will result in any particular result.

We always suggest seeking legal advice before attempting to dispute debt; the section on Finding a Self-Help Legal Coach is designed to help you find legal advice at a reasonable cost; we suggest you follow that advice.

THE FOLLOWING TERMS AND CONDITIONS APPLY:

While all attempts have been made to verify information provided, neither we, nor any ancillary party, assumes any responsibility for errors, omissions, or contradictory interpretation of the subject herein.

Any perceived slights of specific people or organizations are unintentional.

The fullest extent permitted by applicable laws, in no event shall DRH, agent or suppliers be liable for damages of any kind or character, including without limitation any compensatory, incidental, direct, indirect, special, punitive, or consequential damages, loss of use, loss of data, loss of income or profit, loss or damage of property, claims of third parties, or other losses of any kind or character, even if DRH has been advised of the possibility of such losses or damages, arising out of or in connection with the use of the DRH or and web site with which it is linked.

Contents

How to Start Your Negotiation

First Things First Get Your Credit Report

Before you make your first call to the collection company, you should have a copy of your credit report in hand. You really need to look at it at least once a year. The account being collected will be listed in the derogatory account section as a collection. It will have a two year history of late payments and you can check the history. Make sure its your account and compare the account number with the account number on the collection letter. You can easily get a free copy on-line or for a small fee from one of the three major credit bureaus and other web-based providers. So now get online and download your credit report.

Transunion : 1-800-680-7289; www.transunion.com ; Fraud Assistance Division, P.O. Box 6790, Fullerton, CA 92834-6790

Equifax : 1-800-525-6285; www.equifax.com ; P.O. Box 74041, Atlanta, GA 30374-0241

Experian : 1-888-EXPERIAN (397-6285); www.experian.com ; P.O. Box 9532, Allen, TX 75013

Free Credit Report : www.freecreditreort.com

What we are looking for here is the last activity that occurred on the account. That is; the last time there was a charge on a credit card or the last time a payment was made to the account. The credit report should show past due dates as 30 days, 90 days, 180 days past due. You may have to add up the number of days to get an idea of the last activity date. Also try to find old statements showing the first late payment date or when you made the last payment. This is important information because it may be your best defense if the account is past the statute of limitations to collect in the state you live. Read more

Statute of Limitations

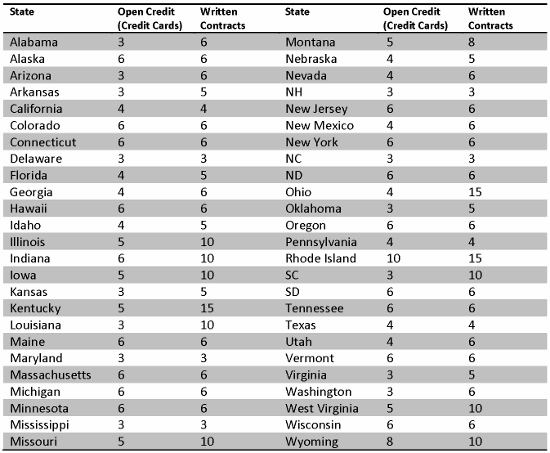

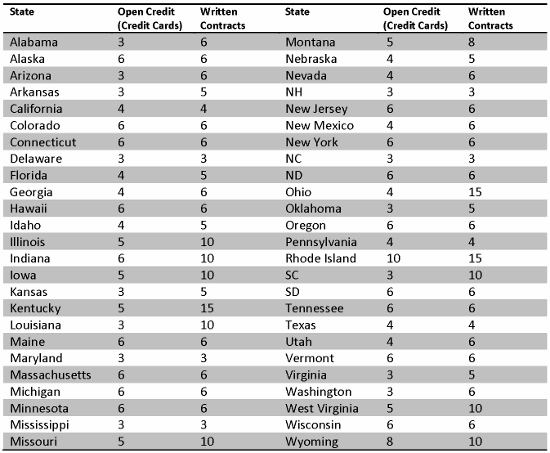

The period of time a collector has to file a lawsuit to collect a debt is limited by each state law. The chart below shows the states and the limits for two types of accounts for which there are different limitations. Open accounts sometimes called revolving accounts like credit cards are usually shorter in number of years then for written contracts like an auto purchase.

The collectors time to collect starts running on the date of last activity on the account. If a consumer leaves the state, resides within the state under an assumed name, or is incarcerated the statute of limitations can be suspended.

We have disputed many a lawsuit based on an expired statute of limitations. The definition of, last activity which is the last time the consumer made a payment or charged to the account is usually at issue. The good news is; the collector has the burden of proof; the evidence has already been destroyed.

When the Statute of Limitations has expired

The Fair Debt Collection Practices Act (FDCPA) states when the statute of limitations has expired, a collector may continue to request a consumer pay a debt, but cannot threaten legal action because the collector can no longer sue the consumer to collect the debt. Collectors are very clever and theyll tell you that if you make a partial payment or sign a written promise to repay the debt, they wont have to file a lawsuit. Be careful; if you do make even a small payment the statute starts all over again.

As stated previously collectors sell debt to other collectors. When the transfer of an account is made, activity is reported to the credit reporting bureaus and the statute of limitations could start all over again when the account is sold.

The original creditor might not keep records beyond two years and its hard to prove their case unless they have records.

So when you dispute a lawsuit based on limitations check for old billing statements and banking records. In the derogatory section, your credit report will show how many days late the last payment was but will not necessarily show the last purchase date on an Open account.

Next page