Improving Your Credit Score

By InCharge Debt Solutions

Published by InCharge Debt Solutions atSmashwords

Copyright 2012 InCharge Debt Solutions

Table Of Contents

Improving Your Credit Score

This book will focus on improving your credit scoresand provide you with information on how you can do even more toimprove your credit status. Doing so will go a long way towardsimproving your credit score because your credit score is derivedfrom the information in your credit report. But there is even moreyou can do. This book covers techniques for raising your creditscore as high as possible. The benefits will be two-foldyou willhave greater access to credit and the credit you obtain will costless.

What You Need ToKnow!

You may find that your credit score is still lowerthan you would like (or deserve) even after making sure your creditreport is accurate. The average FICA credit score has fluctuatedbetween 675 and 700 in recent years, with 850 being the maximumscore one could have. People with below average scores must payhigh interest rates.

What Can You Do?

First, you need to recognize that efforts to improveyour credit score take time to have an impact. Most people findthat it takes about one year for their score to show muchimprovement. This is partly because changes take time to show up inyour credit report.

But it is also true that your credit history stayswith you for a long time. If your history is positive, that is areal plus. But if your history has some negatives, those stay inyour credit file for six seven years. New positive informationhelps, but it does not erase old negative information.

Nonetheless, waiting to do something about a lowscore only prolongs the problem. The time to get started is now.Basically, there are two broad categories for the things you can doto improve your credit score. The first involves improving yourfinancial behaviors. The second involves changing your debtsituation. For each, lets list things you should DO and things youshould NOT DO.

Improving Your FinancialBehaviors

DO pay your bills ontime. The largest single component of a credit score is yourpayment history. If you are late on or skip payments on items suchas credit cards or vehicle loans, your score will surely beaffected. This is true for installment debt paymentssuch as atelevisionand any of your monthly bills, such as your utilities.This is because many merchantsnot just lendersreport paymentpatterns to credit bureaus.

DO focus any searchto obtain new credit within a short period of time, such as onemonth. The number of inquiries from lenders in your credit bureaufile negatively affects your credit score. If the inquiries allcome in within thirty days they will all be recognized as part ofone searchsuch as for an auto loan. But if you spread your searchover several months the pattern will look like multiple searchesanegative in most credit scoring systems.

DO check your creditscore periodicallyperhaps every six months while you are workingto rebuild your credit score. Your own inquiries do not negativelyimpact your credit score. Make sure you get your score directlyfrom the credit bureaus or from FICO. Using a second party to getthe score (such as the many free offers you might see on theInternet) will be viewed as coming from a lender. This means theywill be counted as a lender inquiry, and that is a negative.

DO avoid applyingfor any new credit for one year. Inquiries from creditors areautomatically deleted from your record after twelve months. Thistechnique is especially helpful if your credit report currentlyshows a high number of inquiries. That fact, in and of itself, maybe the major reason for a lower than necessary credit score.

DO NOT ignore billsfor which you are currently behind. Bring them up-to-date.

DO NOT open multiplenew accounts just to show a credit history. If you have had littlecredit in the past, open no more than one or two accounts and buildyour history slowly.

DO NOT close oldaccounts. Length of credit history has a positive impact on yourcredit score. Having a large number of accounts in good standingwith zero balances is a plus, not a negative.

Changing YourDebt Situation

DO reduce yourbalances on your credit cards and other loans. If you a highoutstanding balance on one or more of your credit cards, you willlose points on your score. Lower balances tend to lead to higherFICO scores. Pay down your balances and keep them low.

DO NOT open newaccounts to transfer high balances and spread your total debtacross multiple accounts. If you feel you could benefit by moving aportion of the balance on one card to another, use an existingaccount. Of course, you would not want to move a balance from a lowinterest rate card to one that has a higher rate.

DO get help if youare having trouble paying your debts. It may be possible to haveyour debts renegotiated if you can show that your difficultfinancial situation is temporary and it can be improved over time.For example, you may have fallen behind in your bills because ofunemployment but you are working again now. You can contact lendersdirectly or use a reputable not-for-profit credit-counselingagency. You are not asking your creditors for forgiveness hereyouare just asking for a little more time.

DO pay off any lateor written-off debt. These items will still stay on your creditreport but the fact that you made good on the debt will be aplus.

DO re-establish yourcredit if you have had problems in the past. Opening one or twocredit accounts and using them responsibly will slowly but surelyrebuild your credit score. This may take a few years, however.

DO stop using yourcredit cards if you are not paying your balance in full each month.Using a card on which you carry a balance is almost guaranteed toresult in ever-increasing balances.

DO NOT ignore debtproblems. Credit scores can go down much faster than they can goup. Lenders typically report negative information right away.Again, contacting lenders directly or a telephoning a reputablecredit-counseling agency can be of help.

DO NOT userepossession as a way to get out from under a debt. Repossessionnegatively affects credit scores even if the repossessed item hassufficient value to pay the debt. And in most cases its value isnot enough to pay off the full balance owed. Thus you will stillowe some amount of remaining debt. It would be better to sell theitem yourself, add additional funds if necessary, and pay off thedebt in full.

What You CanDo!

Action Module: Improving YourCredit Score

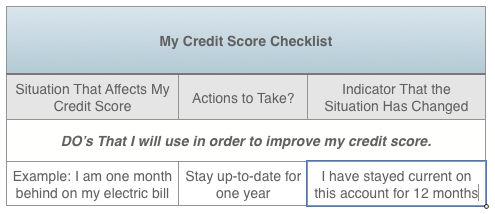

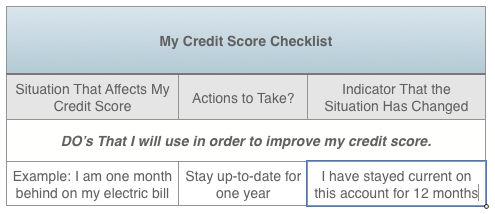

Now that you know some of the DO-s and DONT-s ofimproving your credit score, its time to take action. The twoworksheets below can help you chart a course towards a bettercredit score. The first will help you make sure you pay your billson time. The second provides a checklist for the steps you want totake to build your credit score.

Action Module A: The BillPaying Calendar

Paying bills on time can go a long way towardincreasing your credit score and keeping it high. But how can youmanage that? One simple technique is to set up your bills asautomatic payments from your checking account. Most utilitycompanies and lenders have such plans. You may even receive adiscount if you use this automatic system.