Avery Elizabeth Hurt - Student Debt

Here you can read online Avery Elizabeth Hurt - Student Debt full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2019, publisher: Greenhaven Publishing LLC, genre: Politics. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Student Debt

- Author:

- Publisher:Greenhaven Publishing LLC

- Genre:

- Year:2019

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

Student Debt: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Student Debt" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

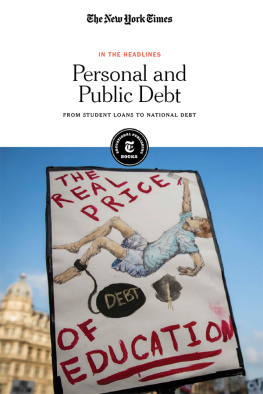

As of 2019, Americans owed over 1.56 trillion dollars in student loan debt, and 69 percent of college students who graduated in 2018 had to take out student loans. Student debt has increased significantly over the past twenty years, but what factors have brought this about? Are students to blame for making irresponsible financial decisions, or is the price of education rising disproportionately to average income? How do variables like class and race impact student debt? What impact do these debts have on individuals and the economy? This volume examines the nature of Americas student debt crisis and explores possible solutions.

Student Debt — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Student Debt" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Student Debt

Other Books in the At Issue Series

Athlete Activism

Celebrities in Politics

Male Privilege

Mob Rule or the Wisdom of the Crowd?

The Opioid Crisis

Public Outrage and Protest

Sexual Consent

Universal Health Care

Vaccination

Vaping

Wrongful Conviction and Exoneration

Published in 2020 by Greenhaven Publishing, LLC

353 3rd Avenue, Suite 255, New York, NY 10010

Copyright 2020 by Greenhaven Publishing, LLC

First Edition

All rights reserved. No part of this book may be reproduced in any form

without permission in writing from the publisher, except by a reviewer.

Articles in Greenhaven Publishing anthologies are often edited for length to meet page requirements. In addition, original titles of these works are changed to clearly present the main thesis and to explicitly indicate the authors opinion. Every effort is made to ensure that Greenhaven Publishing accurately reflects the original intent of the authors. Every effort has been made to trace the owners of the copyrighted material.

Cover image: Cargo/Imagezoo/Getty Images

Library of Congress Cataloging-in-Publication Data

Names: Hurt, Avery Elizabeth, editor.

Title: Student debt / Avery Elizabeth Hurt, book editor.

Other titles: Student debt (Greenhaven Publishing)

Description: First edition | New York: Greenhaven Publishing, 2020. | Series: At issue | Includes bibliographical references and index. | Audience: Grades 912.

Identifiers: LCCN 2019022823 | ISBN 9781534506237 (library

binding) | ISBN 9781534506220 (paperback)

Subjects: LCSH: College costsUnited StatesJuvenile literature. | Student loansUnited StatesJuvenile literature. | Education, HigherUnited StatesFinanceJuvenile literature. | Government aid to higher educationUnited StatesJuvenile literature. Classification: LCC LB2342 .S864 2020 | DDC 378.3/8dc23

LC record available at https://lccn.loc.gov/2019022823

Manufactured in the United States of America

Website: http://greenhavenpublishing.com

Contents

Eric Best

Marshall Steinbaum

Daniel Rivero

Miranda Marquit

Arlene S. Hirsch

Davide Migali

Amelia Josephson

Jarrett Skorup

Ellen Brown

Thomas Adam

Jana Kasperkevic

Sandra Black, Amy Filipek, Jason Furman,

Laura Giuliano and Ayushi Narayan

Tressie McMillan Cottom

Doug McCullough and Brooke Medina

William E. Fleischmann

Elizabeth Verklan

Introduction

A s of this writing, student debt in the United States has topped 1.4 trillion dollars, with more than 40 million people still paying off their student loans. Higher education is now second only to home mortgages when it comes to individual debt. Many of those borrowers are struggling to pay or have even defaulted on those loans. This situation has created a crisis that affects the lives of individuals and families all across the nation.

Funding for public colleges and universities has traditionally come from a combination of state and federal sources. The federal government supports higher education primarily by providing financial assistance to individual students. (The federal government also funds many research projects at universities.) States are generally responsible for the basic operational costs of public colleges. Private colleges, which get no funding from states, depend on donations and endowments, as well as tuition and research grants.

The Great Recession of 2008 led to tremendous cuts in state funding for higher education, as well as a devaluing of endowments at private schools. As a consequence, schools were forced to increase tuition, forcing students to borrow even more money to pay for college. Once the recovery was underway, wages did not recover in keeping with the rest of the economy, making it difficult for many graduates to find jobs that paid enough for them to meet their loan payments.

The problem of college costs, however, predates the Great Recession. Since the 1980s, college tuition has been increasing much faster than other thingseven health carewhile wages have remained nearly flat. On top of that, student debt is handled much differently than other types of debt, making it more difficult to manage. People who have student loans are exempted from some of the protections afforded to other borrowers. For example, education loans are not (except in exceptional circumstances) dischargeable in bankruptcies. The borrowers also have less recourse for protesting predatory collection practices than do other borrowers.

The federal government provides financial assistance to students by means of a system of grants, work study programs, and a complex system of federally insured loans. For many years, most student loans were direct loans, meaning that the government itself provided the loan without involving a private bank. Since 2005, however, there has been a marked increase in the number of private banks offering student loans. Private loans are typically more expensive with less favorable terms than direct loans. Private lenders have also been known to use some shady business tactics. For example, sometimes lenders would attempt to confuse students and their families, making borrowers think they were getting a loan from a federal program rather than a private lender. Private lenders also often loaned students far more than they needed, increasing the students debt burden. One study, by the Consumer Financial Protection Bureau, found that some of these loans were for 151 percent of the students tuition.

Aggressive marketing, often targeting students who cant afford these interest rates, has compounded the problem. First generation college students and those who are not familiar with the ins and outs of borrowing made especially rich targets for unscrupulous lenders. The student debt crisis was made significantly worse in recent years by the advent of for-profit colleges. These companies account for almost a third of all student loans and typically cost far more than state universities. For-profit colleges are especially likely to prey on low-income and minority students.

Though the average student loan payment is not excessive, students who do not graduate or cannot find a good-paying job when they graduate often have difficulty paying. Late payments and interest can accumulate, making it increasingly difficult to get ahead of the debt. Students who dropped out of college or went to for-profit colleges are more likely than graduates from state or private universities to be struggling to make their payments.

Getting behind or defaulting on student debt can create a domino effect of consequences, starting with a hit to the individuals credit rating. This can make it difficult to buy a car, which might be necessary for a person to get to work. It can also make it difficult to find a job because many employers refuse to hire people with poor credit. And, of course, if you cant find a job or cant get to work if you have one, then youre not going to be able to make those loan payments. It quickly becomes a downward spiral that is nearly impossible to get out of. For many people, the struggle can last a lifetime. The psychological impact of being deeply in debt and hounded by creditors is tremendous, as well.

Some people manage to pay their loan payments, but those payments eat up so much of their income that dont have enough left to buy homes. They may be hesitant to start families because of their debt. People saddled with student debt often put off marriage or having children until much later than they would have had they been more financially secure. Excessive debt also prevents people from starting businesses or taking other financial risks. These things have lasting effects on individual lives, of course, but also affect the national economy. Millions of people are putting money into paying off loansmoney they otherwise would have spent on things that boost the economy.

Next pageFont size:

Interval:

Bookmark:

Similar books «Student Debt»

Look at similar books to Student Debt. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Student Debt and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.